Funding rate

The financing rate, also known as “Funding Rate”, is a tool with which the price of crypto assets in unlimited (eternal) futures for market value is adjusted. In practice, it represents a fee with some traders with another certain amount of money. If the financing rate is growing, then buyers (holders of long positions) pay sellers (holders of short positions). If it falls, then the opposite.

Dynamics of financing rates

If traders believe that the price of a particular cryptocurrency will grow, then this causes a demand for the purchase of futures, and, as a result, the financing rate rises. If the moods are negative, then the demand for short positions is growing, and already sellers pay customers.

At the same time, payments do not occur once. Typically, the financing rate is paid every eight hours. Disflowing of funds occurs automatically on exchanges. It is worth noting that the financing rate is not fixed. Each platform has its own ways to calculate it.

An example of calculating the fanding

Panding depends only on one component – the difference between the market price and the futures. Therefore, the first thing you need to calculate its size. Next, the percentage is determined, which this difference is from the market price of a crypto acting. The next stage is the setting of the funding rate. This occurs by calculating the share from the percentage of the difference between the market price and the price of the futures to the market price. Finally, at the last stage, the financing rate is applied to a specific position.

For clarity, consider an example. Suppose that the market price of bitcoin is $ 105,000, and the futures – $ 104,500. That is, the difference is $ 500. The next step is determined by the percentage that it makes up from the market price: -$ 500/$ 105 000*100% = -0.48%. Next, we set the amount of financing rate. Suppose that it is 1/6 of the percentage of the difference between the market price and the price of the futures to the market price. Then we get -0.48%*1/6 = -0.08%. Next, we apply this to a specific case. Suppose that Cryptotrader has $ 100,000 in his hands, and he opened a short position. Then its expenses will be: $ 100,000*( -0.08%) = -$ 80.

The nature of unlimited futures

Ordinary futures are an urgent contract. In other words, there is a certain date when the calculations occur during the onset of. After that, the specific futures disappears. The perpetual futures have no time frame, and its owner can hold it as much as he likes. Given the fact that the prices for cryptocurrencies are dynamic, the conditions are constantly changing. And if so, then for the balance of these changes you need some kind of parameter. They are fanding. Data on the rate of financing on exchanges can be found on specialized resources.

Data sources

Freely available, that is, for free, information about the rates of funding for cryptocurrencies can be found on such platforms as Coinglass or Coinalyze.

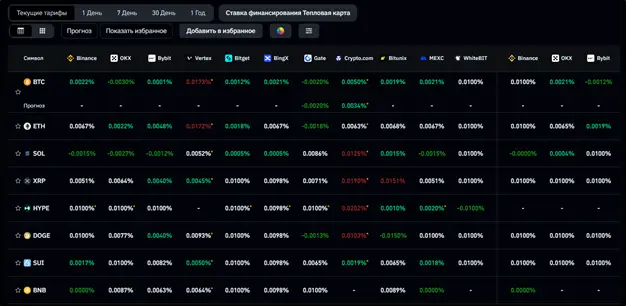

Coinglass presents a common table with coins and financing rates with the corresponding exchanges. Forecast values are bred exclusively by bitcoin, but there is no such information on altcoins.

Source: coinglass.com/

There is also a graphic variation made in the form of a histogram.

Source: coinglass.com/

On Coinalyze, to get information, you need to choose a specific cryptocurrency in the list. But forecast data are also available for altcoins.

Source: Coinalyze.net

Panding and market value of cryptocurrencies

Is there any relationship between fanding and the market price of cryptocurrency? There are, but not straight. Fanding primarily concerns derivatives, namely unlimited futures. At the same time, traders can use information on the financing rate, and on its basis hedge the risks through the purchase or sale of bitcoin.

Fanding and trading

Choosing trading strategies on the basis of one indicator or factor is not worth it. In this regard, the financing rate is no exception. However, you can use it as one of the auxiliary tools. For example, the financing rate manifests itself quite well when it shows some extreme values-it does not matter positive or negative. Usually this serves as a harbinger of a spread in the market, at least a short -term. Although in this case it is better to wait for the confirming signals from other indicators.

A fairly eloquent example occurred this year with bitcoin. As you know, by the end of April, the cost of the largest cryptocurrency dropped below $ 75,000, but by May 22 it increased above $ 112,000. After that, the dynamics of the bitcoin exchange rate changed, and it has not yet risen above. It was on May 22 that the funding rate was maximum over the past six months and much exceeded its values before and after. Anomalous size of the indicator is the harbinger of the turn. After two weeks, BTC lost more than 10% of the cost. In the image below, you can see a huge funding rate on May 22:

Source: Coinglass.com

Conclusion

The financing rate is a tool that is used to eliminate the imbalance between cryptocurrency prices in unlimited futures and their market value. Positive meanings indicate the demand of customers and testify in favor of the bull trend, negative – the predominance of bears. Extremely large funds in financing rates indicate a quick turn.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.