Oil traded lower on Tuesday, although it was found to be moving sharply higher previously, exceeding $ 123 a barrel, with the pressures manifesting after a Bloomberg publication according to which the American Senate is considering imposing federal tax on oil companies in order to fight inflation.

In particular, the crude for July delivery lost $ 2, or almost 1.7%, and closed at $ 118.93 a barrel on the New York Mercantile Exchange. At the high of the day the contract climbed to $ 123.68 a barrel.

Brent crude for August delivery fell $ 1.10, or 0.9%, to $ 121.17 a barrel on the ICE Futures exchange.

The chairman of the US Treasury Committee Ron Weiden will propose an additional tax of 21% on the profits of oil companies, which are considered huge, a Bloomberg journalist wrote on Twitter on Tuesday.

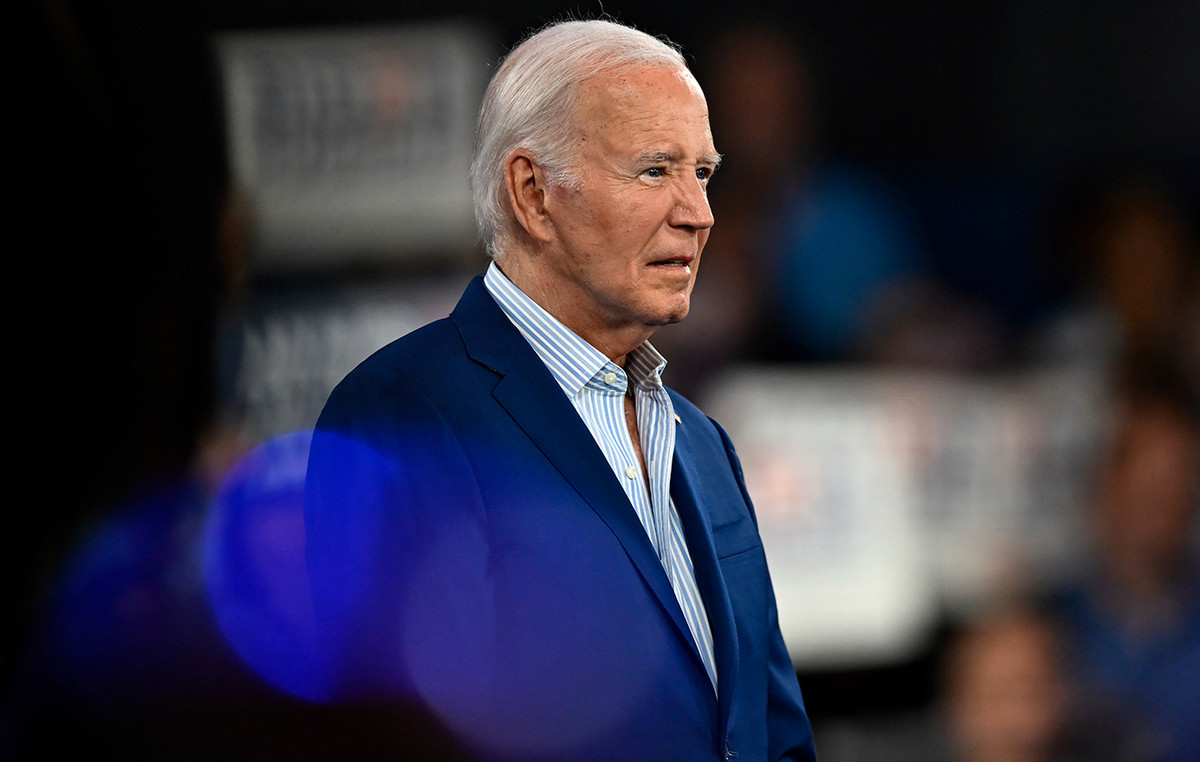

President Joe Biden on Friday accused the oil industry, and in particular Exxon Mobil, of taking advantage of the lack of supply to boost its profits, in the wake of the announcement of inflation, which climbed to a new 40-year record.

Speaking on inflation, President Biden said, “Why not drill? Why make more money when they do not produce more,” accusing oil companies of getting rich at the expense of drivers rather than investing in production.

Price pressures also followed Iran’s assessment that the current negotiations could lead to the revival of the 2015 nuclear deal, paving the way for the return of Iranian oil to world markets.

Dive and five weeks low for gas

Meanwhile, the July delivery contract fell to $ 1.42, or 16.5%, to $ 7,189 a million British thermal units, slipping to a five-week low.

The fall in prices followed Freeport LNG’s announcement that its Texas facility is not expected to reopen soon as extensive work is needed to repair the damage caused by last week’s fire.

“The completion of the necessary work and the return to full operation are not expected until the end of 2022,” the company announced today. Damage to the Freeport LNG facility led to the freezing of quantities for the domestic market, at least until normal operation was restored later this year.

Source: Capital

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.