Crypticnings formed the first red candle in six weeks. After a recent rally, traders fix profit, which causes short -term pessimism and liquidation for some altcoin.

In early August, some cryptocurrencies demonstrate a high risk of liquidation for traders with derivatives. We figure out what kind of altcoins these are.

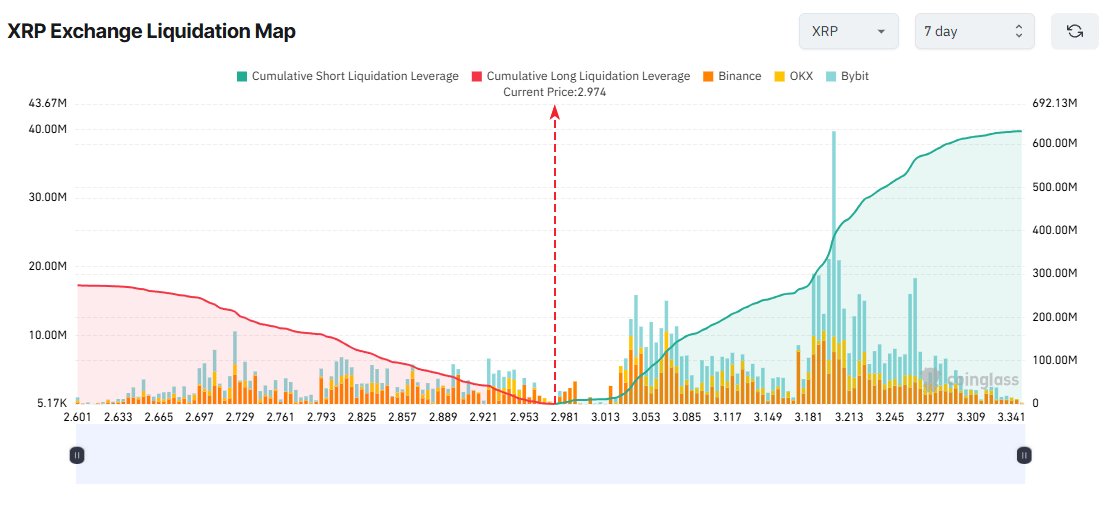

1. XRP

A 7-day liquidation map for XRP shows a significant imbalance between long and short positions. The volume of short positions (green bars on the right) significantly exceeds the volume of Longs (red bars on the left). This suggests that traders expect altcoin price reducing in early August.

XRP has been losing in price for two weeks in a row, falling by more than 18% from $ 3.65 to $ 2.97. Many short -term traders believe that the descending trend will continue. However, if the XRP recovers and rise to $ 3.20, more than $ 400 million in short positions can be eliminated.

From the maximum of July to the minimum of early August, XRP lost 25% of its value. Historically, such sharp falls are often followed by significant rebounds. Analysts warn of possible liquidations caused by such recovery.

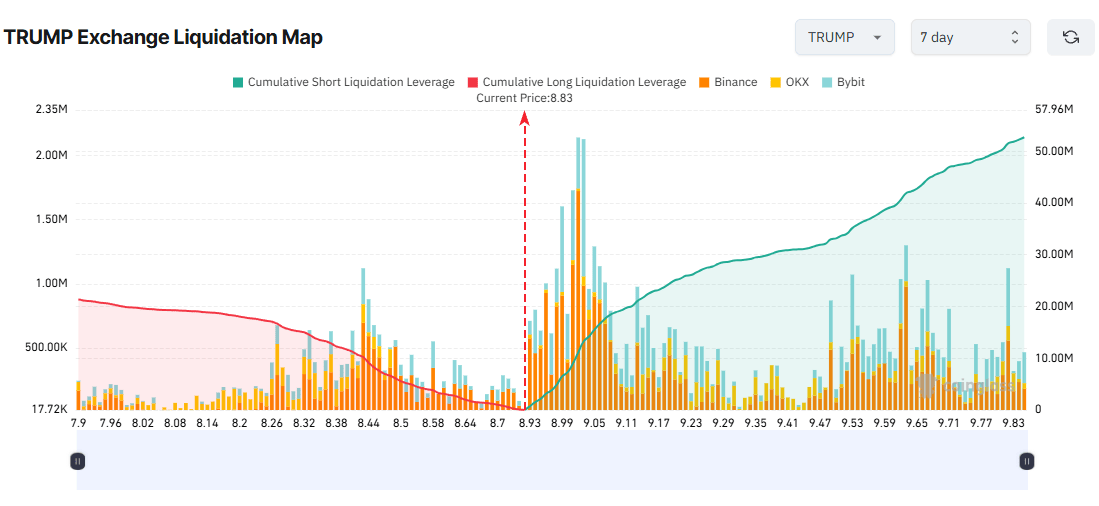

2. Trump

The liquidation map for Memcoin Trump shows a significant imbalance. Most potential liquidations are concentrated on the short side. However, some analysts note that Trump refuses to give up. After the vertical collapse of the token, for more than one month is steadily consolidated in the region of $ 8.50, which is a key level of support. If Trump rises to $ 9.80 this week, about $ 50 million short positions can be eliminated.

At the end of July, Sunpump – a platform for generating memcoirs on Tron – announced the listing of Trump. Inclusion in the listing increased token liquidity. Previously, Justin San publicly promised to invest $ 100 million in Trump. This news gives Trump more pulse for possible recovery. Such a development of events can harm traders who put an altcoin price.

3. Analysis of altcoin CFX

Conflux (CFX) surprised many investors last month, having risen almost four times. The market capitalization of the coin exceeded $ 1 billion. The liquidation card shows that most traders expect CFX correction in early August. This is evident by a large volume of potential liquidations of short positions, which significantly exceed the elimination of Longs. If CFX continues to grow and reaches $ 0.243, about $ 25 million in short positions can be eliminated.

Recent project news can maintain a positive attitude towards this altcoin. On August 1, Conflux announced the update Conflux v3.0.0, which received positive reviews from the community.

Google Trends data show that over the past month the number of requests on the topic “Conflux Network” has increased sharply. This new interest in investors in the project can disappoint traders with a credit shoulder who put on a reduction in price.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.