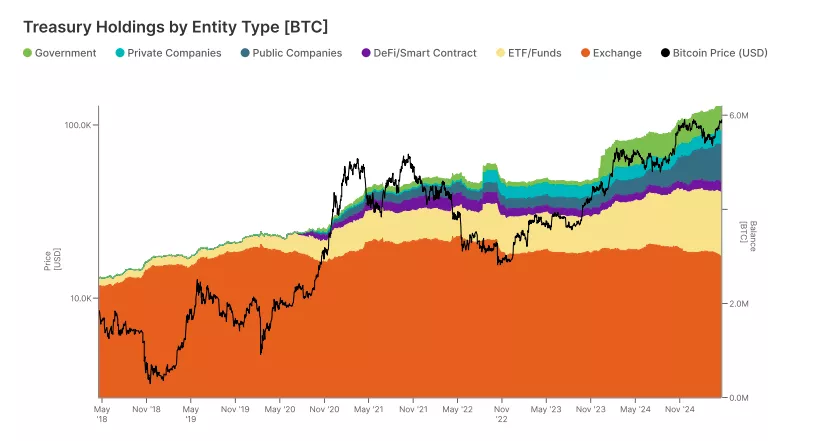

Since 30.9% of the available proposal of the first cryptocurrency is stored in centralized treasury, the market has undergone a structural transformation towards institutional maturity. This is stated in the Gemini and Glassnode report.

Based on these indicators, analysts predict “more stable and ordered rally” digital assets compared to sharp jumps that were observed earlier.

Owners of stocks

According to the report, 30% of the Bitcoin issue (~ 6.14 million BTC worth $ 661 billion at the rate at the time of writing) are concentrated in 216 entities. Among them:

- centralized exchanges;

- ETF and crypto funds;

- public companies;

- private companies;

- Defi and smart contracts;

- government.

According to researchers, the largest number of coins – 3.015 million BTC – hold 27 centralized exchanges.

The largest group in the number of representatives (101) became public companies, but in terms of accumulated volume they occupy third place with an indicator of 765 300 BTC.

The second place in both categories belongs to ETF based on digital gold. In the aggregate of 40 exchange funds, 1.34 million BTCs were concentrated.

Governments are lagging behind

Unlike active market participants, state treasury rarely carry out rebalance.

Their wallets are demonstrated by infrequent movements and a weak correlation with bitcoin cycles, but I hold enough to influence the markets during the sale or movement of coins, experts drew attention.

The United States remains the largest holder-state with a balance of more than ~ 200,000 BTC. At the same time, two confiscations provided the main volume:

- 69 369 BTC from the Silk Road case, seized in November 2020;

- 94 643 BTC, seized in the Bitfinex case in February 2022.

Now these coins are announced as the basis of the US strategic bitcoin reserve in accordance with the Decree of President Donald Trump.

According to researchers, Great Britain also accumulated bitcoins through the National Crime Agency.

Germany actively seized coins during internal investigations, but officially eliminated all the reserves of the first cryptocurrency in April 2025.

The study contains constant purchases by the authorities of Salvador and the Kingdom of Bhutan. Analysts believe that their actions ensure “the legitimacy of bitcoin as an asset of the sovereign level, encouraging the wider institutional participation and stability of the market.”

Structural evolution

Bitcoin still remains a risky asset, but its integration into traditional finances through ETF and other tools made price movement more “reliable and less determined by speculative extremes,” Gemini believes.

Institutional acceptance is also confirmed by the displacement of the volume of trading: now most of them are in centralized exchanges, ETF and derivatives platforms. With the advent of large players on the cryptocurrency market, activity began to flow from onchain-bills into an offchain infrastructure, analysts concluded.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.