SOLANA (SOL) shows impressive onchain-metrics in the last weeks, but large holders are in no hurry to rejoice

On the one hand, Solana demonstrates record use, on the other hand, loses key investors.

Whales sell SOLANA

According to Solanafloor, in July the network reached a new record for the number of monthly voting transactions. The average number of true transactions per second (TPS) was 1,318 – this is the highest indicator in history.

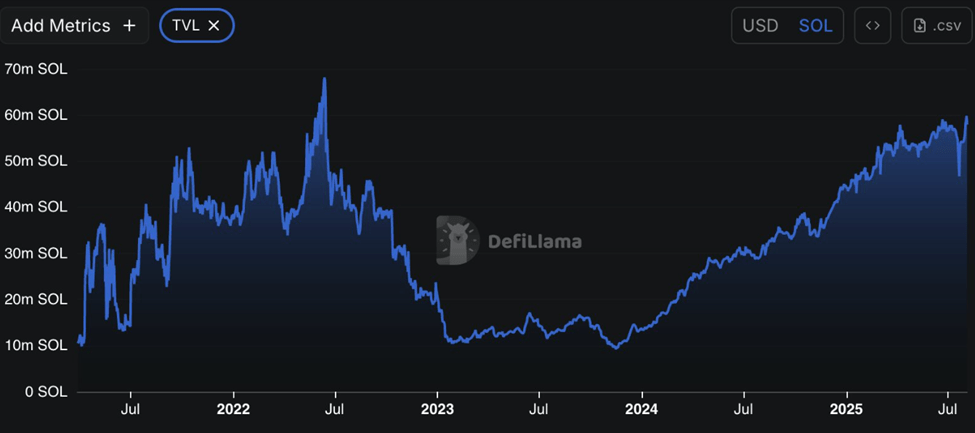

DEFILLAMA data show that the total value of blocked assets (TVL) Solana is now at the highest level over the past three years. This indicates the growing adherence of users and Defi protocols.

Meanwhile, large holders, or whales, bring millions to SOL and send them to the Binance exchange. Lookonchain said that Galaxy Digital has withdrawn 250,000 SOL, worth $ 40.7 million, and transferred them to Binance on Wednesday, the sixth of August.

Another whale tracked by Onchain Lens led $ 4.9 million to SOL after two months of inaction. After four years of stakeing, this address quietly transferred more than $ 30 million to SOL to Binance in recent months. Kit still holds $ 179 million in SOL stake, but the pressure on the sale is growing.

Hyperlique attracts attention instead of Solana

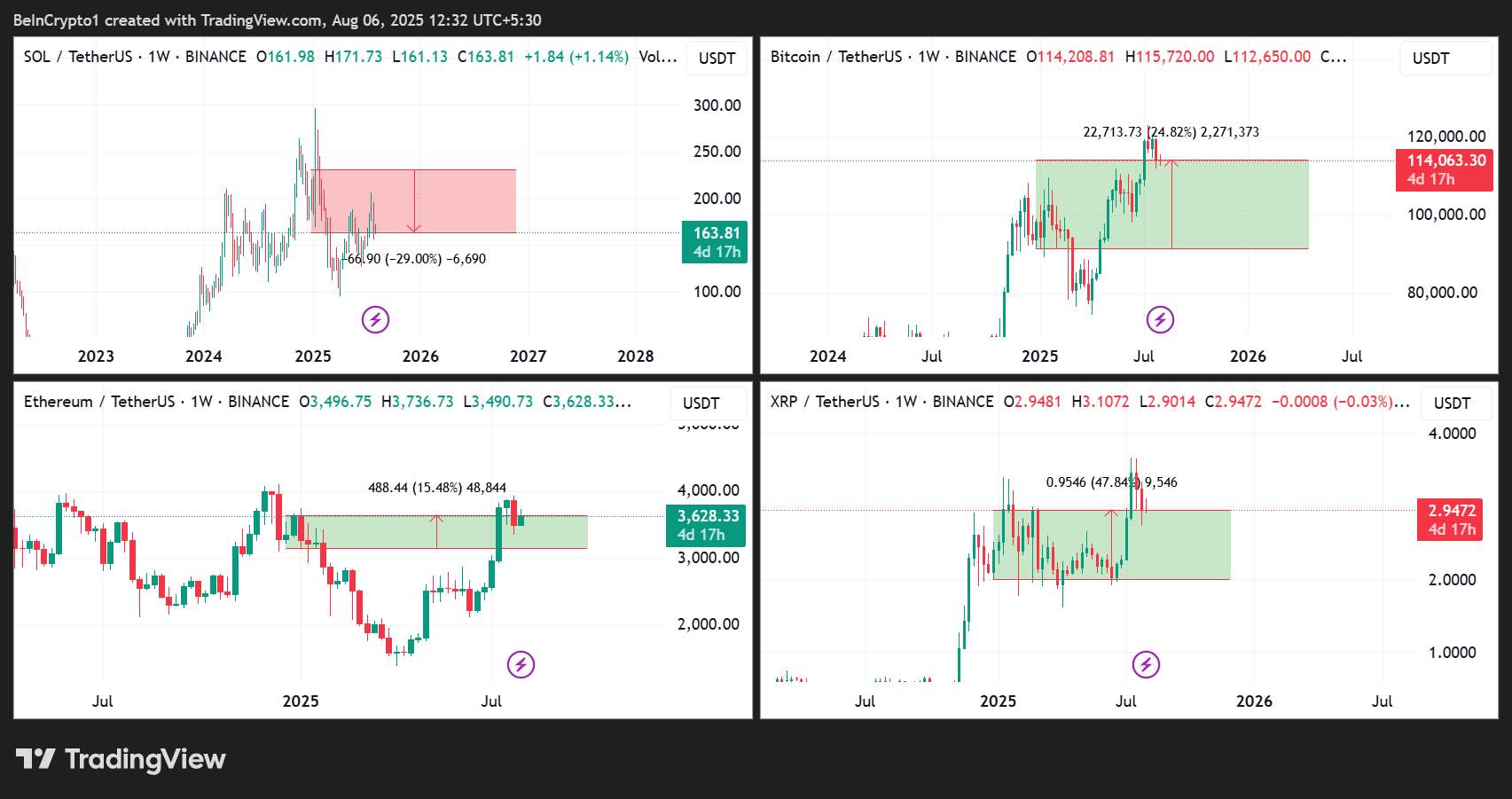

Despite the activity on the network, the price of SOL is disappointed. Since the beginning of the year, Solana has lost almost 30%in price, while the BTC grew by 26%, ETH by 15%, and XRP by 48%.

The main problem for SOLANA was DEX HYPERLIQUID. After a long dominance in the onchain-trading, SOLANA gave way to the product of unlimited Hyperlique contracts, especially among experienced users.

SOLANA’s technical roadmap is faced with difficulties. FireDancer, a high -performance client who was supposed to improve throughput and reliability, did not meet the deadlines.

Internal conflicts, leaving developers and public disputes undermined trust. According to Siegel, this uncertainty can force large investors to leave the project, even if onchain-data indicate a bull trend.

However, not all major investors are leaving. Analyst Ted noted a large purchase of SOL for $ 12 million on Binance, which was again invested in Kamino Finance. This suggests that some investors buy on the decline.

Meanwhile, Solana continues to demonstrate high speed, and the ecosystem has gone beyond the scope of memcoirs. However, institutional investors and serious capital need stability and confidence – two things that the SOLANA engineering roadmap has not yet fully provided.

At the time of writing, SOLANA traded at $ 164.31, decreasing by more than 2% over the past 24 hours.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.