Strategy

Strategy (previously known as Microstrategy) has existed for 36 years. However, far from always its name was associated with cryptocurrency – only the last five years Strategy has become one of the main BTC holders. Otherwise, the company’s activities include developments in the field of business analytics, mobile applications and cloud storage facilities. Thus, Strategy is not an investment organization.

As for the acquisition of bitcoins, the company uses different approaches. Most often these are operations with various securities. For example, in February of this year, Strategy announced On the release of convertible bonds in the amount of $ 2 billion for the purchase of BTC, and in June – about sale privileged shares worth almost $ 1 billion in order to purchase even more first cryptocurrencies.

But why is this Strategy management? After all, bonds are a debt increase, and on shares you can earn yourself.

Hidden meaning

Strategy actions regarding financial planning are quite meaningful. Regarding the same bonds, the release posted in February did not have a coupon. In other words, once again you will not have to pay for them, and they can convert them in the Strategy campaign. There is one nuance: converting will occur with a certain premium. But it is likely that by the time of repayment of bonds in the market, shares will be traded more expensive than in the indicated conditions.

Now let’s move on to shares. Strategy began to buy BTC in August 2020. At that time, her shares traded in the range from $ 12 to $ 15. Their current cost is almost $ 404, and at the peak in November 2024 it even reached $ 543. Thus, from August 2020, by the beginning of July 2025, the price of Strategy shares took 33.7 times. The question arises: why not fix part of the profit now?

Source: TradingView.com

It is also worth taking into account another nuance. Since August 2020, Bitcoin has grown 10.2 times. This is a great result, but against the backdrop of Strategy’s stakes for the same period, it looks quite trivial.

However, not everything is so bad for BTC. One of the strengths of the first cryptocurrency from the point of view of the economy is a small and limited issue. This is not entirely true with shares. No one can forbid the management to make an additional issue or split. In addition, BTC does not depend on traditional financial institutions and can continue to function outside their influence. But regarding Strategy this cannot be said. The company cannot be insured, for example, from bankruptcy. Management also most likely understands that the growth of shares will not always be so violent, so getting rid of them in time is not the worst idea.

BlackRock

BlackRock is only a year older than Strategy – it appeared in 1988. However, in relation to bitcoin, it is worth considering not the whole company as a whole, but its separate spotal ETF – IBIT. He was admitted to bidding relatively recently – in January 2024. In fact, IBIT is an investment fund that invests money in BTC. Its shares are traded on the exchange, and their price follows bitcoin.

Thus, the differences from Strategy are obvious. IBIT is an investment product, not a fintech organization. In addition, there is a difference in the approaches to the possession of the BTC themselves. Strategy keeps them on his balance sheet, and is essentially their immediate owner. IBIT also buys BTC, but investors are owners. However, although it is not to exchange a direct way of investing in cryptocurrency in the Bitcoin spotto on bitcoin, in the reality of IBIT IBIT, it is impossible to exchange it on BTC.

The choice of a private investor

So what is better for ordinary private investors? It all depends on specific tasks. The choice in favor of Strategy is made by those investors who want to quickly earn. At the same time, it is worth realizing that a large potential profit bears great risks – for example, strong price drawdown.

IBIT is a more conservative method. There will be no price jumps, but the profitability will be lower. In addition, unlike Strategy, you will need to pay a certain commission to the fund. In July 2025, it is 0.25%.

In any case, it is worth remembering that when buying at least Strategy securities, at least IBIT, investors do not acquire bitcoin in the literal sense of the word. In this regard, they even came up with a separate term in English -speaking sources – “Prixing of the Bitcoin of the Promotion”.

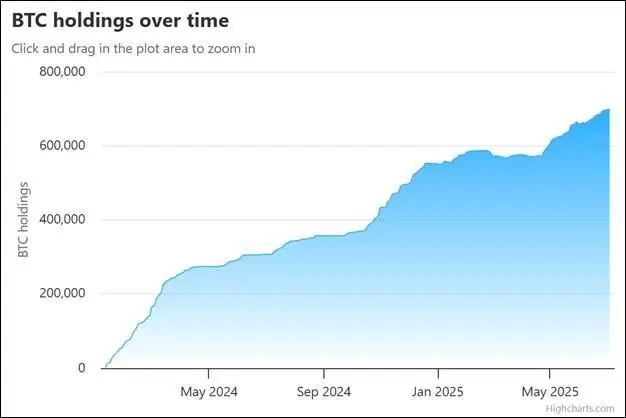

BTC reserves

By data The Bitcointreasuries portals, as July 2025, Strategy has more than 597,000 bitcoins. This makes the company the largest organization whose shares are freely contacted on the exchange.

Source: Bitcointreasuries.net

At the disposal IBIT, by information Bitbo portal, in July 2025 a little less than 699,000 BTC. Thus, this is the largest expires of Bitcoin Sprite ETF.

Source: Bitbo.io

Conclusion

Both Strategy and IBIT are invested in BTC. However, the acquisition and possession style is very different. In both cases, the usual private investor should remember that the purchase of securities of both the company and the fund does not give a direct right to bitcoin.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.