The SOLANA network has proposed to consider the alpenglow consensus (SIMD-0326), designed to speed up the finalization of blocks. This step was a response to a sharp increase in transactions on the network, which has already brought SOLANA to leaders compared to most world stock exchanges.

Alpenglow: New Era of the Finalization of Blocks

If the proposal is adopted, the Alpenglow protocol will replace the current Solana system based on the Proof-OF-History and Towerbft mechanisms. According to the developers, the current protocol has a number of restrictions, including a long time of confirmation and a lack of formal security guarantees.

The new update introduces Votor-a simplified voting protocol capable of finalizing blocks in just one or two rounds, depending on the state of the network. Alpenglow is expected to reduce the finalization time of blocks from the current ~ 13 seconds to 100-150 milliseconds, and also significantly reduce the load on the network by eliminating excess messages.

At the moment, the proposal is at the stage of public discussion. Voting is planned for the period between eras 420 and 840 (the current era – 835). To accept the update, you will need to support two -thirds of the vote.

Solana wants to overtake Nasdaq

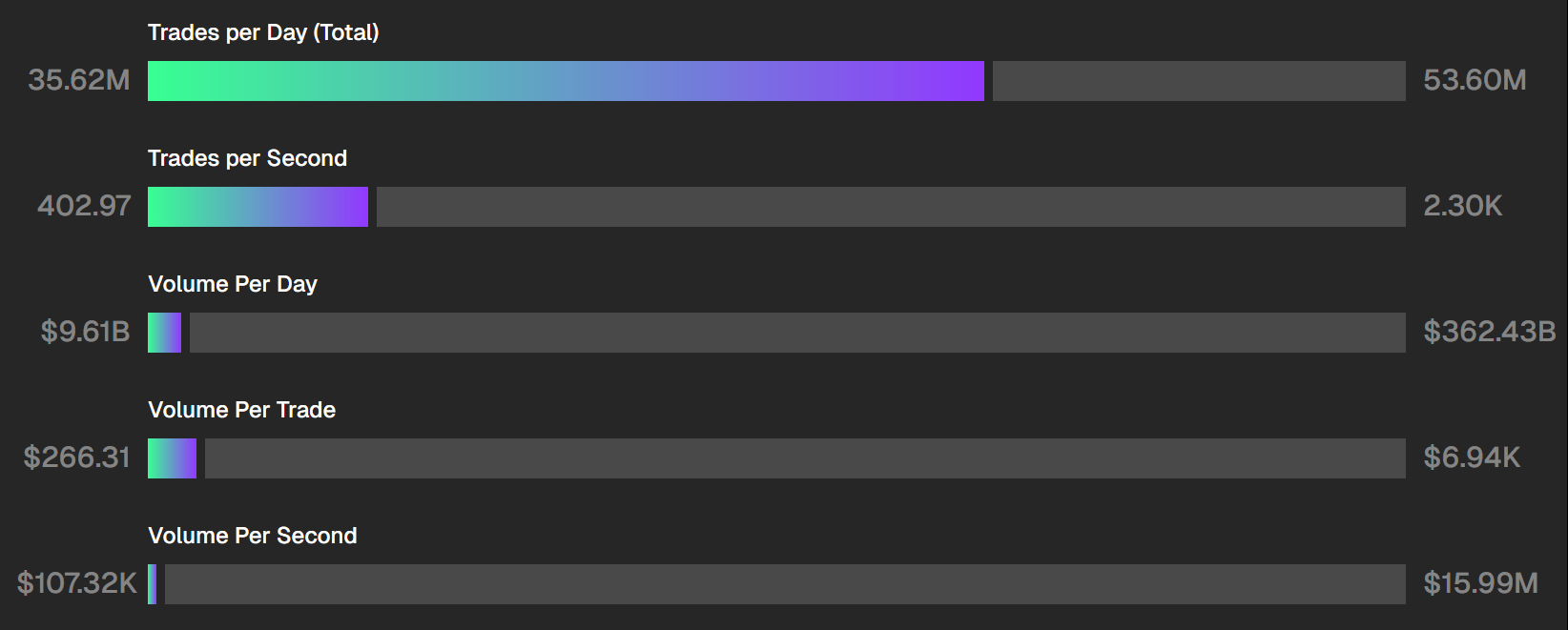

Against the background of these technological ambitions, Solana is already showing impressive operating results. A recent indicator of 35 million transactions per day puts blockchain on a par with the world’s largest stock exchanges, and even above many of them. For comparison, the Tokyo exchange processes about 5 million transactions per day, and London – only 600 thousand.

Now the network is aimed at the American Nasdaq, which so far remains an unattainable leader in speed and volume. NASDAQ processes about 2,290 transactions per second, while the average SOLANA indicator is 402. The gap is also large for the daily bidding volume: $ 362 billion in NASDAQ against $ 9.6 billion from SOLANA.

Despite this, the Solana team is sure that the constant updates and expansion of the ecosystem will reduce this gap over time. Thus, the alpenglow update is considered not just as a technical improvement, but as a strategic step towards competition with traditional financial giants.

Earlier it became known that the Canadian company SOL Strategies, specializing in the SOLANA ecosystem, submitted documents to the US Securities and Exchange Commission (SEC) to go to NASDAQ

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.