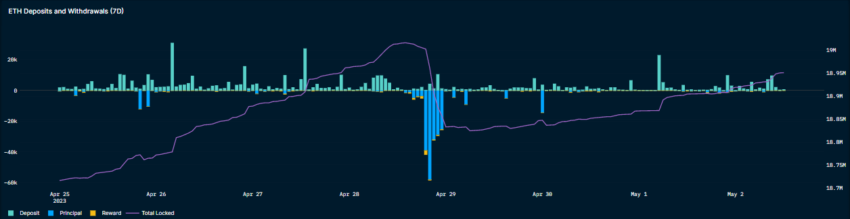

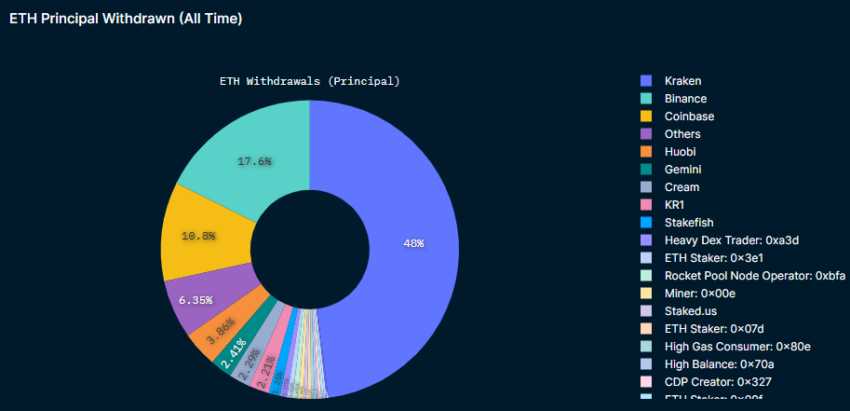

Since the activation of the Shapella update, validators have withdrawn 1,976,138.58 ETH worth about $3.6 billion from staking. 80% of these funds have come from rewards, and only 3% of stakers have taken advantage of the full withdrawal of deposits.

This trend is indicative of Ethereum users viewing the asset as a long-term rather than a short-term investment.

The Lido Finance platform remains the leader in the number of ETH locked in staking: it has placed about 6 million coins on Beacon Chain. Lido, Rocket Pool, and other liquid staking protocols are experiencing a surge in user interest thanks to low fees and the ability to bypass the 32 Ethereum limit.

Centralized exchanges Coinbase, Binance, and Kraken have staked 2.3 million, 852,512, and 799,200 coins, respectively.

Low withdrawal rate of ETH deposits guarantees network security

The developers opened deposits on Beacon Chain in December 2020. Stakers could convert their nodes to validator status by locking 32 ETH in a smart contract and earn rewards for securing the network by successfully confirming and broadcasting transactions.

A full withdrawal releases 32 ETH and all accumulated rewards from staking and revokes the validator authority from the node operator. However, only 15,395 validators, or about 2.6%, took advantage of this opportunity. The majority of withdrawal requests came from Kraken.

According to beaconcha.inthere are currently 554,266 active validators.

The current price of Ethereum at the time of writing is $1,831.65. After the activation of the Shapella update, its price rose to about $2,100, but after a few days it corrected along with the rest of the crypto market.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.