- The ADP report is expected to show that the US private sector added 179,000 jobs in April.

- Labor market tightness and persistent inflation support the Fed's restrictive stance.

- The US dollar appears to have entered a consolidation phase.

On Wednesday, the United States (US) Automatic Data Processing (ADP) Research Institute will release private employment data for the month of April. This survey provides information on private sector job creation and typically precedes the official employment report from the Bureau of Labor Statistics (BLS), which includes Nonfarm Payrolls (NFP) data and will be released on May 3. .

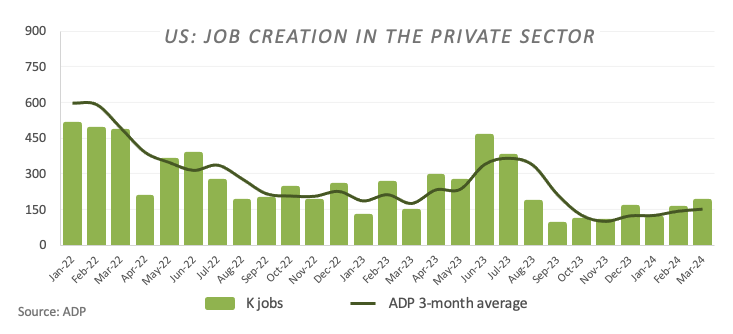

Market analysts expect the ADP survey to reveal that 179,000 new jobs have been created over the past month, slightly below the 184,000 jobs recorded in March. However, it is important to note that the figures above are subject to revision, and while a robust ADP survey may hint at a similar trend in the NFP report, the correlation between the two reports has been inconsistent.

However, the importance of the ADP survey is accentuated by the publication in the US of various employment-related data in the days prior to the publication of Non-Farm Payrolls. Together, this data helps market participants decipher potential monetary policy actions from the Federal Reserve (Fed).

Many Federal Reserve (Fed) policymakers have spoken out in recent weeks about the resilience of the US labor market, while highlighting the good health of the US economy as a whole.

That said, US Treasury Secretary Janet Yellen stated that they currently have a robust labor market and see no signs that labor market conditions are contributing to inflation. Chicago Fed President Austan Goolsbee stressed the need to evaluate whether the strong GDP and employment numbers signal an overheating that could be fueling inflation, noting that not all data suggest an overheating of the labor market. . Fed Chair Jerome Powell noted that the labor market is moving toward a healthier balance despite current strength, and that broader wage pressures are gradually easing. Additionally, Mary Daly of the San Francisco Fed noted that the labor market remains strong, although inflation is not declining as quickly as last year.

When will the ADP survey be released and how could it affect the USD index?

The release of the ADP survey on job creation, scheduled for Wednesday, May 1, is expected to reveal an increase of 179,000 new jobs in the private sector in April. If the actual figure far exceeds this estimate, it could indicate continued strength in the labor market. Along with rising wages, these results are likely to stimulate demand for dollars. Conversely, if job creation falls short of expectations and wages show signs of moderation, it could hurt sentiment around the Dollar and likely put some downward pressure on the US Dollar Index (DXY).

Pablo Piovano, Senior Analyst at FXStreet, says: “If bearish pressure intensifies, the USD Index (DXY) is expected to find initial support around the critical 200-day SMA at 104.13. , followed by the April low at 103.88 (April 9). Further weakness could break this level, leading to a test of the 100-day SMA at 103.77, which precedes the March low at 102.35. (March 8).”

On the other hand, Pablo notes that the resumption of bullish momentum could try to retest the 2024 high at 106.51 (April 16). Breaking above this level could encourage market participants to contemplate a move towards the November high at 107.11 (Nov 1), just before the 2023 high at 107.34 (Oct 3).

Considering the broader perspective, the prevailing constructive tone is expected to continue as long as the DXY maintains its activity above the 200-day SMA.

economic indicator

Non-Agricultural Payrolls

The Nonfarm Payrolls publication presents the number of new jobs created in the US during the previous month in all nonfarm companies; It is published by the US Bureau of Labor Statistics (BLS). The monthly evolution of payrolls can be extremely volatile. The figure is also subject to strong revisions, which can also trigger volatility on the currency board. Generally speaking, a high reading is considered bullish for the US Dollar (USD), while a low reading is considered bearish, although revisions from previous months and the unemployment rate are just as relevant as the headline figure. The market reaction, therefore, depends on how the market values all the data contained in the BLS report as a whole.

More information.

Next post: Fri May 03, 2024 12:30

Periodicity: Monthly

Consensus: 243K

Former: 303K

Fountain: US Bureau of Labor Statistics

The monthly US employment report is considered the most important economic indicator for currency traders. Published on the first Friday following the reporting month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the mandates of the Federal Reserve, which takes into account the evolution of the labor market when setting its policies, which has an impact on currencies. Although several leading indicators shape estimates, Non-Farm Payrolls often surprise markets and trigger high volatility. Actual numbers that exceed consensus tend to be bullish for the dollar.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.