According to the adviser, the main factor, which should instill in the crypto -investors confidence that the local decrease in the market value of bitcoin is temporary, is associated with zero involvement in the event of mining companies.

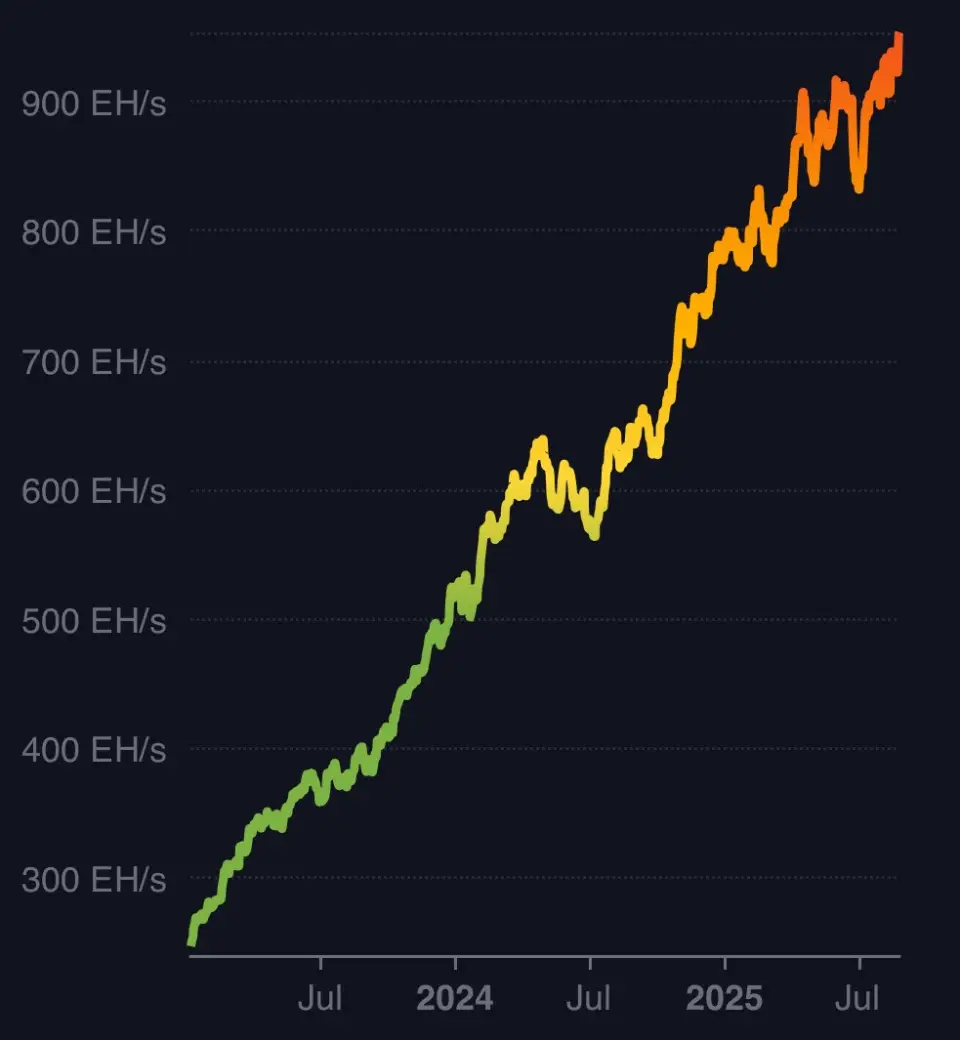

Kaiser argued his conclusions on the growth of the general hashReit of the Bitcoin network, which exceeded 900 eh/s.

“It is the miners, and not BTC buyers are risk and give the best signal. Mining is completely independent of the price. The miners know what will happen next, ”said Kaiser.

Bitcoin adviser saw another event that can be interpreted as a signal to the market about the imminent restoration of the price of the first cryptocurrency. This is a decline in speculative demand in the futures market.

“Futures traders stop hunting“ feet ”. When they end, the BTC will rise to a new maximum in the coming days, ” – He thinks Kaiser.

The founder of The Birb Nest Adrian Zdunchik announcedthat the average cost of mining of one Coin BTC is now about $ 97,000, which completely covers the costs of miners for electricity, equipment and operating costs.

The general director of Whalewire’s analytical platform Jacob Kinge said that Bitcoin could encounter a catastrophic collapse, since the first cryptocurrency mining became too centralized.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.