Bearish sentiment on Hamster Kombat (HMSTR) is intensifying. Let’s look at why the token will likely continue to fall.

After the airdrop and the start of trading on crypto exchanges, Hamster Kombat did not live up to expectations. Despite initial interest in the project, the active sale of HMSTR tokens led to their significant depreciation last week.

Hamster couldn’t keep investors’ interest

On September 26, Hamster Kombat distributed 60 million tokens to its players, after which the coins appeared on cryptocurrency exchanges at a price of $0.014.

However, massive sales quickly reduced the value of the token. It has lost 50% in value in the last six days and is down 11% in the last 24 hours at the time of writing.

Since the airdrop, HMSTR has faced pessimistic sentiment. This is confirmed by negative weighted sentiments. The indicator reflects the overall market sentiment, and its negative value suggests that most discussions of the asset on social networks are associated with fear, uncertainty and doubt. Now it is equal to -0.16. This could be a sign of further price decline.

The coin has already lost half its value in just a week. However, futures traders remain optimistic. According to Coinglass, HMSTR’s funding rate has remained positive since trading began. This mechanism provides a balance between long and short positions in the perpetual futures market. Positive rates indicate dominance of long contracts and that the contract price is above the spot price. This means that traders buy a coin with the expectation of selling it at a higher price.

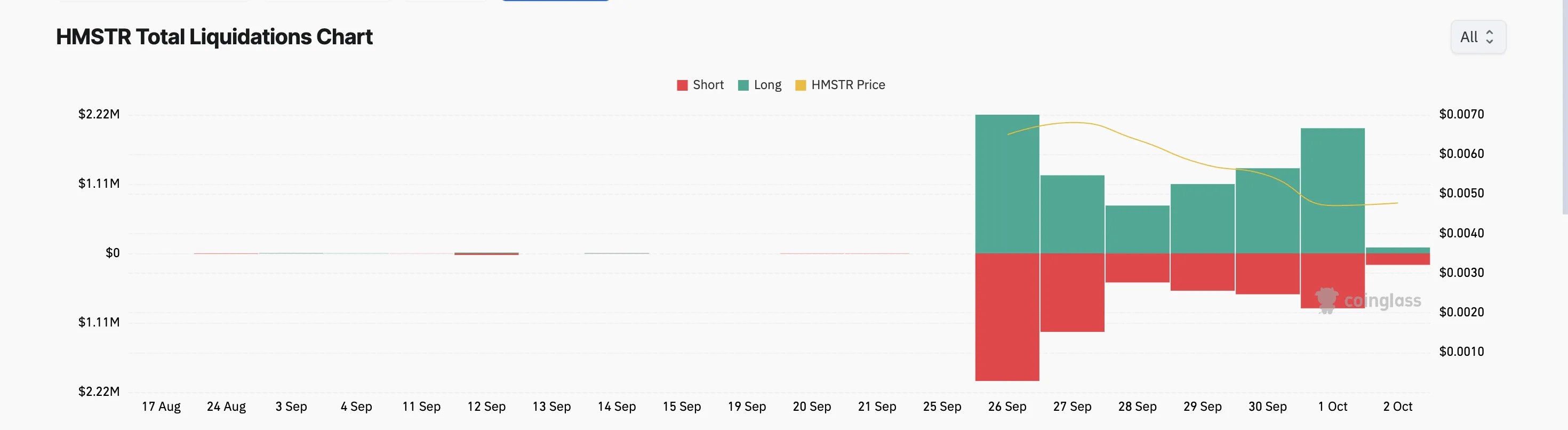

However, many of these long positions have turned out to be unprofitable as liquidations continue. Since September 26, long positions worth $9 million were liquidated due to a drop in the token price.

General HMSTR Eliminations. Source: Coinglass

General HMSTR Eliminations. Source: Coinglass

HMSTR forecast: further decline expected

The hourly chart shows that the token may continue to fall. Directional movement index (DMI), which assesses the strength of the trend, confirms this bearish forecast.

At the time of publication, a positive directional indicator (blue) is below negative (red). This arrangement most often promises a decrease in price and indicates the dominance of sellers. If the bears maintain control, they could push the HMSTR price down to a low of $0.0010.

However, if market sentiment turns bullish, the price could jump 59% and reach the resistance level at $0.0075.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.