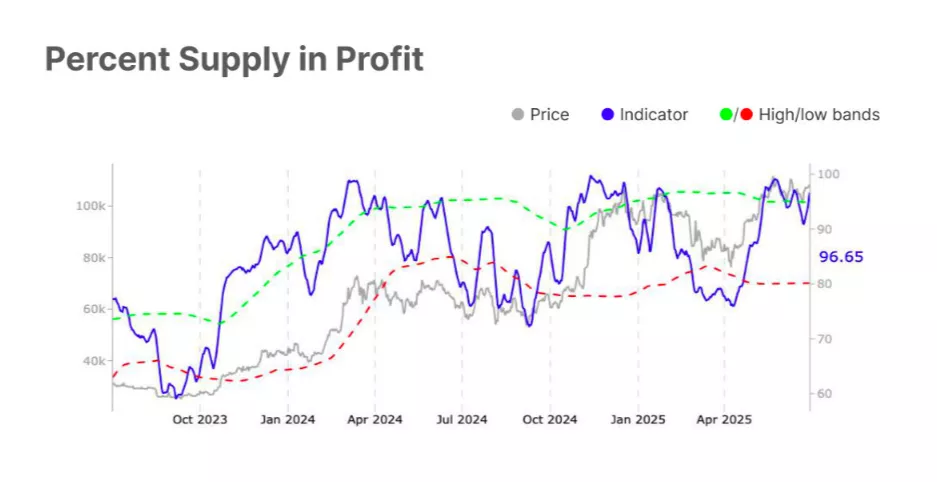

As of the end of June, 96.7% of the first cryptocurrency proposal was in profit, which indicates a high risk of volatility. This is stated in the Glassnode report.

Historically, such high levels lead to sales pressure, since the potential for profit fixation is growing, the researchers said. The current situation reflects the “bull mood of investors, but with maintaining caution in relation to price corrections.”

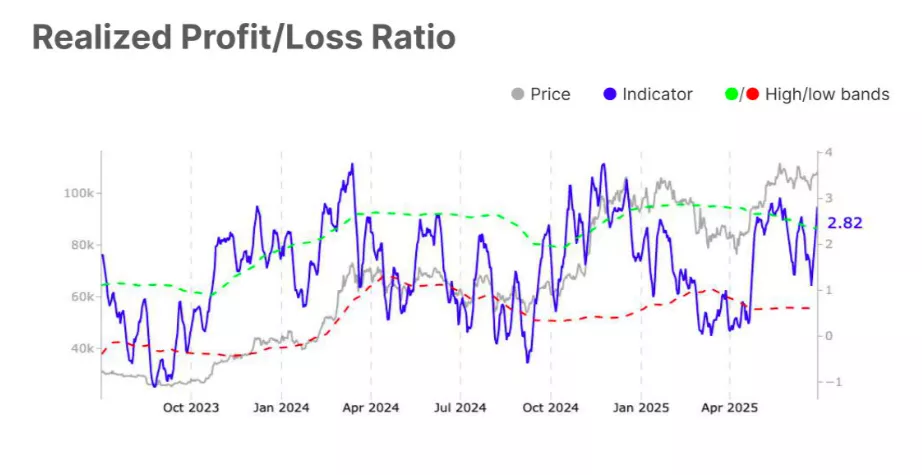

From June 22 to 30, the coefficient of profit and loss on bitcoin jumped from 1.1 to 2.8 points.

According to experts, to maintain rally, constant demand and wider market trust are necessary.

The weekly report of the company said that the total “paper profit” of bitcoin investors reached $ 1.2 trillion, approaching the historical maximum of the late 2024 of $ 1.3 trillion.

The average unrealized profit of the digital gold holder is 125%. Before the maximum, the indicator was 180%.

Such dynamics leads to a decrease in the realized profit of bitcoin and an increase in the volume of coins in long -term holders. The metric almost approached the record.

Glassnode also drew attention to a sharp decrease in sales from short -term holders after bitcoin growth to levels of a historical maximum in May 2025.

Recall that Standard Chartered Bank said that halving will no longer affect the first cryptocurrency cycle, and predicted its growth of up to $ 200,000 by the end of 2025.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.