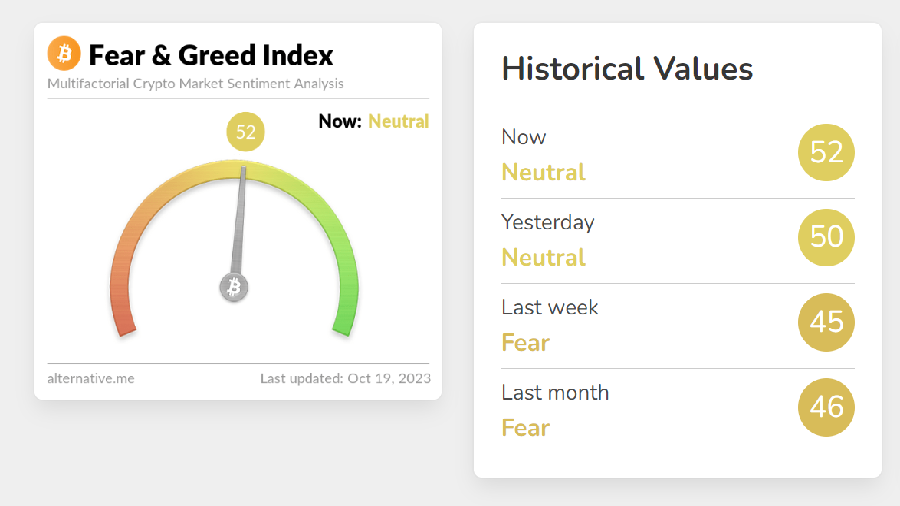

The balanced state of the index demonstrates that the majority of digital asset holders have coped with the panic in the third quarter of 2023 and have begun to show readiness to accumulate assets.

The index takes into account: volatility factors (25%), market dynamics/volume (25%), social media activity (15%), dominance (10%), Google trends (10%) and survey results (15%). Little by little, the level of greed in the crypto market begins to increase.

Alternative experts remind: the behavior of crypto investors is very emotional. People tend to become greedy when the market rises, leading to FOMO (fear of missing out). Additionally, people often sell their assets due to an irrational reaction. According to analysts, a deviation in the indicator towards fear may be a sign that investors are too worried and are ready for sales. When investors get too greedy, it could mean the market is headed for a correction.

Previously, the analytical platform CoinMarketСap provided Bits.media with a report on trends in the market for cryptocurrencies and other digital assets based on the results of the third quarter of 2023. Over the course of three months, market sentiment gravitated towards fear, and the greed index dropped from 60 to 42 points.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.