- The June CPI shows that inflation rises from the minimum of May.

- Futures of US shares show increases and low as IPC inflation is present.

- The June general CPI jumps from 2.4% to 2.7%.

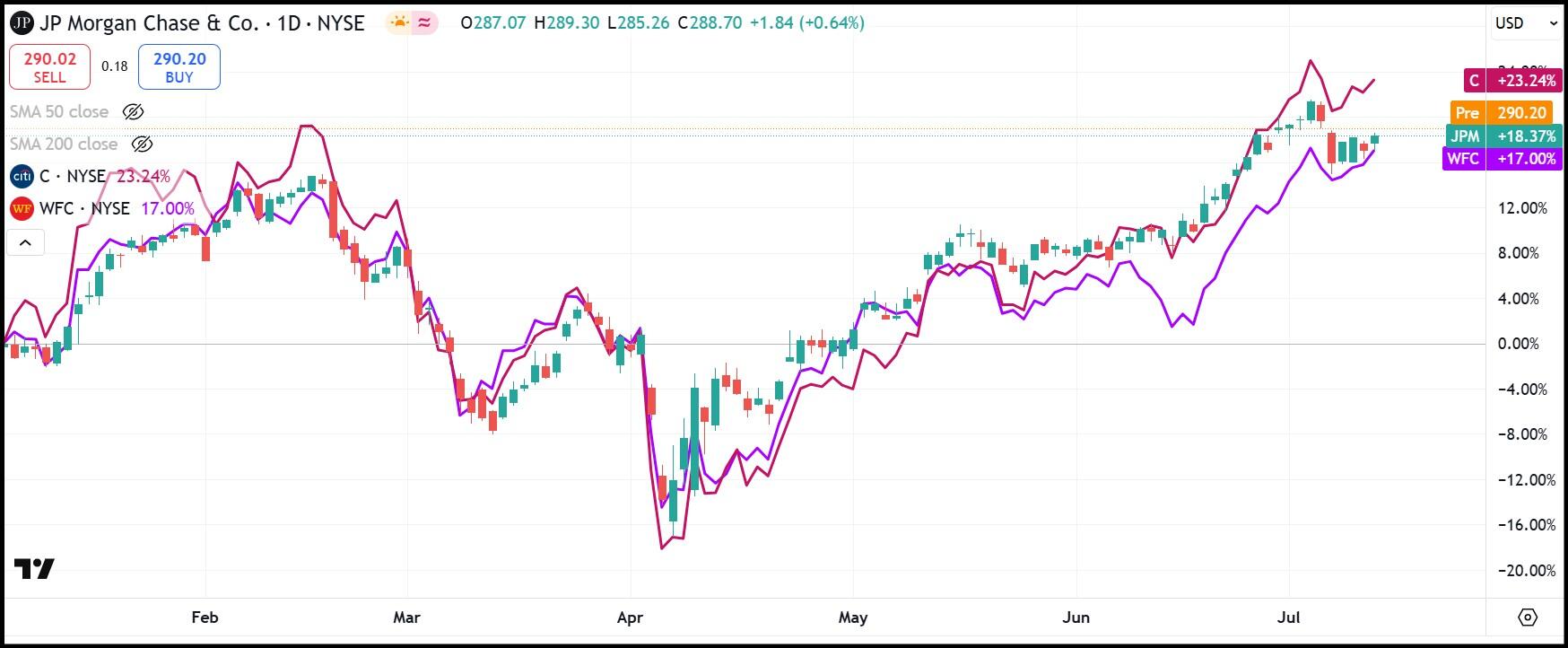

- Banks mostly exceed earnings expectations, but Wells Fargo cuts their projection.

Inflation in the June consumer price index (CPI) index again appeared its ugly head. Both general and underlying inflation increased with respect to May numbers, since general inflation aligned with consensus, and underlying figures increased but were behind the consensus.

The annual underlying IPC of June reached 2.9%, greater than 2.8%in May but lower than the 3.0%consensus. The general CPI reached 2.7%, in line with expectations and well above 2.4% in May.

Dow Jones’ futures remained negative, while S&P 500 futures lost 0.45%, and Nasdaq 100 futures won 0.11%. Inflation, although not well received, also supports the prices of assets, often elevates them. A large part of the recovery of the market of shares towards new maximums from the minimum of April can be attributed to the fall of the US dollar amid the expectations of higher price levels caused by the tariff policy of the Trump administration.

Deutsche Bank and others had warned at the beginning of this week that the increases in tariff rates would begin to be reflected in the CPI data from this month. While importers have large inventories prior to rates that move first, the increase in government revenues by rates indicates that policies are beginning to take effect. Until now this year, the US has raised more than 100,000 million dollars in tariffs.

With the recent 30% rates ads about the European Union (EU), Mexico and Canada, as well as 25% rates on Japan and South Korea, all scheduled to begin on August 1, economists expect the highest inflation figures in June to continue gaining impulse in the following months.

Banks start the profit season

Although FASTENAL Gains (FAST) They exceeded expectations on Monday, which marked the technical start of the profit season, the main banks on Tuesday are seen as the first assault. The profits largely exceeded consensus on Tuesday, helping to raise stock indices.

JPMorgan (JPM) He led the way with a great surplus in profits. The largest Bank of the US revealed $ 4.96 in earnings adjusted by action (BPA), 48 cents above the Wall Street consensus. The income of 45.7 billion dollars was 1.66 billion above the projections.

Citigroup (C) He was in a similar situation, since the bank won 35 cents above the consensus with $ 1.96 in adjusted BPA. The revenues of 21.7 billion dollars were 740 million above expectations.

Wells Fargo (WFC) The actions fell almost 4% in the premarket, however, since the bank cut the projections for the net interest income of this year. For the whole year 2025, the address now expects net interest revenues to be in line with the 47.7 billion dollars of 2024, approximately 200 million dollars below its previous guide.

JPM, C, WFC shares graph to date

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.