Bitcoin

Bitcoin from June 13 to June 20, 2025 decreased by 1.42%in price. The largest cryptocurrency in capitalization for seven days did not rise above $ 109,000 and did not fall below $ 102,000. Changing the price of the BTC price in the course of the week did not exceed 2.1%.

Source: TradingView.com

On Wednesday, June 18, a Federal Security Council was held, at which the head of the American Central Bank Jerome Powell performed. He announced that the key rate remains at the same level of 4.25%–4.5%. In other words, this year the size of the indicator remains unchanged. Representatives of the Fed are awaiting inflation and unemployment in the near future. Nevertheless, Powell adheres to a position according to which by the end of the year the rate will be reduced twice. On relatively neutral news, crypto -investors reacted sluggishly: after

performances The head of the regulator in no one of the days of bitcoin did not change even by 0.5%.

Despite some stagnation in the dynamics of BTC prices, some analysts believe that not everything is so bad. For example, the Santment Analytical Platform Marketing Director Brian Quinlivan believes that retail traders create all the current negativity regarding bitcoin. As an argument, he cited statistics according to which 1.03 positive for each negative review about BTC. This is the lowest ratio since the start of the deployment of Donald Trump’s trade war in early April. By

opinion KUINLIVANA, now a wonderful moment has come for purchases, given that cryptocurrency prices usually go in a direction opposite to retail expectations.

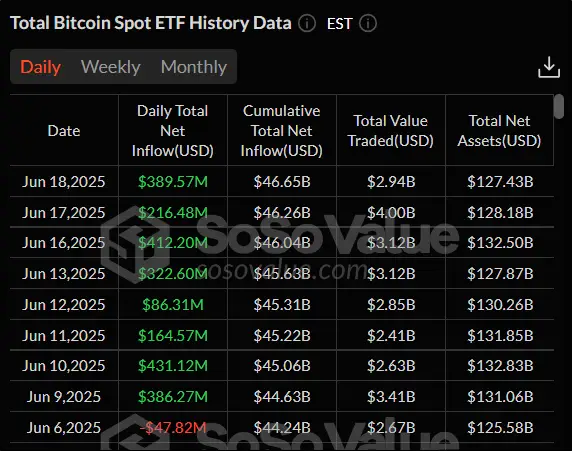

But from the side of institutional investors there is a positive attitude, says the flow of funds in the spotal ETF on Bitcoin. In the week, the tributary exceeded the mark of $ 1 billion. The receipt of the funds in exchange bitcoin funds has already been going on eight trading sessions in a row.

Source: sosovalue.com

From the point of view of technical analysis, Bitcoin formed a symmetrical triangle (in the image below it is indicated by purple lines). The upper line is the level of resistance, and the lower level is the level of support. In the case of breaking through the first, it is worth expecting growth, and in case of closing below the second – the fall. The overall picture is formed in favor of the bears. The price is insignificant, but fell below the 50-day sliding average (marked in blue), and the RSI fell below the mark 50, although it has not yet reached the resolving zone.

Source: TradingView.com

Index

Fear and greed Compared to last week, he fell by seven points. The current value is 54. This suggests that between greed and fear, neutrality was established in the mood of the crypto -investors.

Ethereum

The broadcast decreased in seven days from June 13 to 20 by 2.5%. All week, bidding took place in a rather narrow corridor between $ 2,450 and $ 2,650. The change in the price of ETH in one day has never exceeded 2.5%.

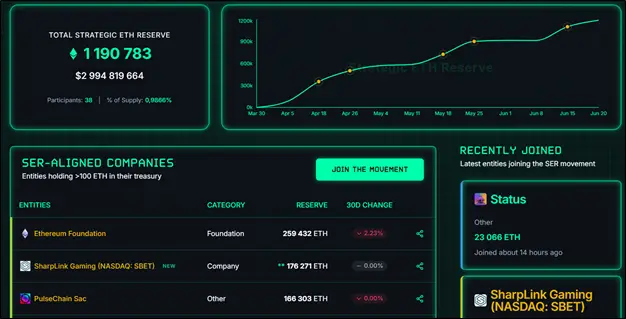

Source: TradingView.com

Although the dynamics of the price of the broadcast was negative in the last week, its strategic reserve continues to grow and almost reached 1% of the total cryptocurrency offer – 1.2 million ETH (about $ 3 billion). In other words, companies with great capital are more and more preferred by the ether. The largest holder is the Ethereum Foundation, standing behind the development of the Ethereum. She has more than 200,000 ETH on her balance. The second place is occupied by the Marketing Company Sharplink Gaming with more than 176,000 ETH. Troika is closed by the creators of the first -level blockchain Pulsechain from 166 303 ETH.

Source: strategicethreserve.xyz

The analytical platform Santiment signals the positive dynamics of intra -meter indicators of the Ethereum. Since mid -May, the number of new addresses that are created in a week is in the range from 800,000 to 1 million. In the same period 2024

indicators Metrics were more than 30% less.

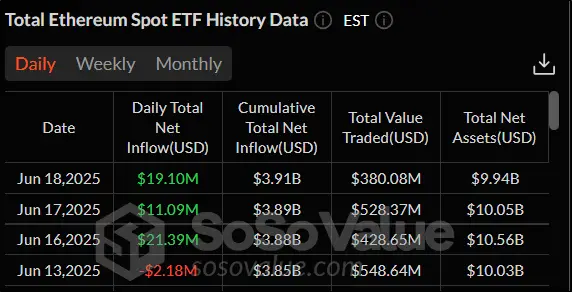

Positive in spotes ETF on the air is preserved. True, a series of nineteen trading sessions of the flow of money in a row was interrupted on June 13. Nevertheless, shortly after this day, a new one began, which so far has reached a modest three days. In total during this time, the influx of investment amounted to $ 51.58 million.

Source: sosovalue.com

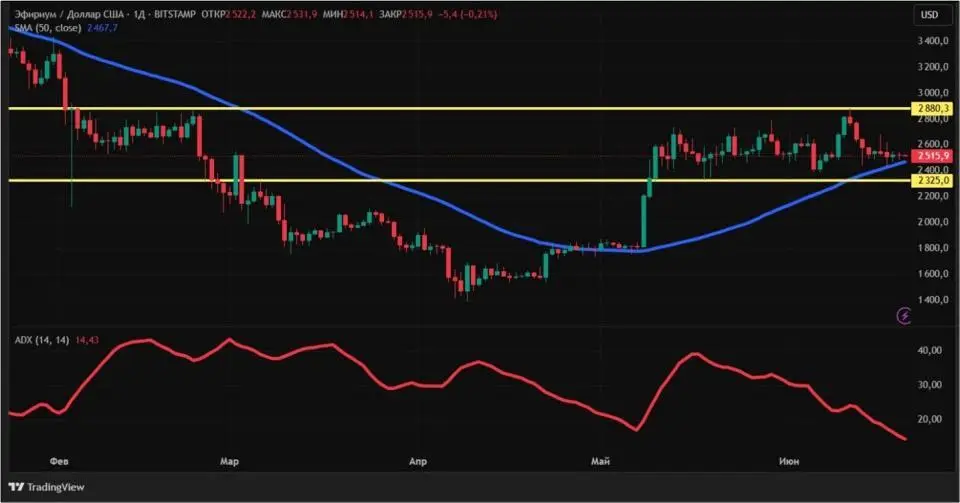

From the point of view of technical analysis, ether is traded in the sidewall. Its price has been clamped between $ 2,325 and $ 2,880.3 for a month and a half for a month and a half. The presence of lateral movement is confirmed by the ADX indicator, the value of which dropped to 14.43. At the same time, the long-term trend remains ascending-given that the price still exceeds (although it approaches it closely) a 50-day sliding average (indicated in blue).

Source: TradingView.com

Tron

Unlike bitcoin and ether, the cryptocurrency of the Tron project from June 13 to 20 increased in price by 1.78%. At the same time, on June 16, the coin was much more expensive – $ 0.2953, showing a maximum of six months. However, TRX has not yet been destined to stay near the peak values of TRX.

Source: TradingView.com

One of the main news of the week was the information that the Tron project Justin San will become a public company. This should happen through the background of SRM Entertainment, which specializes in the release and sale of goods for children and selling NASDAQ. On this news, the cost of TRX jumped above $ 0.29. The reverse absorption is a process as a result of which a private company absorbs public and thus becomes public. As the first

Must Tron directly act, and as the second – SRM Entertainment.

Cryptoquant’s analysts noticed that the number of daily transactions on the Tron network over the past four years has increased by 3.6 times – from 2.5 million to 9 million. This indicates not only about user activity, but also an increase in interest in cryptocurrency from investors. In Cryptoquant

NoticedWhat has been demonstrating amazing stability since 2021: about 96% of all transactions were successful.

But another analytics platform, Glassnode, focuses on the price. Her experts believe that Tron found support in the area of $ 0.26– $ 0.27. As an argument, they provide data from Cost Basis Dustribution, which shows the number of tokens that was bought and sold at specific prices. According to this

indicatorthe offer over the zone $ 0.26– $ 0.27 is quite narrow, and most of the coins were in motion at lower prices.

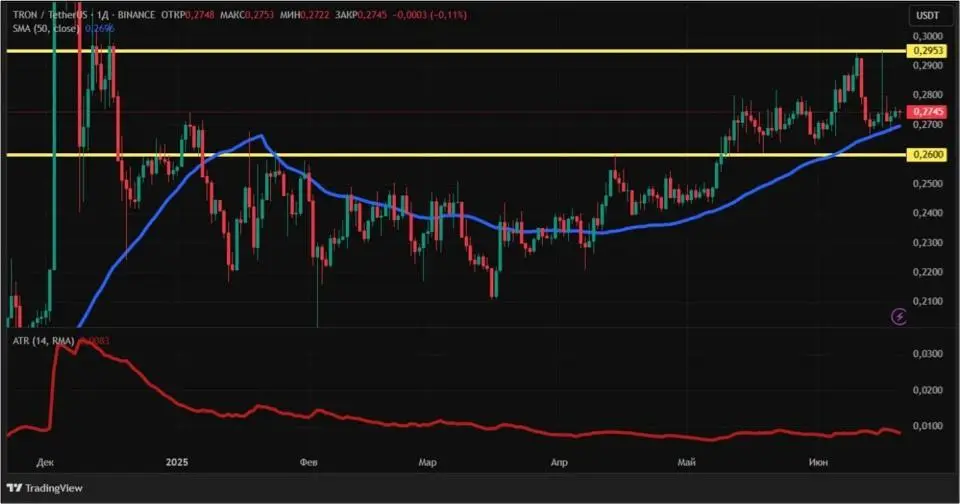

From the point of view of technical analysis, the TRX is in an upward trend, since the price exceeds a 50-day sliding average (indicated in blue). But the volatility of Coin remains low, given that the ATR indicator is less than 0.01 – 4.1 times lower than in December. The levels of support and resistance are $ 0.26 and $ 0.2953, respectively.

Source: TradingView.com

Conclusion

The largest cryptocurrencies are not observed in strong price movements. The actions of the US Federal Reserve remain monotonous and predictable for investors, and the general political and economic instability interferes with the growth of both bitcoin and altcoins.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.