The descent of bitcoin in early August to the levels of the first days of July scared many participants in the crypto community. While some in a panic sell coins, others are purchased on the contrary with a crypt, as they believe that the BTC groped for the local bottom.

A popular trader, investor and analyst Ted Pillow called arguments in favor of continuing the growth of bitcoin. He is sure that in early August the cryptocurrency passed the local bottom.

The beginning of August 2025 was the very period for the crypto market this summer. According to the independent analyst Ted Pillus, BTC “reaching the bottom” in front of the potential parabolic rally in the IV quarter. That’s why he thinks so:

Deep subsidence. At the weekend, Bitcoin fell by 5.6% – to $ 113,411, provoking the elimination of futures positions by about $ 900 million. Such a deep drawdown has not been since the beginning of June.

Panic. The catalyst for panic moods was a series of statements by US President Donald Trump about his readiness to use nuclear weapons and the order to transfer two atomic submarines to the banks of Russia. Many investors managed to click the “Sell” button.

Insider game. Pillus claims that the largest trade exchanges in Binance and Coinbase took advantage of the surge of fear to “ride” the price down and collect stop losses. According to him, several million dollars in the BTC, ETH and SOL were reset on the spot and derivatives – a volume sufficient to disrupt $ 115,000.

A sharp rebound. After the collapse, the price sharply bounced. Recovery forced many bears to close shorts.

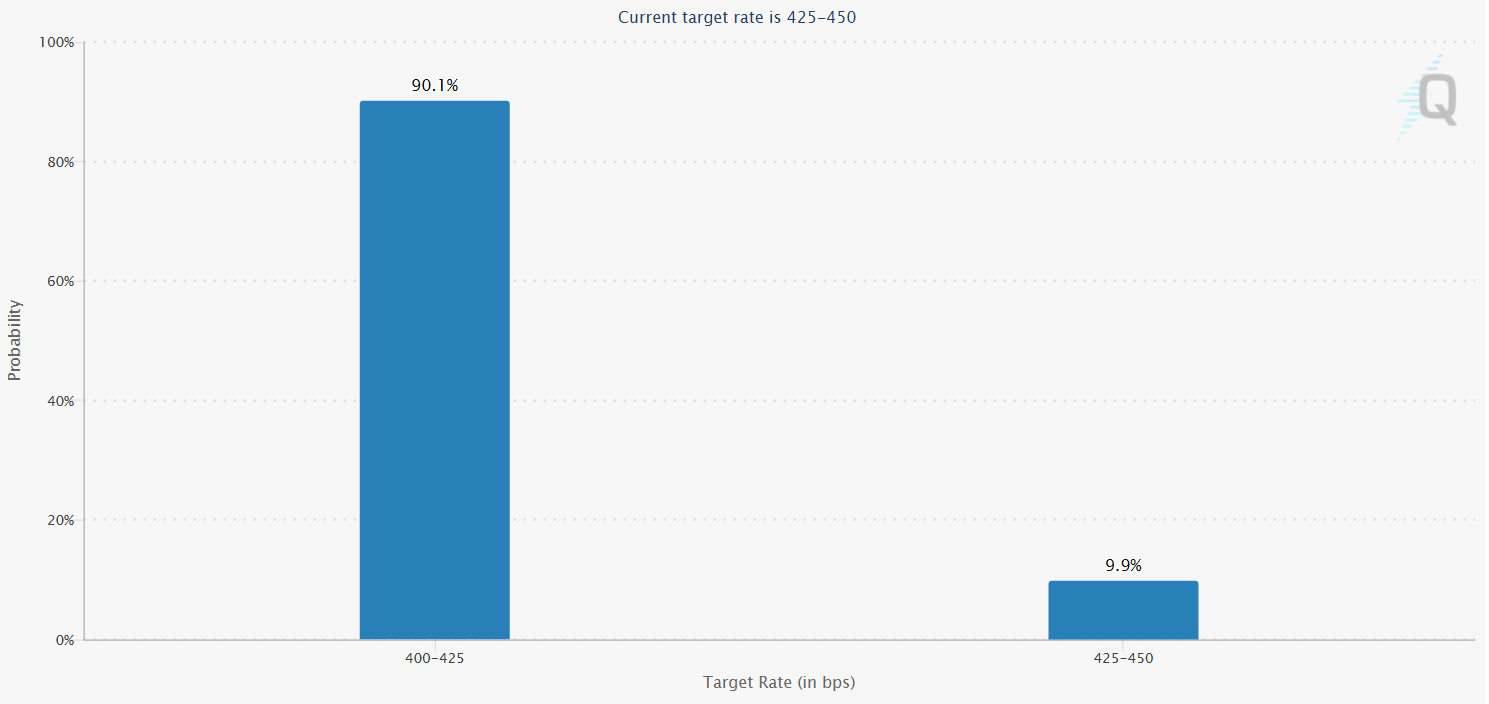

The probable decrease in the key rate of the Fed in September. Bitcoin updated the absolute maximum in July without a clear softening of Federal Reserve policy. The author believes that the main driver of Bullran is still ahead. A weak July report on employment raised the probability of reducing the rate in September to levels above 90%. Changes can maintain interest in such highly risked assets as a crypt.

Pillus is sure that the combination of pressure reduction in the geopolitical arena, the potential turn of the Fed to reduce the rate and the steady increase in the money supply M2 create conditions for the release of bitcoin in parabolic growth in the IV quarter of 2025.

He noted that historically such false holes on the negative news of geopolitics have previously repeatedly become the start of the start of the new bull market.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.