Cryptoquant Carmelo Aleman, based on historical laws, predicted that the price of the first cryptocurrency will reach $ 205 097 – this will become an extremum of the current market cycle.

According to him, metrics like MVRV, Hodl waves, SOPR or the dynamics of exchange reserves are useful-they “make it possible to understand what is happening in onchain and make reasonable decisions.”

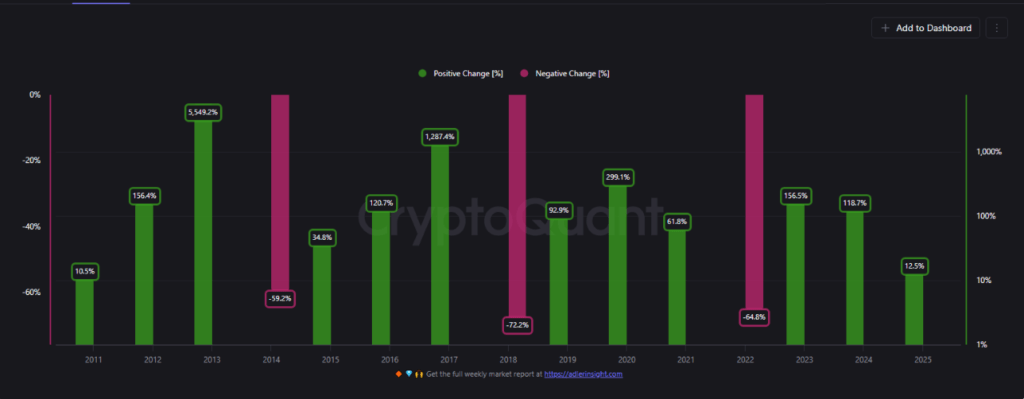

The analyst suggests paying attention to the digital gold yield schedule since 2011 – he demonstrates the repeating cycle: “Three years of growth are replaced by the year of consolidation, which corresponds to the four -year rhythm of halvings.”

He believes that the continuation of the trend for a year can make 2025 “The Third in a row by the bull”, thereby completing the next phase of growth.

The expert added that the annual profitability schedule allows you to weed out market noise and focus on the cyclic nature of the first cryptocurrency.

According to him, the long -term prospect helps investors “to remain calm during market fluctuations and it is better to correlate their actions with the historical dynamics of the asset.”

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.