The crypto space has changed a lot since the 2020-2021 bull market, which saw popular memecoins like Dogecoin, Shiba Inu, and FLOKI soar.

Crypto Koryo, a data scientist, explained how the meme coin market has evolved and why investing in memecoins is now considered a high-risk investment with potentially low returns.

Is it worth investing in memcoins?

In the past, meme coins have benefited from a massive influx of retail investment and limited competition. However, the barrier to creating new coins has dropped significantly, leading to an oversaturation of the market.

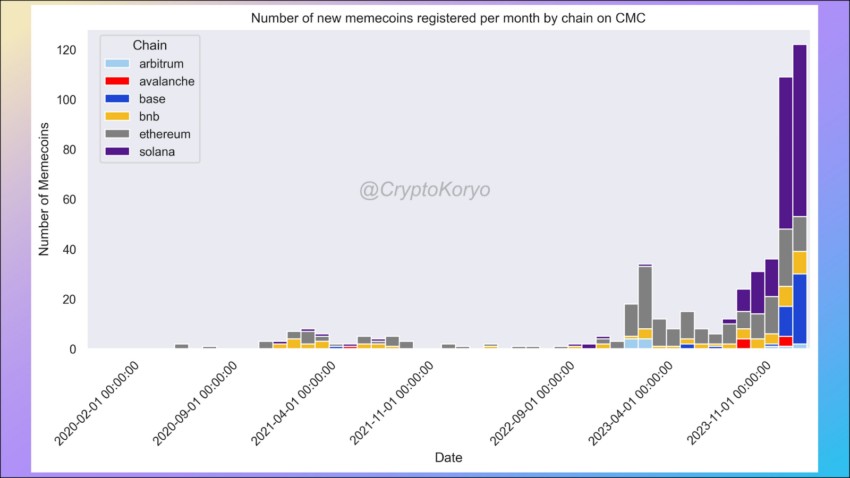

Statistics back up his claims. Last month, 138 new meme coins were registered on CoinMarketCap, up from just 18 in April 2023. This influx led to the erosion of the potential profitability of individual altcoins. In addition, competition has spread to various blockchain platforms, and even the Bitcoin network now supports memcoins.

New meme coins on CoinMarketCap. Source: Crypto Koryo

New meme coins on CoinMarketCap. Source: Crypto Koryo

Investing in these coins now means navigating a volatile market with many alternatives. Koryo warns that investors need significant portfolio diversification or risk falling to zero value.

In addition, retail investors are now becoming market drivers instead of developers. This means that the dynamics of supply and demand have fundamentally changed. If in 2021 demand significantly exceeded supply, the situation has now reversed, creating a market in which supply exceeds demand.

As a result, memcoins can still bring significant profits, but the chances of success are much lower and the risks are much higher. For most casual investors, the hassle and effort required to stay profitable is too much.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.