The analyst Martyparty drew attention to an interesting pattern in the motion of bitcoin, behind which market manipulations can stand. According to his observations, the market regularly demonstrates noticeable changes in exactly the 6th number of each month.

The analyst shared the details of his theory in X. He accompanied the post with marking the cryptocurrency schedule, which shows how, in his opinion, BTC is manipulated.

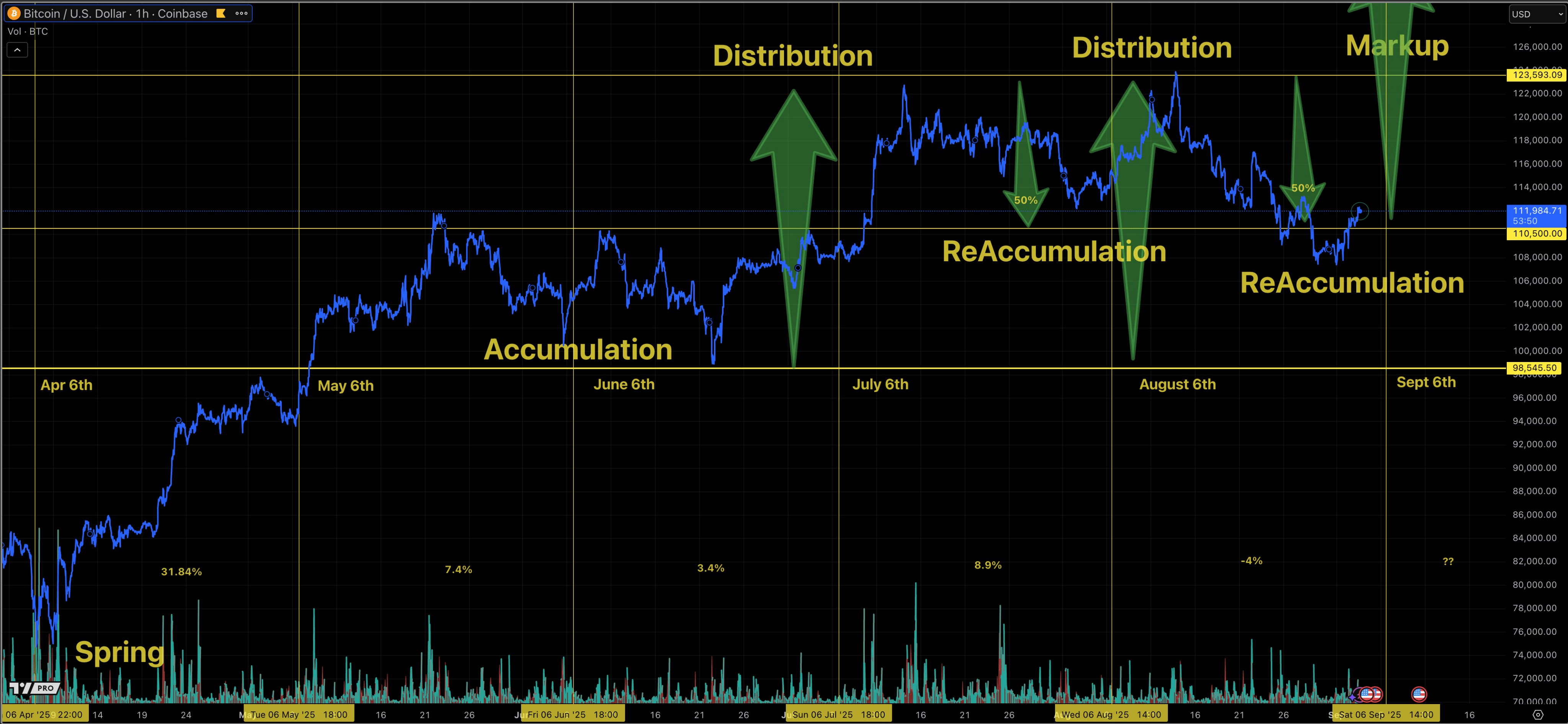

In the crypto community, they discuss the idea that the Bitcoin market is moving along a special calendar rhythm. According to this hypothesis, noticeable price fluctuations and phase change occur regularly on the 6th of each month. If you look at the BTC/USD schedule from April to September 2025, you can notice a repeating drawing that many associate with the actions of large players.

In early April, the market survived a sharp fall. After that, the price turned upward quickly. From mid -April to early June, an accumulation phase was underway. During this period, large market participants gradually bought an asset. In July and August, signs of distribution showed. This is the fixation period of profit on the maximums. Between these stages appeared re -accumulation areas, which served as preparing for new growth impulses.

Statistics confirm the pattern around the sixth. From April 6 to May 6, Bitcoin grew by 31.84%, in the next months he added 7.4%, 3.4%and 8.9%. By the beginning of September, a decrease was recorded by about 4%, which is interpreted as a pause before a new movement.

Key levels are highlighted on the graph. Support takes place in the area of $ 98,500. The zone of about $ 110 500 is considered an important point of turn, from which the price often changes the direction. If buyers can hold the market above these marks, the next purpose will be the area of $ 123,600 – a level that is associated with a possible start to the accelerated growth phase (Markup).

Supporters of this model believe that another important point will come on September 6. The US Federal Reserve Set of the US Federal Reserve on September 17, which traditionally has a strong impact on financial markets, can provoke an increase in volatility.

Judging by the markup of the graph that the analyst Martyparty shared, on September 6, another change in the Bitcoin phase on Vaikoff Model should occur. If you follow the logic of its marking, on this day it expects the beginning of the next phase of Markup – accelerated price growth and movement to the corner of the upper boundary of the range in the region of $ 123,600.

According to the theory, it is by September 6th that the market marquers will finish the set of positions and launch an impulse upward, which can fix the bull script.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.