The price of the first cryptocurrency is believed to have hit a local bottom before recovering to a high of nearly $66,000 earlier this week, reports The Block with reference to the CryptoQuant report.

Bitcoin’s recent price drop to around $55,000 has resulted in the largest realized losses for holders of the asset in 2024, analysts say.

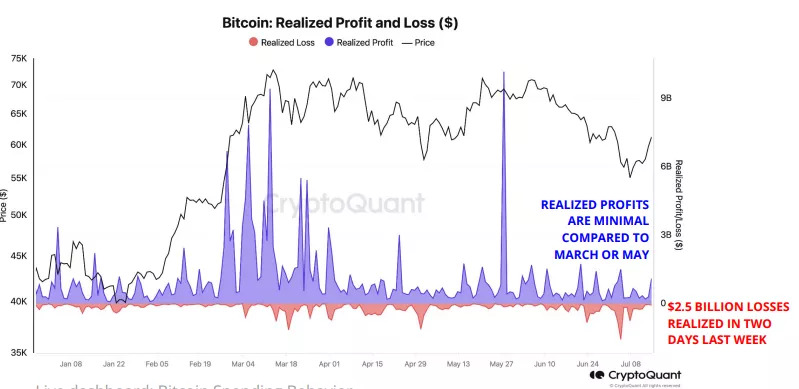

Bitcoin Realized P&L. Data: CryptoQuant.

Bitcoin Realized P&L. Data: CryptoQuant.

They added that last week, unrealized trader margins fell to -17%, the lowest since the FTX crash (November 2022).

Positive forecasts

The report says that various Bitcoin metrics have bounced off key levels recently, which is also a sign that the local bottom is behind us and that upward price momentum is ahead.

A spoon of tar

The report also found that liquidity in the form of stablecoins is still insufficient to fuel meaningful growth.

In their opinion, USDT’s market cap is not growing enough, which “reduces the likelihood of a more significant price increase.”

But at the time of writing, the price of Bitcoin is trading around $63,730. Over the past seven days, the asset has grown by ~11%, according to CoinGecko.

Earlier, Bitwise’s investment director predicted that digital gold would rise to $100,000 by the end of the year.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.