The fall of the cryptocurrency market and the massive liquidation of positions have sparked rumors that the Singapore-based cryptocurrency hedge fund Three Arrows Capital is on the verge of bankruptcy.

By opinion analysts, Three Arrows Capital (3AC) could crash in a bear market. How reported According to The Block, unnamed sources, the total liquidation amounted to about $400 million. Analyst Onchain Wizard noted that another $300 million could be liquidated on Aave and Compound if the market continues to fall.

Investor and cryptocurrency trader under the pseudonym Moon led on Twitter that Three Arrows Capital ranked 2nd on the Bitfinex leaderboard for realized losses in May 2022 with -$31 million.

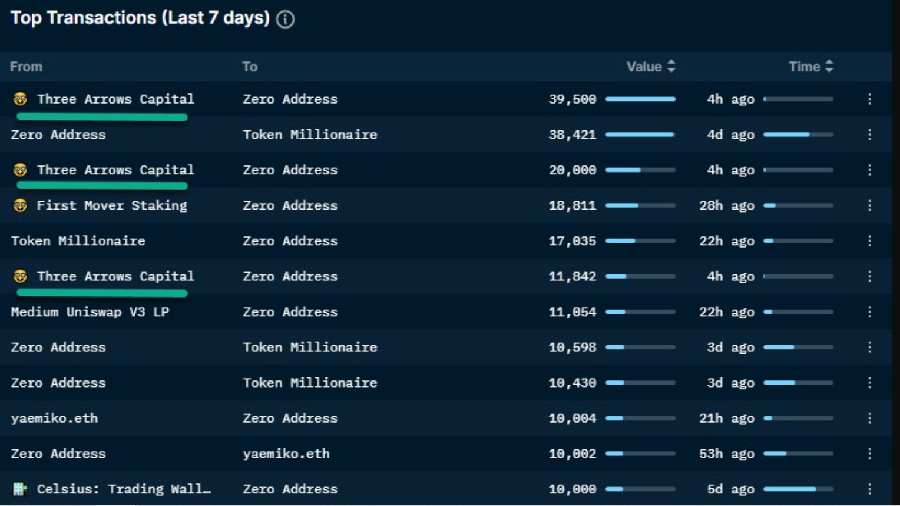

According to the AppZerion service, June 14 3AC sold Lido Staked ETH (stETH) worth at least $40 million, making it the largest seller of an ETH 2.0 staking token. Moon confirmed AppZerion observations. In his analysis of the situation around Three Arrows Capital, Moon noted:

“People think Celsius is the biggest stETH dumper, but it’s actually 3AC. They are dumping on every account and seed round address, and it’s like paying off the debts and outstanding loans they have.”

Three Arrows Capital co-founder Zhu Su, in response to rumors that the company is struggling with insolvency, limited himself tweet: “We are in the process of communicating with the relevant parties and are fully immersed in resolving this issue.”

Recall that in April, Three Arrows Capital moved its headquarters to Dubai and created a fund focused on raising capital from external investors in the UAE.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.