Memcoins continue to be one of the most successful narratives of 2024. Their market capitalization has exceeded $58 billion, and this is causing differing opinions among seasoned investors.

Analysts cannot agree on whether memcoins are on the verge of a supercycle or are facing a major correction.

Opinion 1: memcoins have hit the ceiling

Investor Miles Deutscher says widespread discussion of meme coins on social media, from YouTube to X, is a red flag. According to Kaito, their share of attention reached a new high of 27.32%. Attention Share is a metric that shows how much of a community’s attention a topic receives.

Share of attention to memcoins. Source: Kaito.

Share of attention to memcoins. Source: Kaito.

While Deutscher acknowledges the long-term promise of meme tokens, he believes they are at a crossroads. This means that they will either collapse or make a correction when the hype subsides.

Besides, he assertsHowever, selling altcoins now to buy memcoins may not be the best strategy. He recommends investors think carefully about their moves before jumping on the hype.

CrediBULL Crypto presents a less common view, highlighting the connection between Bitcoin and altcoins. He notes that the rise of small-cap memcoins amid the stagnation of large-cap coins indicates the end of the hype cycle.

Opinion 2: Memecoins are entering a supercycle

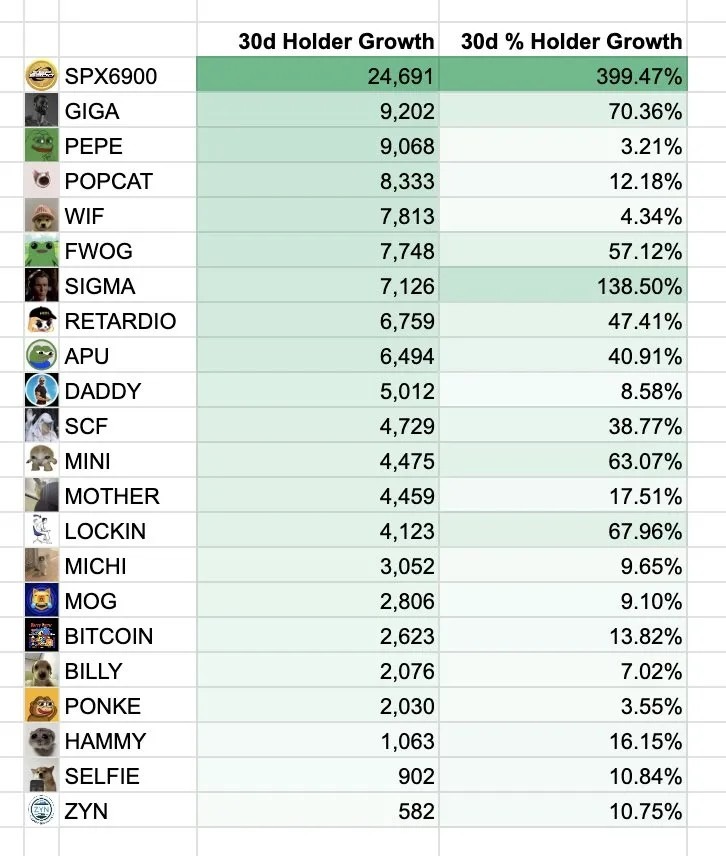

However, optimistic forecasts are still no less popular. For example, analyst Murad notes progress over the past month:

Memcoin performance for the past month. Source: Murad

Memcoin performance for the past month. Source: Murad

In addition, according to Google Trends, interest in memcoins remains at a high level – between 75 and 100 points in October. This suggests that memcoins continue to attract new investors to the market.

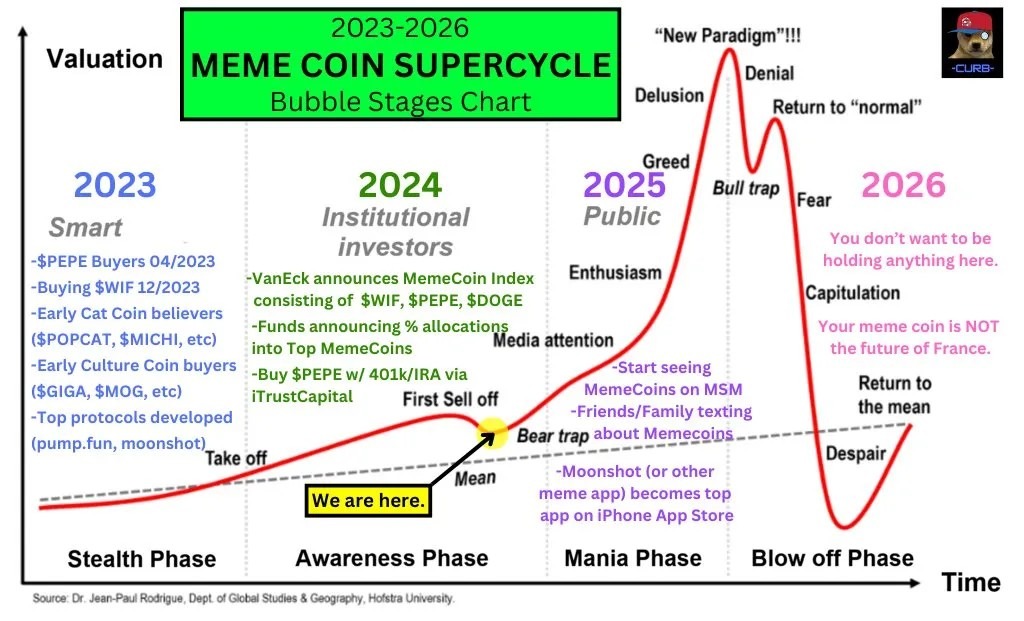

Memcoin supercycle. Source: Curb

Memcoin supercycle. Source: Curb

Investor Curb uses the bubble growth model and based on it predicts that memcoins are just starting their cycle. At the time of writing, the market capitalization of this segment of the crypto market has reached $58.3 billion, an increase of 2.8% over the past 24 hours, according to data from Coingecko.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.