One of the factors that influenced the jump in the SOL rate is the price pressure on the asset from users of the Coinbase exchange. This follows from a report by Kaiko analysts.

Coinbase has been leading this SOL rally for the past week; Kraken’s CVD flipped positive on the 30th while Binance and OKX went positive in the past 12 hours. Upbit doing its own thing pic.twitter.com/AgVYOKyVxR

— Riyad Carey (@riyad_carey) November 1, 2023

As you can see in the chart above, SOL’s cumulative volume delta (CVD) on Coinbase has increased by nearly $1 million since October 25, 2023. This indicates an influx of capital, the report said.

The CVD of the SOL token on the Binance and Kraken exchanges was also positive. But its value is lower compared to the Coinbase indicator. In the case of the Upbit platform, it gradually decreased over the specified time.

According to Kaiko analyst Riyad Carey, the average SOL order size on Coinbase was larger compared to other exchanges. He admitted that demand could come from institutional clients of the site.

hard to say without speculating too much, its average order size is smaller than Kraken but its median (and st. dev) order size is larger than on any other exchange so… maybe some institutional demand?

— Riyad Carey (@riyad_carey) November 1, 2023

Note that the asset’s rise occurred against the backdrop of the publication of a report by the investment company VanEck. It states that the SOL rate could reach $3,200 by 2030.

At the time of writing, the asset has rolled back to $38.6. During the day, from November 2 to November 3, the price fell by 4%, according to TradingView.

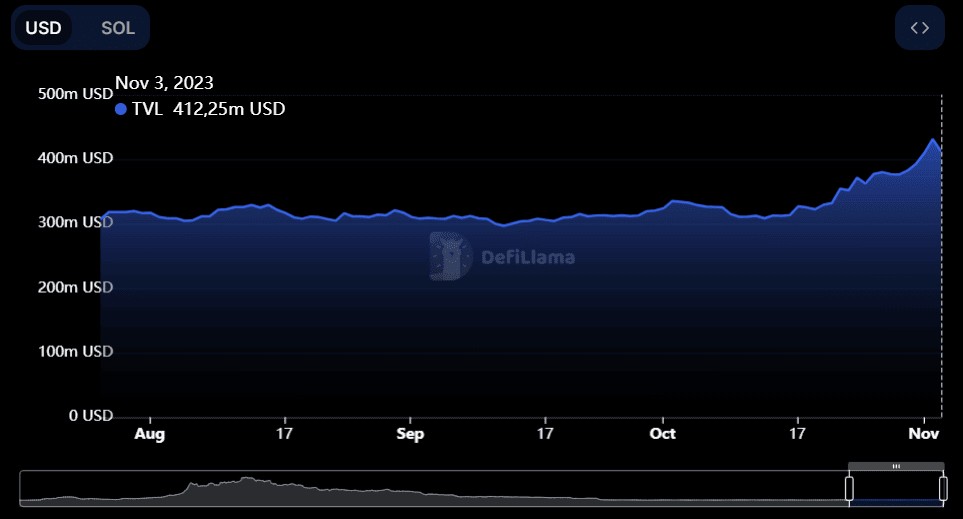

Notably, the Solana network’s total value locked (TVL) remained virtually unchanged despite the rally. At the time of writing, it stands at $412.2 million, according to DeFiLlama:

Let us remind you that TVL reflects the total value of assets locked in the smart contracts of the network.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.

![News and prognosis of the price of the pound sterling: the GBP/USD earns even when the unemployment rate in the United Kingdom is accelerated [Video] News and prognosis of the price of the pound sterling: the GBP/USD earns even when the unemployment rate in the United Kingdom is accelerated [Video]](https://editorial.fxsstatic.com/images/i/gbp-usd-001_Large.jpg)