In 2023, the Bitcoin network hashrate increased by 90%. In their report, CoinShares experts assessed the prospects for further development of the industry and considered issues of profitability and environmental friendliness of mining.

Want to understand the impact of the halving on Bitcoin Miners revenues and how bitcoin mining can reduce global CO2 emissions? Please do read our 2024 mining reporthttps://t.co/0gJBTMB4yq

— James Butterfill (@jbutterfill) January 12, 2024

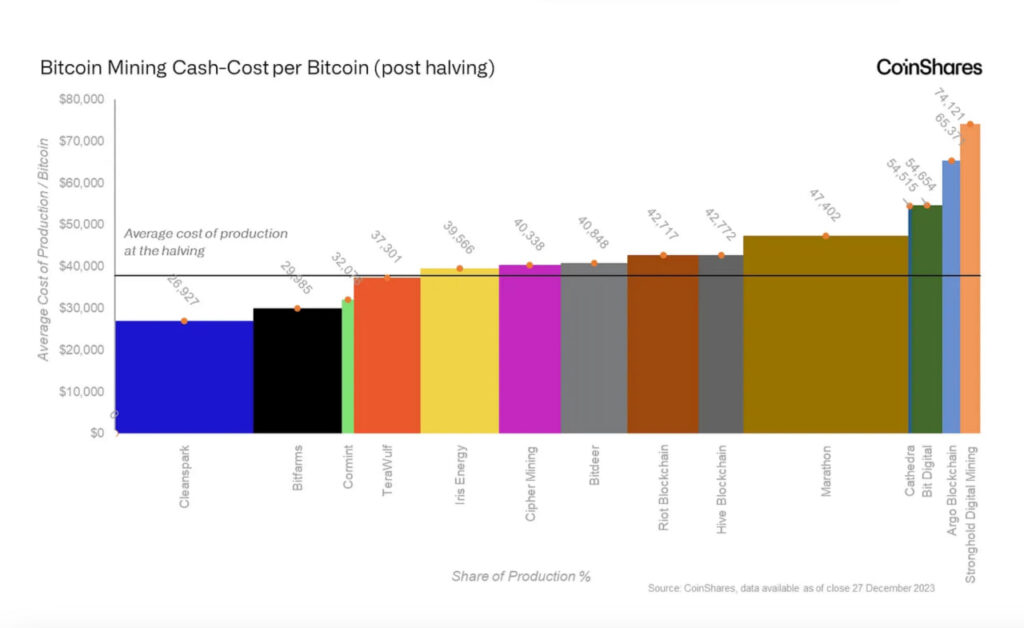

CoinShares predicts an increase in the average cost of Bitcoin mining to $37,856 after the halving, which will take place in April 2024. The reward for the mined block will be halved to 3.125 BTC, and the overall speed will decrease as part of the deflationary policy, experts noted.

According to the report, the average energy consumption in the network is 34 W/T, but by mid-2026 it could fall to 10 W/T. Experts pointed to the need to cut costs to avoid operating losses:

The study suggests that Bitcoin miners' capital costs are covered through equity or debt. If Bitcoin falls, high interest rates could expose such companies to additional risks.

Analysts believe that after halving, Bitcoin will trade at $40,000. A fall below this level will lead to unprofitable mining for many companies. Only Bitfarms, Iris, CleanSpark, TeraWulf and Cormint will be able to operate profitably, the report says.

Average cost of Bitcoin mining after halving for various companies. Source: CoinShares.

Average cost of Bitcoin mining after halving for various companies. Source: CoinShares.According to CoinShares, approximately 53% of mining electricity comes from environmentally friendly sources. Meanwhile, miners' demand for electricity reached 115 TWh year on year. In 2023, this figure increased by 44%.

As experts noted, most Bitcoin miners are working to improve their efficiency. They purchase new equipment with reduced energy consumption and high performance.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.