The $ 110,000 mark is a “rescue circle” for the first cryptocurrency. This was stated in Swissblock.

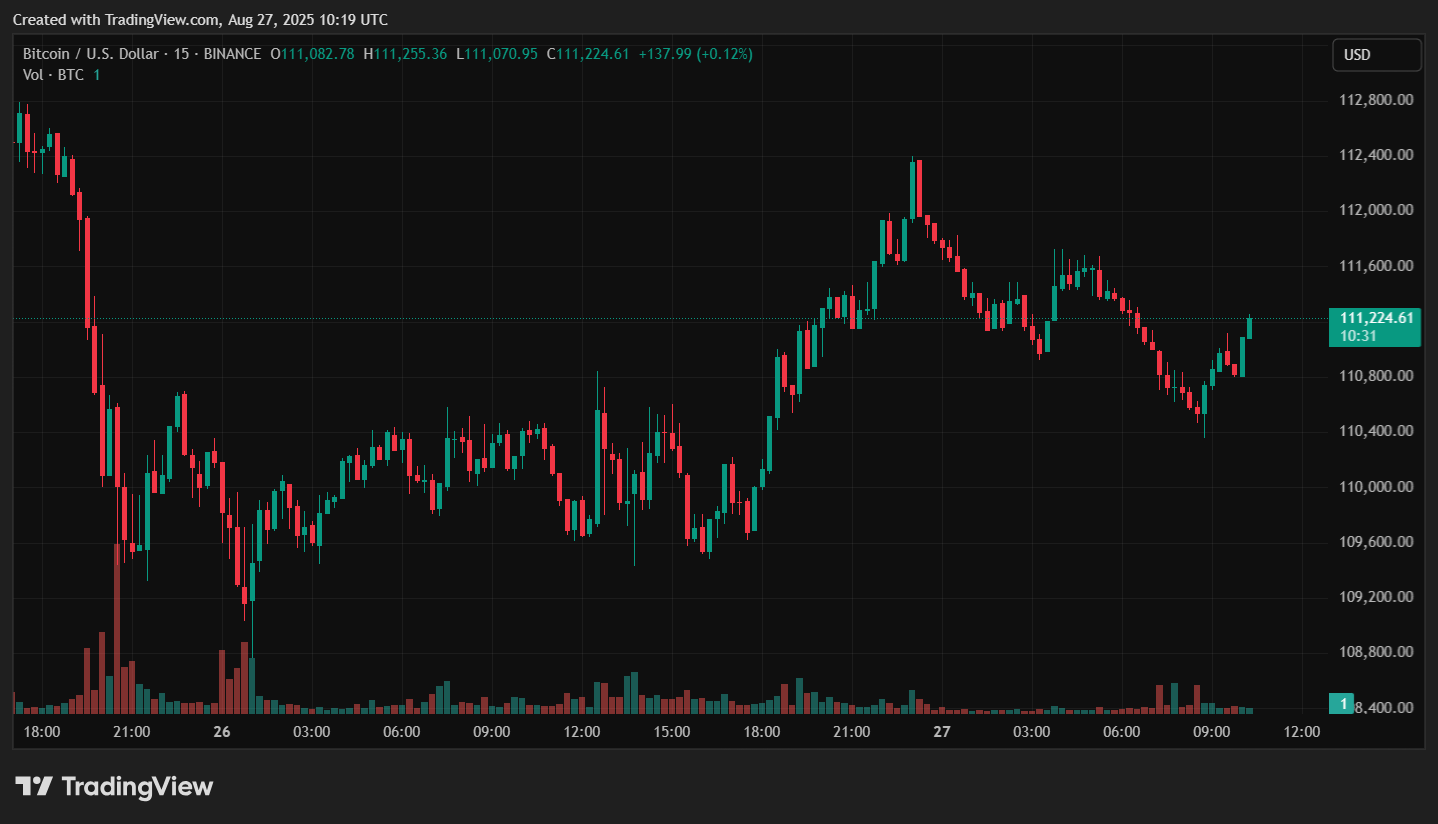

$ BTC is at a make-r-break level:

$ 110k = Lifeline Support

$ 121k = Ceiling to Break

In Short: BTC Has Proven Resilience ABOVE $ 100k, But Survival Abo $ 110k Will Decide if Continues Bullish or Tips Into Structural Weakness. pic.twitter.com/g24cmc96cn

– Swissblock (@swissblock__) August 26, 2025

The company’s experts believe that retention of this level is necessary to maintain a bull trend. The “ceiling”, which must be overcome to continue growth, is $ 121,000.

The analyst under the nickname AlphabTC also indicated the importance of the zone $ 110 000-112 000.

📈#Bitcoin Game Plan 📈

Lower Time Frame View AS $ BTC Attempts to Break Back Out of the June / July Range.

For Me, Until We G4 Close ABOVE 112K I Still Feel 105k IS in Play, So I Will Be Watching that Lovel Closely.#Crypto #Btc https://t.co/puuftwwvdx pic.twitter.com/vcfrvf7s5s

– Alphabtc (@mark_cullen) August 27, 2025

According to him, to resume growth, a four -hour candle is necessary above this range. Otherwise, the rollback of $ 105,000 is likely.

Signs of weakness

At the time of writing, bitcoin is traded at $ 110 951 (-0.6% per day). The price of the first cryptocurrency was adjusted by 10.6% of the historical maximum of $ 124 128, reached on August 14.

The coefficient of purchase and sale of bitcoin sank to -0.945. Values below 1 talk about the dominance of sellers. The analyst Cryptoquant under the pseudonym GAAH noted that this signals pessimism in the market. According to him, similar levels were observed at the peak in November 2021, after which the correction began.

Network activity is also reduced. According to Glassnode, the average monthly volume of transfers fell by 13% – from $ 26.7 billion to $ 23.2 billion.

Network Activity Slowing

The Monthly Average of Change-DJUSTED TRANSFER VOLUME HAS Decline From $ 26.7b to $ 23.2b (~ 13%), Tracking the Pullback in Price. A break below the Yearly Average of $ 21.6b Woup Confirm Weakening Speculative Activity and Signal a Broadader Contraction in … pic.twitter.com/gnytokjzma

– Glassnode (@glassnode) August 26, 2025

The company believes that the fall below the annual average value of $ 21.6 billion will confirm the weakening of demand.

Market cooling

The market entered the “late stage of the cycle”, according to Glassnode. This is evidenced by the high level of realized profit by investors.

#Bitcoin Has Now SPENT 273 Days with A Super-Majority of Supply Held in Profit (ABOVE The +1σ BAND)-The 2nd Longest Stretch on Record, Behind Only The 2015–2018 Cycle AT 335 DAYS. A Signal of How Extended the Current Cycle Has Been Relative to History. pic.twitter.com/tyghf21mvp

– Glassnode (@glassnode) August 26, 2025

The founder of the Tymio platform Georgy Verbitsky in the comment of Decrypt said that he expects a “cooling period” that could last until September.

The mood of investors is also influenced by the outflow of funds from spotto bitcoin-ETFs and macroeconomic risks. According to Ecoinometrics, while maintaining the current volume of conclusions, the price can fall to $ 107,000 and even drop below the psychological level of $ 100,000.

ETF Flows Are Pulling Bitcoin Lower.

As of Friday, OUR Flows-to-Price Model Put The Expied Price At $ 107k, With Downide Risk Below $ 100K Outflows Persist.

The Macro UNCERTAINTY of the PAST Few Weeks IS Showing Up Directly in the Flows. pic.twitter.com/imf3ltqliv

– Ecoinometrics (@ecoinometrics) August 26, 2025

Verbitsky also admits a fall to this mark.

The expert advised to refrain from opening new long positions and wait. In his opinion, purchases will be justified only after consolidating prices above $ 118,000.

Capital tributary on Binance and discrepancy with M2

Against the background of sales, Binance users introduced $ 1.65 billion in stabelcoins to the platform. Large tributaries of “stable coins” on exchanges often precede the growth of demand for cryptocurrencies.

According to Cryptoquant, the influx of funds coincided with the withdrawal of almost $ 1 billion in Ethereum with Binance. The analyst under the nickname of AMR Taha noted that this is the second case in a month, when the flow of stabilcoins on the exchange exceeded $ 1.5 billion. This “emphasizes a new wave of capital entering the spoke market.”

The fall of bitcoin to $ 109,000 led to the most sharp divergence with the dynamics of the global money supply M2 in two years. This indicator measures the amount of money in circulation.

After the pandemic, the first cryptocurrency showed a strong correlation with M2, usually with a delay of two to three months. This served for traders a guideline for short -term price trends.

At the same time, the founder of the Real Vision Raul fell, who was one of the first to point out this relationship, noted that in the long term, the correlation is stronger with the indicator of general global liquidity, and not only with M2.

The Longer Term Correlaration (Not Daily Wiggles) is Far Stronger Using Total Global Liquidity and Not Global M2

– Raoul Pal (@raoulgmi) August 25, 2025

Recall that onchain analyst James Chek outlined a model of bitcoin cycles independent of halving.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.