Bernstein analysts called two Ethereum prices by 55% over the past 30 days: record flow in spot ETF and the emergence of a new class of investors. He writes about this The Block.

The companies began to form corporate reserves in the second cryptocurrency capitalization in order to receive stake income.

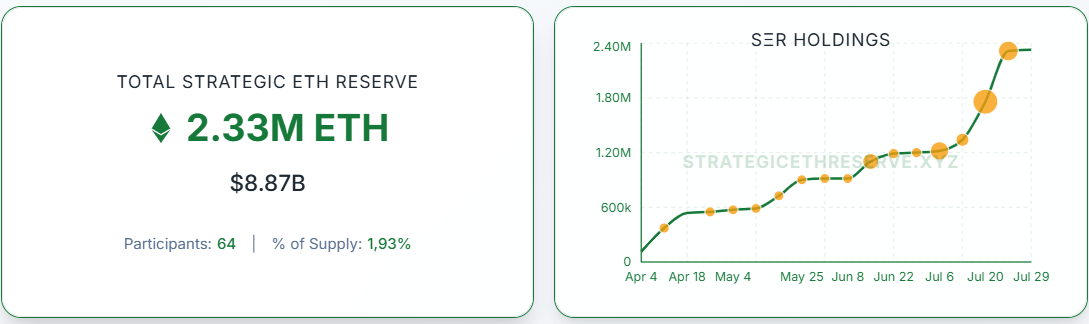

According to Bernstein, companies like Sharplink Gaming, Bitmine Immersion, Bit Digital and BTCS purchased about 876,000 ETH in July. Their combined share in the total proposal of the asset reached 0.9%. They attract capital in public markets and from private investors.

Ethereum corporate holders can receive staying profitability, which is now about 3% per annum. This is a key difference from bitcoin reserves, where the network commissions go to miners, and not to holders of coins. According to analysts, the Ethereum-treasury of $ 1 billion can bring from $ 30 million to $ 50 million income per year.

Unlike liquid bitcoin reserves, ETH-treasury faces delays when withdrawing coins from stakeing, which can last several days.

Bernstein warned that companies should also take into account the risks of smart contracts in Defi and when using wrestling through platforms like Eigenlayer. The success of such firms depends on the conservative management of balance and risks.

Institutional demand and strategic goals

Corporate procurement occurs against the backdrop of the growth of spotes ETH-ETF. Since the beginning of the year, the influx in them amounted to $ 6.7 billion, and the amount of assets under the control reached $ 20.7 billion.

Analysts noted that companies consider Ethereum as a strategic asset due to its role in the sectors of stablecoins and the tokenization of real assets. More than 50% of the supply of “stable coins” tied to the US dollar circulates on the Ethereum network.

According to Bernstein, these factors, together with the mechanism of combustion of commissions, can contribute to the growth of the value of the asset as the use of the network increases.

Bitmine shares fall

BITMINE shares (BMNR) fell by almost 27%, despite the presentation of plans for the accumulation of Ethereum. The performance of the representative of Fundstrat Tom Lee did not convince shareholders.

The company launched a monthly series The Chairman’s Message To cover your crypto strategy. Lee spoke about plans to hold and steak 5% of the general offer of Ethereum. On one of the slides, the company predicted the increase in the price of ETH to $ 60,000 with reference to unnamed research firms.

However, the market reacted negatively. BMNR decreased by 11% during the trading session and another 15% at the post -Market.

This contrasts with recent growth. After the announcement of the purchase of Ethereum, the quotes took off by more than 3000%, to the annual maximum of $ 135.

During the speech, Lee confirmed that Bitmine owns 600,000 ETH worth more than $ 2.2 billion.

He said that in the long run, the company intends to become an “American network of validators” with 100% of the US operations. According to him, the company seeks to become a member of the Ethereum community to strengthen the ecosystem.

Sharplink and corporate treasury race

Sharplink Chairman Joseph Lyubin announced the company’s intention to increase reserves in Ethereum with maximum speed. He believes that the company will be able to accumulate ETH per share faster than any other project.

According to Lyubin, Sharplink daily buys cryptocurrency due to market placements. At the same time, the company steaks the existing assets for additional income.

Lyubin noted that Sharplink adheres to a conservative approach to risks. The company does not use the credit shoulder, but considers the possibility of releasing convertible bonds-a method that Strategy used to replenish bitcoin reserves.

Currently, the Bitmine leads in the treasury race with 566 800 ETH, while SharPlink takes the second place with 360 800 ETH.

The trend is considered as an active driver of demand for cryptocurrency, which contributes to its growth. Over the past month, the price of ETH has increased by 56.9%, according to Coingecko.

Wilson Ye analyst called what was happening “institutional FOMO“. In his opinion, large players are in a hurry to take dominant positions to the possible approval of the spotal ETF, which will create even greater demand pressure.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.