With the Bitcoin (BTC) halving approaching, which is expected in April 2024, the supply shortage of the first cryptocurrency has reached a historical maximum, writes RBC Crypto with reference to Glassnode.

According to the report’s authors, the upcoming halving represents an important fundamental, technical, and even “philosophical” milestone for Bitcoin. The overall supply of the main cryptocurrency is becoming increasingly scarce, and the circulating supply is already at an all-time low.

Analysts write that there are currently 2.33 million bitcoin coins in the wallets of short-term investors, which is the minimum for several years. As a rule, it is this volume that can be considered the real supply on the market, since statistically it is short-term investors who are ready to part with their coins in the near future.

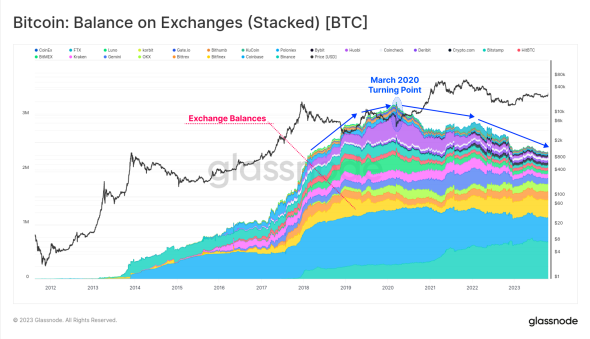

In addition, experts record a constant outflow of coins of the first cryptocurrency from exchange wallets. Currently, the number of bitcoins held on exchanges has reached its lowest level since March 2020.

The volume of Bitcoin on the balance of exchange wallets. Source: Glassnode

The volume of Bitcoin on the balance of exchange wallets. Source: Glassnode

Wallets identified by analysts as long-term holders, on the contrary, continue to actively accumulate bitcoins, thereby contributing to a decrease in market liquidity.

In October, Glassnode analysts estimated that long-term investors were accumulating $1.35 billion in Bitcoin each month. Experts also emphasized that the total number of bitcoins owned by long-term holders has reached a new historical high – more than 14.8 million BTC, which is about 76% of the circulating supply of the cryptocurrency.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.