The memcoin market frenzy shows no signs of ending. However, experts fear that the bubble may yet burst.

Currently, trading volumes of “meme” coins are at levels that were last observed on the eve of the protracted crypto winter. Writes about this Bloomerbg with reference to a report from the Kaiko analytical platform.

Boom in the memecoin market

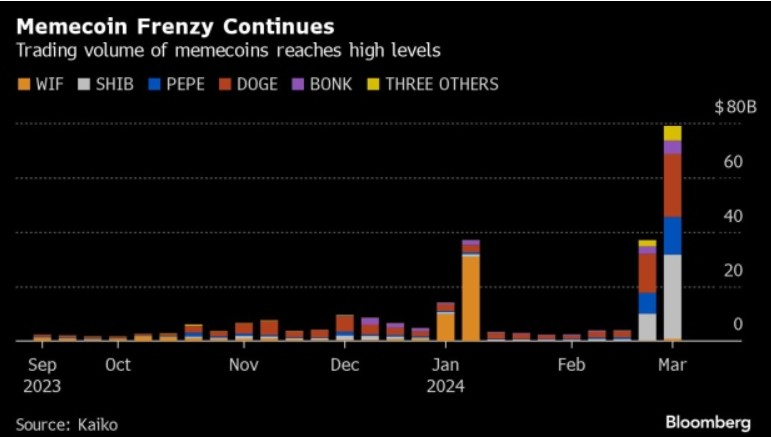

Over the past week, trading volume for leading memecoins has reached nearly $80 billion, the highest level since October 2021. The sector's capitalization, meanwhile, is more than $48 billion, according to CoinGecko.

Top gainers over the past month include coins like dogwifhat (WIF), Shiba Inu (SHIB), Pepe (PEPE) and Bonk (BONK).

Memcoin trading volume. Source: Bloomberg

Memcoin trading volume. Source: Bloomberg

Among them, the greatest growth was shown by WIF, PEPE and SHIB tokens. Their prices increased by 495%, 451% and 160% respectively. Such significant dynamics are far ahead of even the first cryptocurrency – Bitcoin (BTC), which over the same period of time grew by a modest 20%.

Experts remind about the risks of investing in “meme” coins

However, despite such rapid growth, experts recalled that investors prefer memcoins only for quick profits. Such assets do not have any fundamental value.

However, there is little stopping members of the crypto community and they continue to maintain the momentum. Thus, the dogwifhat team last week raised $700 thousand in order to place the logo of their favorite token on one of the most famous buildings in Las Vegas.

The trading volume of the infamous Slerf token (SLERF) exceeded $3 billion per day. In just 24 hours after its launch, the Solana-based memecoin (SOL) managed to break into the top 10 “meme” coins by capitalization.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.