Bitcoin miners have begun shutting down inefficient equipment and selling reserves, a definite sign of their capitulation, according to report CryptoQuant.

Experts noted that such periods are historically associated with minimum prices.

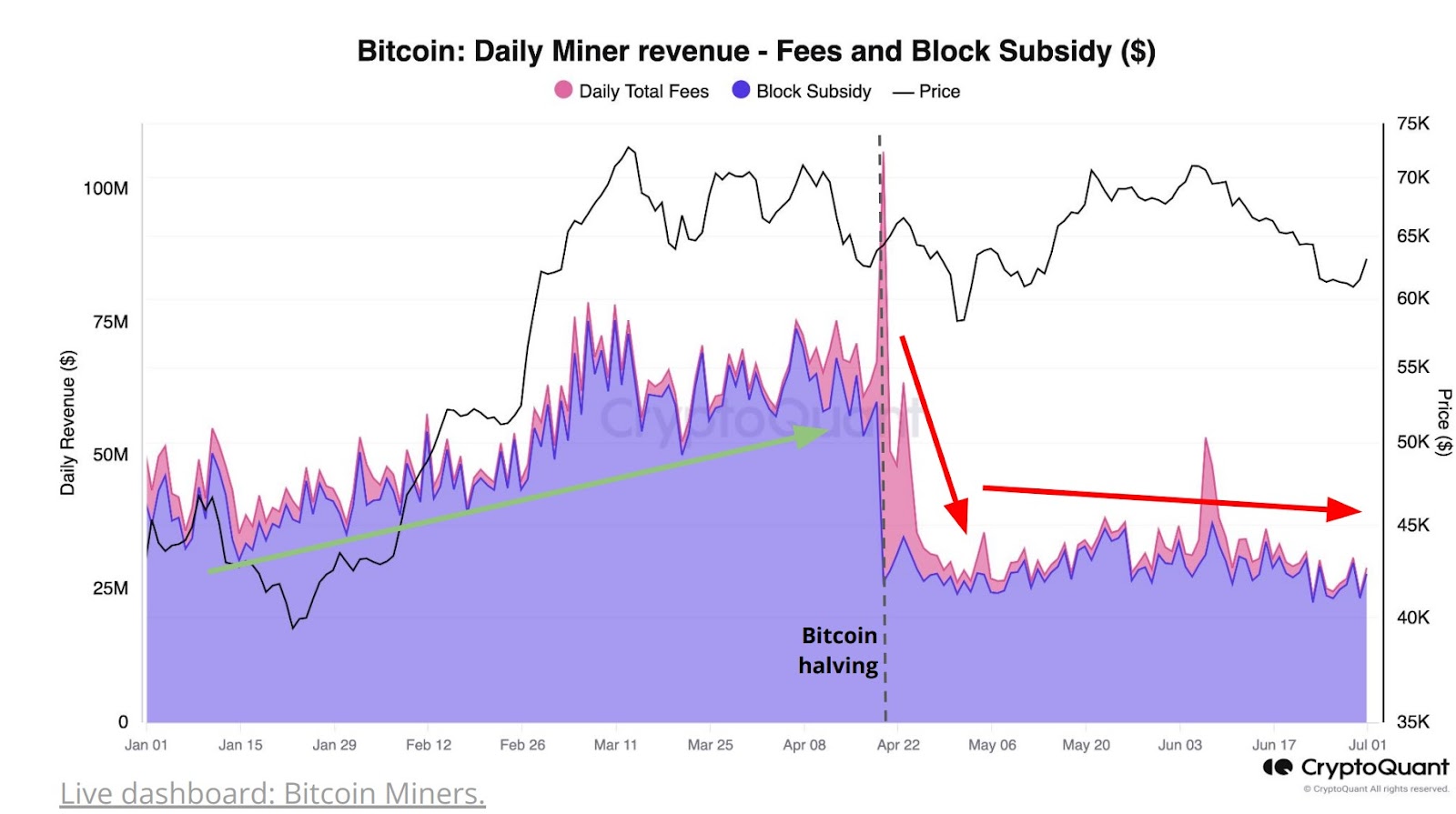

They noted that miners’ daily income has dropped from $79 million on March 6 to $29 million currently. The volume of commissions in revenue has fallen to 3.2%, which is the lowest share since April 8. Although before the halving, the excitement around Ordinals and Runes brought cryptocurrency miners “tens of millions” of dollars.

Miners’ daily income. Data: CryptoQuant.

Miners’ daily income. Data: CryptoQuant.

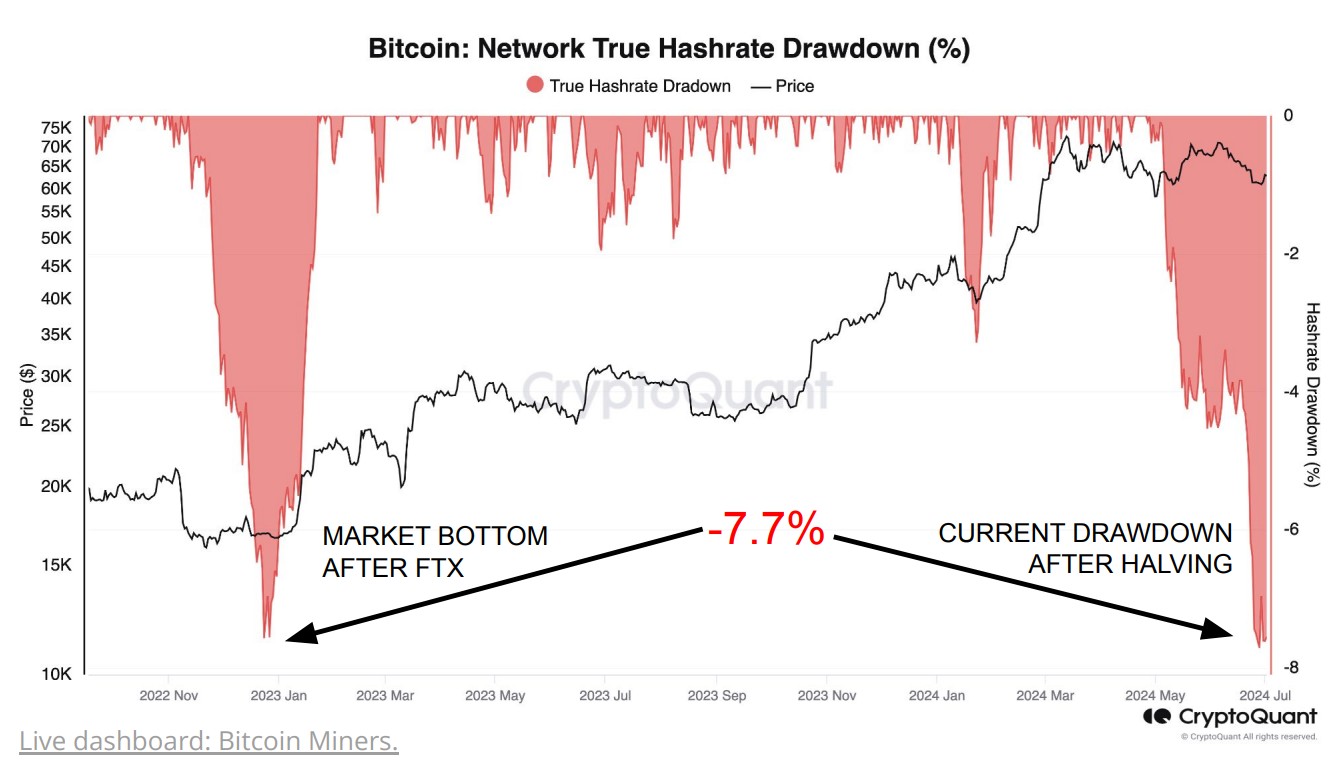

The network hashrate has fallen by 7.7% since the block reward halving in April, the biggest drop since December 2022, when the market bottomed after the FTX crash.

The Real Drop in Bitcoin Hashrate. Data: CryptoQuant.

The Real Drop in Bitcoin Hashrate. Data: CryptoQuant.

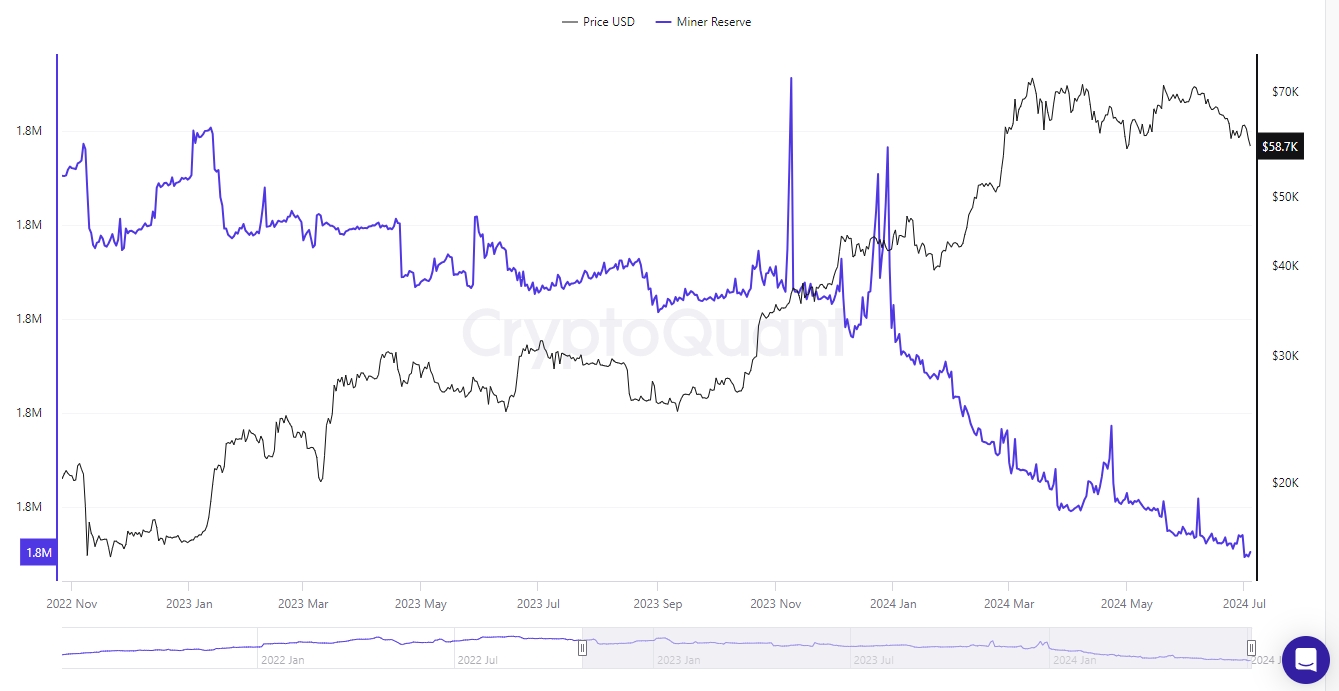

According to CryptoQuant, daily outflows from miners’ wallets have reached their highest levels since May 21, indicating likely sales, experts say.

Bitcoin Miner Reserves. Data: CryptoQuant.

Bitcoin Miner Reserves. Data: CryptoQuant.

CryptoQuant founder and CEO Ki Yoon Ju found no signs of miners capitulating in late April. Glassnode analyst James Check expressed the same opinion in June, although he acknowledged the serious problems of cryptocurrency miners.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.