The price of the first cryptocurrency was stuck in the range between the support of $ 116,000 and the resistance of about $ 120,000. Ethereum also loses the impulse on the way to a psychological mark of $ 4000. This was reported by QCP Capital analysts.

In their opinion, in the medium term, a high probability of updating historical maximums is maintained. This is facilitated by the influx of institutional capital and positive changes in regulation.

Analysts noted that companies like Strategy and Sharplink Gaming continue to attract funds for buying bitcoin and Ethereum, which indicates long -term confidence in the asset.

The total daily clean influx in ETH-ETF is $ 218.64 million.

However, in the short term, experts called for caution. The market is weakly responded to positive news, including the adoption of the laws friendly to cryptocurrencies in the United States and the progress in the field of ETF. The lack of growth against the background of good news often signals the depletion of the market and is classical behavior at the late stage of the cycle, experts emphasized.

The threat of the dollar

Analysts associate the main macroeconomic risk to the US dollar. Most traders rely on its weakening, opening short positions. According to CFTC, the number of such positions has reached extreme values.

A similar situation makes the market vulnerable to shorts. If the dollar exchange rate begins to grow, traders will be forced to massively close unprofitable transactions. This can provoke the departure from risky assets, including cryptocurrencies, analysts explained.

In the near future, information on inflation and employment in the United States will be in the focus. They will determine the development of the market in the third quarter. At the July meeting of the Fed, analysts are expected to preserve the key rate. The regulator most likely emphasizes the dependence of its decisions on incoming data. The key will be the September meeting, at which the chances of reducing the bets remain balanced.

Most (97.5%) market participants expect to preserve the indicator at the same level following the meeting on July 30.

Bitcoin fall to $ 110,000

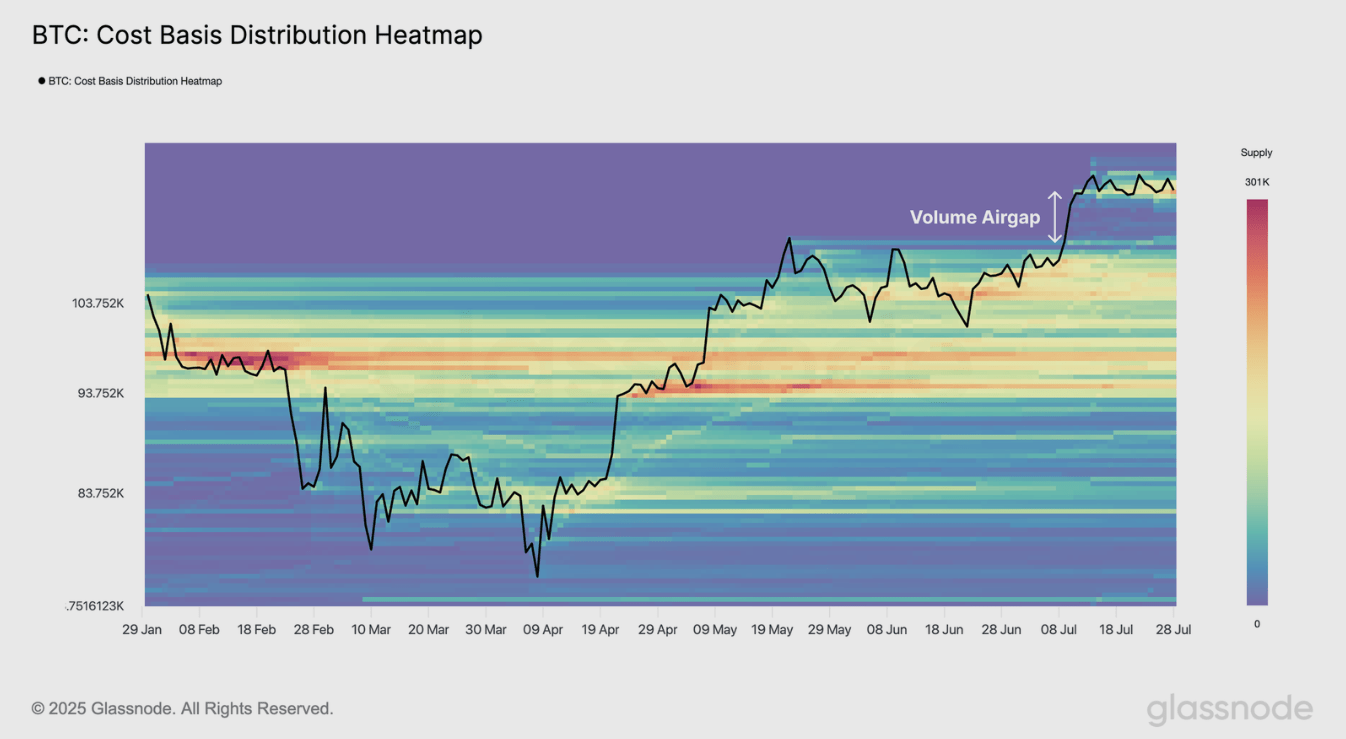

Glassnode analysts allowed Bitcoin correction to the level of $ 110,000 for the key support test. The reason may be a “price gap” without a significant amount of trading at this level.

Experts explained that with a rapid price increase from $ 110,000 to $ 115,000, investors had little time for purchases. As a result, a zone was formed without strong support based on the price of acquisition of assets.

Glassnode believes that the market can test the zone in search for support. Although such gaps are not always filled, they create “attraction” for the price.

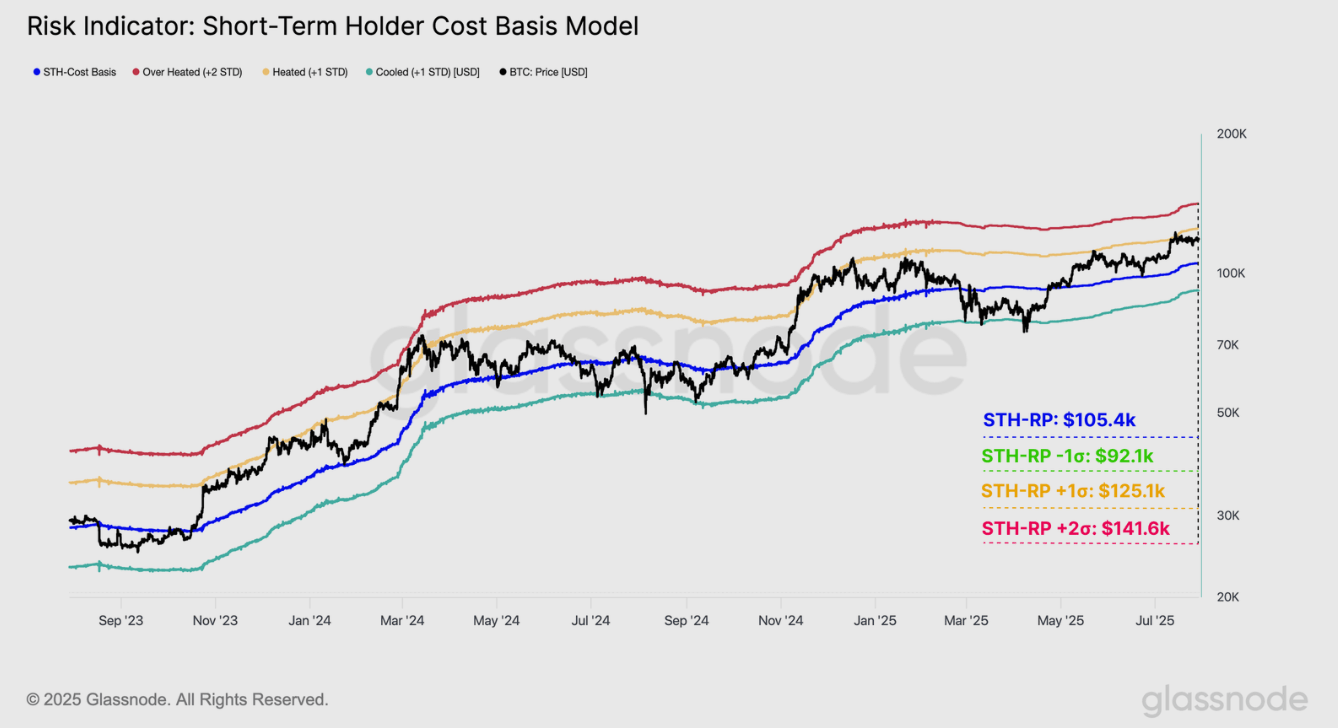

Analysts used the cost of short -term holders to determine potential support levels. The same levels help to identify prices at which investors can begin to fix profit.

Using a standard deviation, Glassnode predicted a possible local maximum of about $ 140,000 in case of growth.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.