The growth of the second in capitalization of cryptocurrency above $ 4700 is based on the market expectations to reduce the Fed’s rate in September. Analysts warned – if the regulator does not justify hope, the price of the asset can collapse, writes Cointelegraph.

At the time of writing, Ethereum is traded at $ 4546. Its price is 6% of the historical maximum of $ 4878, according to Coingecko.

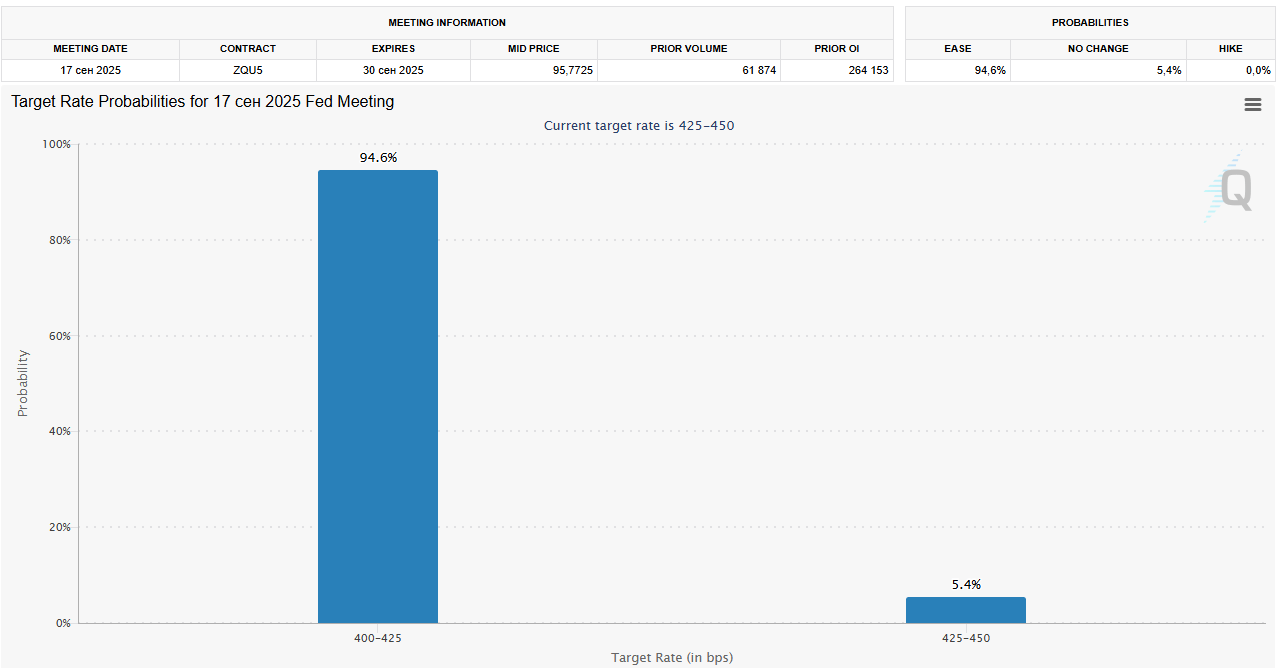

Market participants evaluate the likelihood of reducing the rate in September by 94.6%.

The founder of Capriole Investments Charles Edwards also believes that the price of the second in capitalization of cryptocurrency will continue to grow. However, he agrees that the unexpected decision of the Fed can be influenced by the market. According to him, this can “scare liquidity when the capital just freezes, and the flows stop.”

Edwards admitted that Ethereum is likely to “double easily” in price in the coming months if bitcoin reaches $ 150,000-200,000.

However, not all experts are sure of reducing the rate. Morgan Stanley Wealth Management Ellen Zentner noted that the Fed officials can “besiege” the market expectations if they consider them incorrect.

The President of the Federal Reserve Bank Kansas City Jeff Schmid also considers the current monetary policy “appropriate at the moment”.

ICO kits fix profit

One of the early investors Ethereum transferred 1060 ETH (~ $ 5.1 million) to the Kraken exchange. According to Arkham, this is the fourth transaction over the past four days.

Earlier, the addresses with 0x815, tranches of 2000 ETH ($ 8.6 million), 1162 ETH ($ 5.2 million) and 1121 ETH ($ 5.2 million) were received with the address. The total amount of deposits in a week reached $ 24.1 million.

According to ARKHAM, 4657 ETH remain on the wallet for $ 21.12 million. Translations to exchange addresses often indicate the intention to sell assets.

According to Onchain Lens, this participant received 100,000 ETH during the ICO, paying $ 31,100 for them.

An #Ethereum ICO Participant Has Deposited 2.000 $ EthWorth $ 8.55m, Into #Kraken.

The Whale Initially Receved 100,000 $ Eth for $ 31,100 at the time of the ico.

The Whale Still Holds 58,000 $ EthWorth $ 247.86m in multiple Wallets.

Deposit Address: … pic.twitter.com/nu90rgpwux

– Onchain lens (@onchainlens) August 11, 2025

Today, this volume is estimated at $ 471 million. Analysts noted that Kit still owns more than 50,000 ETH distributed by several wallets.

This is not the only early investor who moves assets against the background of Ethereum price growth. According to Lookonchain, on August 11, another ICO participant transferred 2300 ETH (~ $ 9.9 million) to Kraken. He received 20,000 ETH for $ 6200 on Kraudsale, and now their cost is about $ 94 million. $ 1623 ETH remains at the address.

Ethereum tokensel was held from July to September 2014. The project attracted about $ 18.3 million, selling more than 60 million ETH at an average price of $ 0.31.

The line for the output of Ethereum

The volume of ETH in the line for withdrawal from stakeing Ethereum reached 671 900 ETH (~ $ 3.1 billion). Applications began to accumulate against the background of a summer price rally.

The increase in the number of requests increased the waiting time from nine to about 12 days. At the same time, the expectation of the input to the stakeing is much less – 105 620 ETH (~ $ 480 million).

The analyst under the pseudonym IGNAS called several reasons for the growth of the queue.

1/ Record Number of $ Eth IS in the unstaking queue:

671k $ Eth = $ 3.2b USD

What’s More, Queue Wait Time Reted Record of ~ 12 Days.

Who is it happting? A Few Reasons: pic.twitter.com/w2daxxxome

– IGNAS | Defi (@defiignas) August 14, 2025

One of them is the closure of positions with Levreig. Traiders who received liquid steiking tokens (LST) like Steth and took loans under them, now reduce risks due to growth in the cost of lending.

Another reason is arbitration and concerns about the possible lift of LST from the price of the broadcast. A decrease in the Steth course to ETH could encourage market participants to withdraw stake assets for rotation between tokens and profit from the spread. IGNAS noted that among the largest sources of bred coins – Lido, Ethfi and Coinbase.

The expert also suggested that some validators are changing the strategy in anticipation of new stake products in the United States. In May, the US Securities and Exchange Commission explained that the process does not violate the rules on securities.

Finally, against the background of approaching the price of Ethereum to historical maximums, some validators can simply fix profit.

Recall that the influx in ETF based on the second according to the capitalization of cryptocurrency exceeded the release of new coins after The Merge. Sprint exchange funds in the United States attracted $ 2.45 billion per month, which is equivalent to about 500,000 ETH.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.