The withdrawal of 48,000 validators with 1.55 million ETH from the Beacon Chain deposit contract after the activation of Shapella did not significantly affect the quotes of the second largest cryptocurrency by capitalization. This is the conclusion made by Glassnode analysts.

We previously simulated the potential economic outcomes of ETH withdrawals enabled by the Shapella upgrade.

In this edition, we will examine what actually happened to the 1.55M withdrawn ETH, and how stake has reshuffled between stakers, staking service providers, and sell-side… pic.twitter.com/x36QNU9RfU

— glassnode (@glassnode) May 8, 2023

The price of Ethereum jumped to $2110, then dropped into the $1809-1995 corridor.

The experts stated that the rate of change in the number of validators was consistent with the mechanics declared by the developers, as well as the stability of the consensus mechanism since the hard fork.

Analysts admitted that their baseline estimate of the number of coins withdrawn by validators during the week after Shapella (789,500 ETH) was conservative (1.08 million ETH).

The specialists explained the discrepancy by the actions of Kraken (125,088 ETH), which was not fully reflected in the forecast. The platform was actively reducing its presence in the segment amid pressure from the SEC, which added the closure of the staking service.

Glassnode’s maximum valuation of 1.54 million ETH has remained elusive.

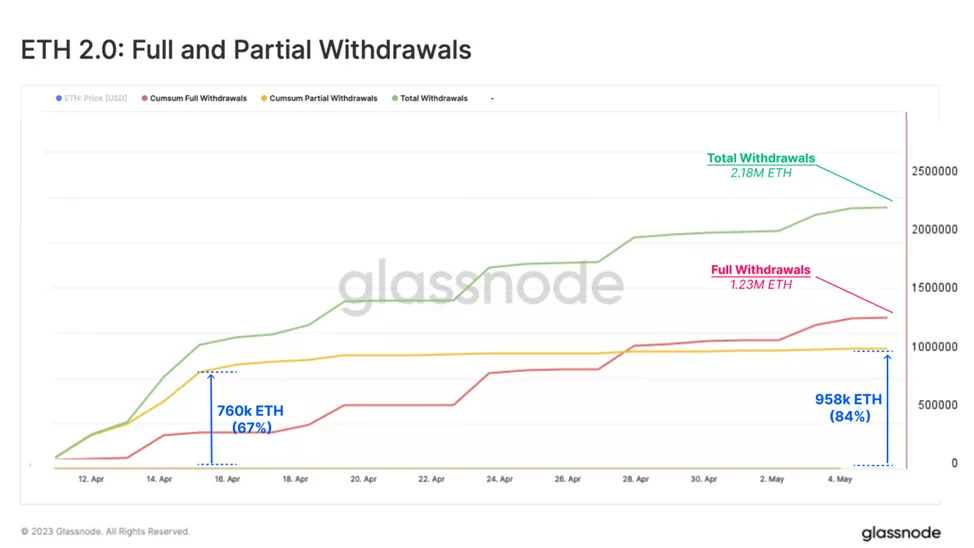

Of the said 1.08 million ETH, rewards accounted for 856,000 ETH (or 80%), and 232,000 ETH (20%) for the withdrawal of the full stake.

Analysts drew attention to the lack of a surge in the influx of Ethereum deposits on CEX. This confirmed their expectations that the rewards received would not increase selling pressure.

During the week, 1.8 million ETH entered the platforms, which is in line with typical patterns and inferior to landmark dump events in the past.

Analysts recalled that the Proof-of-Stake algorithm in Ethereum involves the partial and full withdrawal of coins, and it may take 4.5 days to complete the submitted applications.

To automatically release funds, validators need to update the credential type from 0x00 to 0x01. During the first week, 85% of non-compliant participants did this, mostly in the first two days. In the total mass, only 2% of validators remain, who have not yet updated the account type.

At the time of writing, 84% of the accumulated rewards have been withdrawn by validators. The remaining 16% formed coins, which are accounted for by participants who did not update their credentials.

As the illustration below shows, in the first hours after Shapella, a partial release of funds formed the bulk of the withdrawal of coins from the deposit contract. Subsequently, the proportion of complete conclusions increased.

From the point of view of the full withdrawal of funds, there is an algorithm that limits the number of validators that satisfy this rule, according to the formula:

Churn Limit = Active_Validators/65536

With the current Churn Limit equal to 8 and 225 epochs per day, only 1800 validators can fully withdraw their funds per day, which is equivalent to 57,600 ETH. This limit was reached immediately after the activation of Shapella.

Since April 28, the cumulative value of coins associated with a full withdrawal has exceeded that of a partial one.

At the time of writing, a total stake of 1.55 million ETH ($2.93 billion) has been withdrawn by 48,341 validators. The largest number fell on the first day after Shapella – 14,249. Later, the figure dropped to 300-700 per day.

The complete departure of validators is balanced by new deposits – both indicators (1800 per day) are equivalent to each other. The “queue” of the first has been reduced to 1837, the second has reached 23,738. Currently, the number of active validators has stabilized, but will soon resume growth.

The structure of withdrawn funds is dominated by centralized intermediaries. Out of a total of 48,341 validators, only 2,561 (6.6%) are not affiliated with staking services.

Kraken had the highest number (15,501 validators), followed by Binance (6000), Coinbase (5179), Figment (2514). Experts recalled that this process has not yet been initiated in Lido.

In terms of deposits, the largest number (15,522) of validators are individual users. Lido (9396) and Rocket Pool (7556) LSD protocols remain popular in this regard.

In less than a month after Shapella, the structure of the staking protocol market has not changed significantly. The share of Rocket Pool increased by 2.3%, stakefish – by 1.7%, Lido – by ~0.2%. This happened due to a reduction in the share of Kraken by 1.1% and Binance by 0.5%.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.