Apple Inc. predicted bigger problems yesterday, Thursday, as the rolls due to COVID-19 make production more difficult, but also the demand in China, while the war in Ukraine reduces sales, with growth slowing down in the field of services.

The company, which produces the iPhones, considers the service sector a driving force for the expansion of its activities.

Apple Corps’ share price fell 2.2% after executives announced a pessimistic outlook for the future during a digital update. The new data came in the opposite of record profits and sales of the company for the second financial quarter, which ended in March.

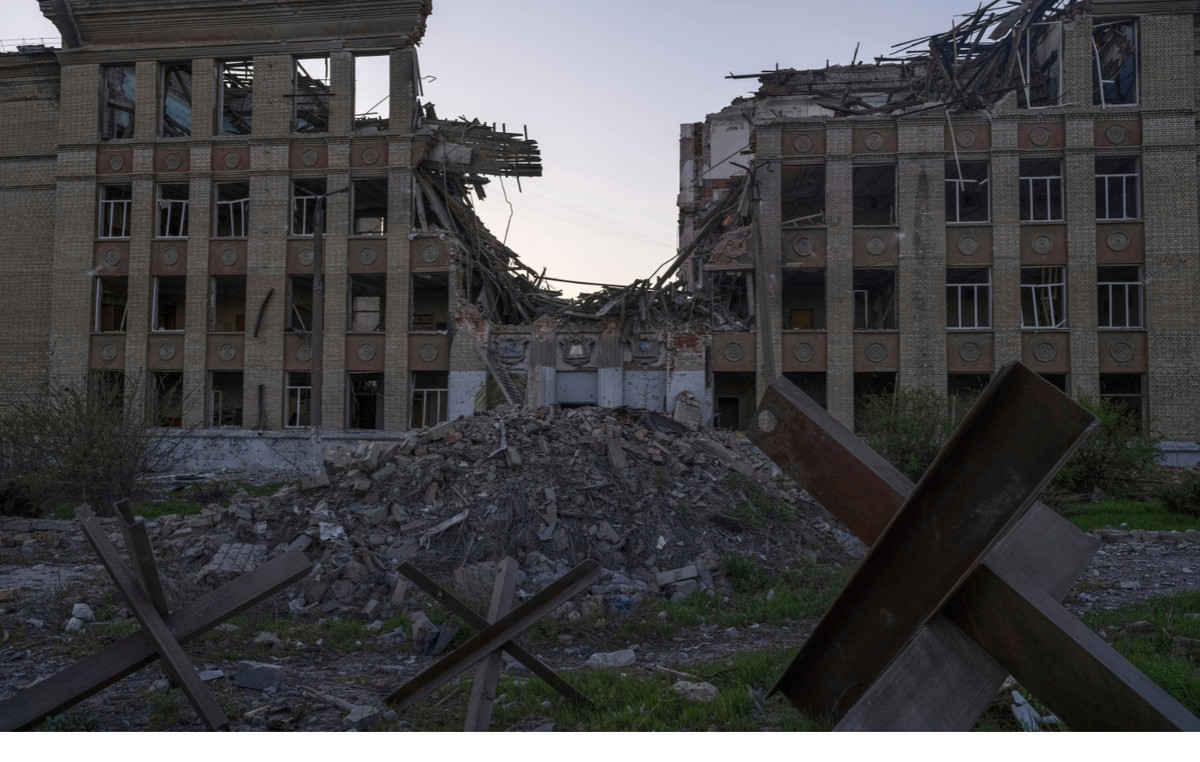

Apple chief financial officer Luca Maestri warned in an interview that the war in Ukraine, which led to the company ending its sales in Russia, could further reduce sales in the third quarter.

He told analysts that supply chain problems could hit between $ 4 billion and $ 8 billion (€ 3.80 billion and $ 7.60 billion) in sales, “substantially bigger” than the blow in the second quarter.

Supply problems are concentrated in Shanghai, China, reflecting the problems of taking additional measures against COVID, as well as shortages of microchips (chips), he added. The pandemic is also affecting demand for Apple devices in the Chinese market, according to Maestri.

CEO Tim Cook said that almost all Chinese industries involved in the final assembly of Apple devices are restarting after the pandemic, but the company can not predict when it will end. lack of microcircuits that mainly affects the older devices.

Cook said he hoped the issues arising from COVID in China would be “temporary” and that the situation “would improve over time”.

At least one analyst said Apple’s prospects were unclear.

“We are all looking for better guidance on the real situation in China …, but it did not work out,” said Louis Navelier, Navellier & Associates, an investment manager.

Kim Qui Forrest, investment manager at Bokeh Capital Partners, said continued demand remains a big question mark, despite Apple supply chain management problems in the March quarter.

It is a fact that other large companies have also expressed their concern. Among them, Amazon and Intel Corp, which made pessimistic estimates for the quarter, regarding the problems in the supply chain, with their share price falling.

The two companies, along with Apple, are involved in shaping the Nasdaq stock index, whose price has fallen by about 19% this year as rising inflation drives investors to other investments.

SOURCE: ΑΠΕ-ΜΠΕ

Source: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.