Analyst company Arcane Research noted that large mining companies have significantly increased their growth rates. In addition, the reserves of bitcoins in their wallets continue to grow.

In their report, Arcane Research analysts emphasized that public mining companies are “constantly looking for development opportunities” and “plan to increase hashrate faster than ever.” Now, according to the University of Cambridge Bitcoin Miner Energy Consumption Index, North American miners consume 44.95% of the total world energy consumption by miners. And the share will increase, given the plans for the expansion of miners.

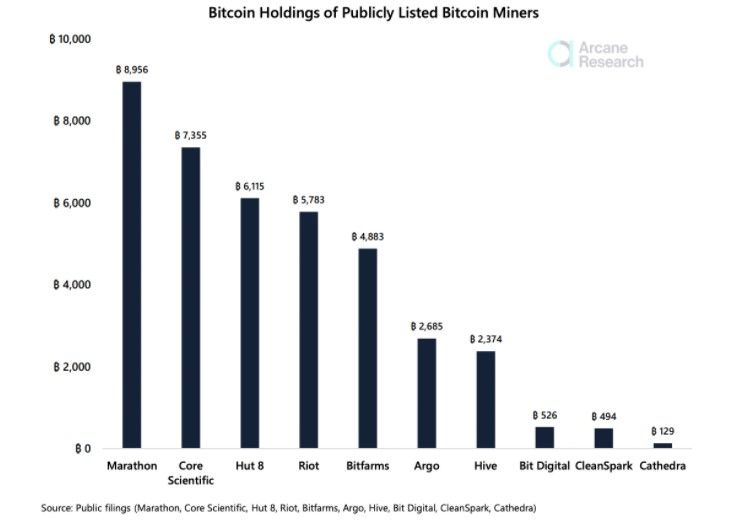

“Most of the public mining companies follow the HODL strategy, they do everything possible to save the maximum number of mined bitcoins. This allows them to be an investment vehicle for those investors who want to indirectly invest in bitcoins through reliable stock platforms,” said Jaran Mellerud, an analyst at Arcane Research.

As Compass Mining CEO Whit Gibbs noted, public mining companies have some advantage – they do not need to sell bitcoins to expand their business, buy new mining devices, and so on. They simply receive funds from investors, and BTC continues to accumulate. Therefore, now a lot of bitcoins have accumulated on the wallets of most mining companies.

Interestingly, according to a report from Riot Blockchain, 2022 will be the year of “consolidation” for the mining industry.

Source: Bits

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.