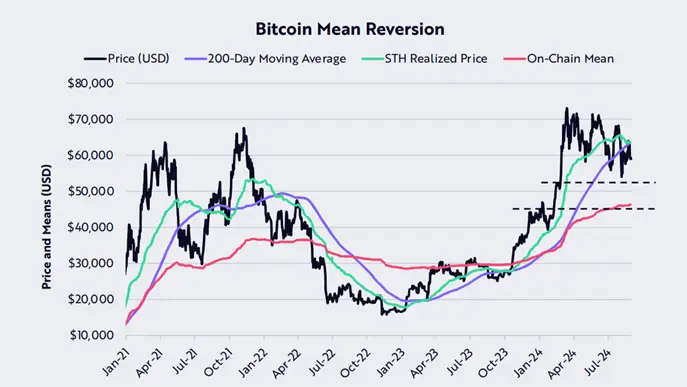

According to the Bitcoin Mean Reversion chart presented by the company’s specialists, the rate BTC is no longer held above the 200-day moving average, indicating the possibility of a price correction in either direction.

Analysts believe that the decline in the value of Bitcoin is in line with the historical norm, and the current macroeconomic conditions are generally favorable for the crypto market.

“However, a fall below these support levels could be the start of a long-term bearish trend. Short-term holders of the asset and institutional investors are currently facing unrealized losses,” the document states.

While the first cryptocurrency is in an uncertain position, investors who have invested in spot bitcoin-ETFmay suffer minor losses, but there is a chance that the market will move into a bullish trend, experts suggested ARK Invest.

Earlier, experts from the Santiment platform reported that large holders of the first cryptocurrency are preparing for high volatility in the crypto market – the number of Bitcoin whale transactions fell by 33.6% by mid-August.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.