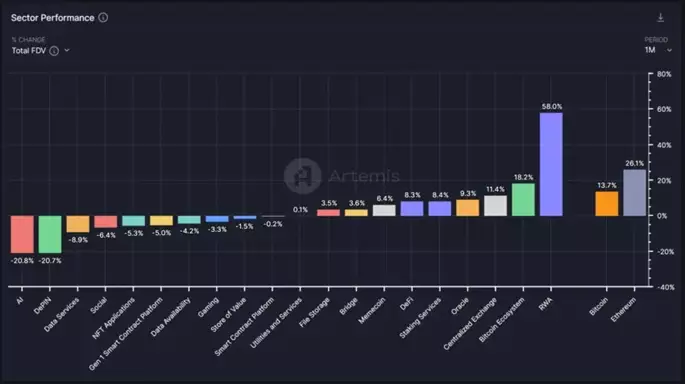

According to expert estimates from Artemic Terminal, the growth is due to several events, including the tokenization of Antonio Stradivari’s violin and the sale of a 10% stake in Watford FC in digital format.

In addition, the meeting of the Committee on Financial Services of the US House of Representatives, which discussed the issues of tokenization of real assets as drivers of growth in the digital economy, had a positive effect on the RWA sector. The hearing also discussed the need to develop additional rules to support the tokenization of assets and derivatives.

According to BlackRock CEO Larry Fink, asset tokenization has significant potential as it increases the flexibility of investment strategies through the rapid execution of transactions in bonds and shares of companies.

Jenny Johnson, President and CEO of Franklin Templeton, shares a similar view. According to her, asset tokenization makes it possible to reduce minimum investment amounts and operating costs, making professional asset management more accessible to novice investors.

Earlier, a Watcher.Guru observer reported that the market capitalization of BTC exceeded the combined market value of the shares of the three largest banks in the world: JPMorgan Chase, Bank of America and Industrial and Commercial Bank of China.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.