It is necessary to open a long position on Bitcoin and later on shitcoins. A similar recommendation gave ex-CEO of BitMEX Arthur Hayes, citing changes in the macroeconomic background.

The expert drew attention to the results of the meeting of finance ministers and heads of the Central Bank G7. One of the topics discussed was the weakness of the Japanese yen against other reserve currencies.

They decided to fight this by reducing the difference in yields between government bonds of Japan and its allies. The latter will become possible with the easing of the monetary policy of the G7 countries, since the Japanese central bank has kept it at a near-zero level since 2009. The regulator cannot afford a sharp tightening, since it owns over 50% of the country’s government debt.

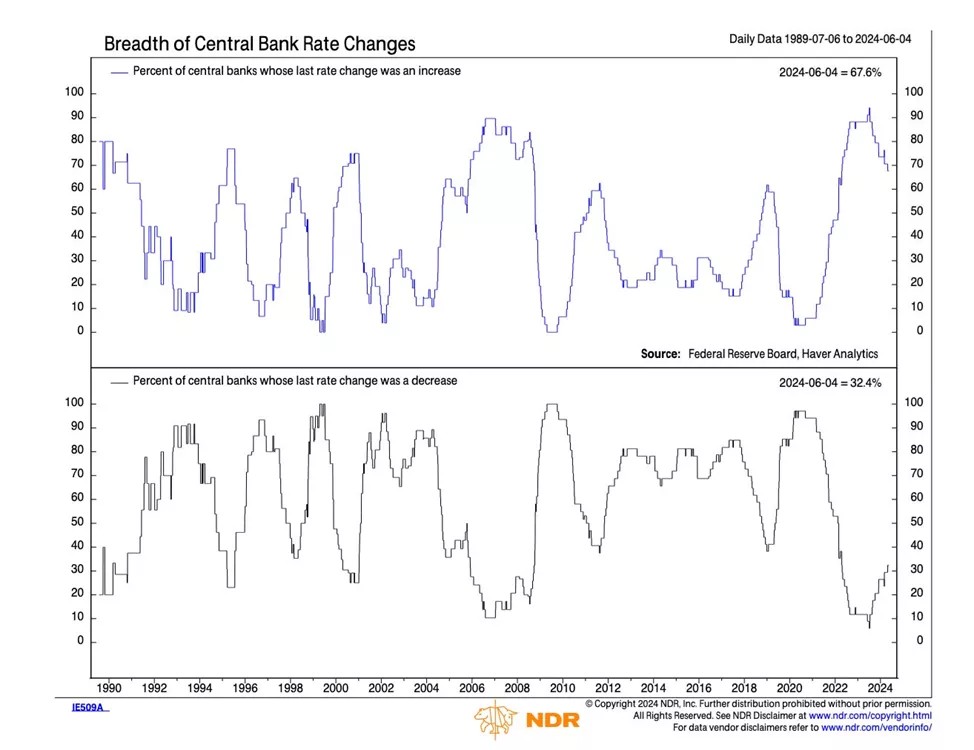

This week ECB and the Bank of Canada lowered the key parameter by 25 bps. P. Hayes emphasized that this happened in conditions of inflation exceeding the target value of 2%.

The expert urged to follow the final statement of the G7 leaders. In his opinion, it may contain a decision on coordinated actions in the foreign exchange or bond markets in order to strengthen the yen. Its absence will mean “tacit agreement” with the need for central banks other than the Central Bank of Japan to reduce key rates.

The ex-CEO of BitMEX considers the base scenario of no mitigation from the outside Fed, given Joe Biden’s gains in the declared fight against inflation ahead of the November elections. At the same time, Hayes did not rule out that the Bank of England will lower the rate earlier than the market currently expects.

The expert admitted that the weakening of policies by the Bank of Canada and the ECB forced him to reconsider his expectations regarding the return of cryptocurrencies from the “summer calm to the path to the Northern Hemisphere.” The trend is obvious; monetary regulators have launched an easing cycle, he added.

The specialist announced plans to withdraw liquidity from USDe to shitcoins. He promised to reveal his positions in the future.

Previously, Hayes predicted that Bitcoin would rise to $70,000 by the end of the summer.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.