By July 2025, Bitcoin reserve more than 150 public corporations reached 917 853 BTC. Strategy Michael Seilor controls 607,700 BTC – this is 66.2% of total corporate reserves and about 2.9% of the total offer of the first cryptocurrency.

Together with Coinex analysts, we analyze the current state of corporate reserves and understand how the mechanisms of accumulation of bitcoin invented by immigrants from Wall Street can provide a bearish with a crypto industry.

Corpo-Rat Race

In June 2025, corporate bitcoin reservations stepped over 900,000 BTC. A year ago, this indicator was 325 400 BTC. The growth of 2.8 times indicates a great institutional interest in digital gold.

In the first half of 2025, the average monthly acquisition of bitcoin exceeded 40 800 BTC. Corporations added about 245 300 BTC to their reserves, and more than 50 new organizations disclosed allocations this year. Conventionally, they can be divided into three categories:

- Diversifiers – added bitcoin to the main business as a tool for diversification of reserves. Tesla Ilona Mask holds 11 509 BTC. In 2024, Block Dorsii pledged to use 10% gross profit for regular bitcoin purchases. Coinbase controls 9267 BTC as part of the corporate treasury.

- Miners – accumulate mined coins instead of sale to cover operating costs. The largest public miner Mara owns 50,000 BTC. Riot Platforms holds 1925 BTC, and HUT 8 – 10 273 BTC.

- Treasury structures – their main activity is to accumulate bitcoin through debt instruments. Strategy remains an unconditional leader, but the Twenty One (XXI) launched in 2025 has already accumulated 37,230 BTC, which puts it in third place in the list of public organizations in terms of the volume of bitcoin reserves.

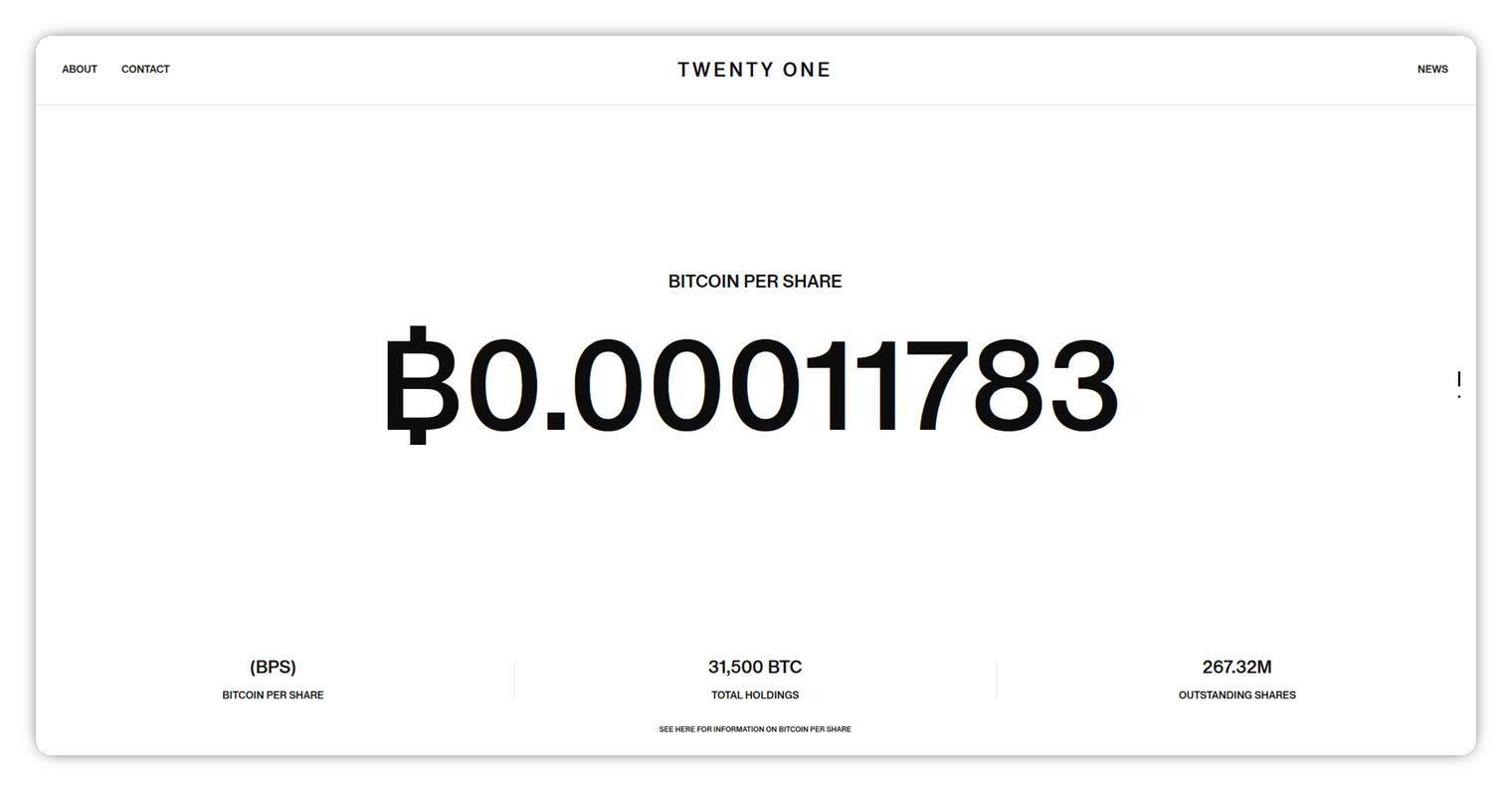

XXI – the founded Cantor Fitzgerald, SoftBank, Tether and Bitfinex – on its minimalist site selects the BTC Per Share (BPS) metric. This indicator reflects how many bitcoins per share, and it has become the main guideline for evaluating such companies.

Coinex analysts note that XXI positioning illustrates well how the very concept of accumulation of bitcoin reserves has changed.

They emphasize the importance of distinguishing structures like recently included in the S&P 500 Block, which add bitcoin as an element of diversification of assets, and “quasi-ETF”, for which the BPS indicator is not just a metric, but the essence of the business. It is these structures that bear increased risks when changing the market trend.

Coinex also draws attention to the fact that a number of organizations adopted the Strategy Strategy not only in relation to Bitcoin, but also more volatile altcoins like Ethereum and Solana. According to Strategic Eth Reserve, trading on the NASDAQ Sharplink Gaming holds 360 800 ETH. Defi Development announced an agreement for the sale of shares for $ 5 billion for the formation of the Fund in SOL.

PTCV

In the June Coinbase Institute, this new type of company received its own abbreviation – PTCV.

Prior to this, the US Council for Financial Accounting Standards (FASB) allowed corporations to reflect only the depreciation of crypto assets.

In December 2023, FASB updated the leadership, allowing organizations to reflect digital assets at fair market value. This eliminated the main obstacle to corporate accepting cryptocurrencies.

Domino strategy

The growth of the number PTCV creates new risks for the cryptocurrency market in the form of forced and panic sales.

Firstly, many of these companies produce convertible bonds to attract money to buy digital assets. This gives bond holders the opportunity to earn with an increase in shares (which can occur with the growth of the basic cryptoactive). If things go badly, investors receive money back – organizations must pay off debts.

The risk of mass sales can lead to market liquidations and a fall in the crypto market as a whole.

Secondly, PTCV themselves can destabilize the trust of investors in the cryptocurrency ecosystem.

If prices begin to decline and the organizations consider that the window of opportunities is closing, others can hurry to sell assets after, thereby destabilizing the market long before the emergence of real problems with repayment of debts.

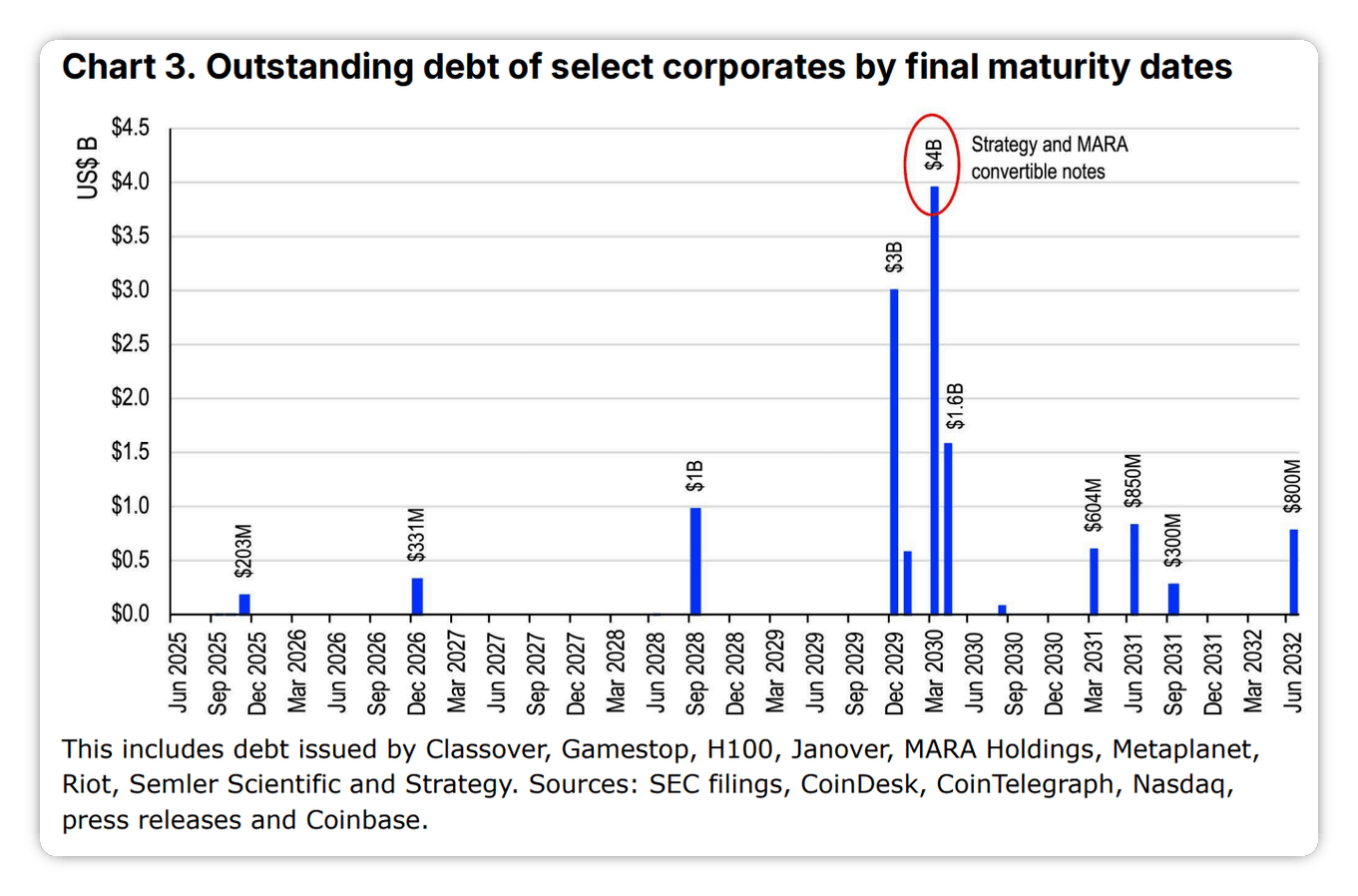

In the short term, analysts consider the critical pressure of sales unlikely. An analysis of the outstanding debt of the nine largest PTCV shows that most of the obligations will not occur until the end of 2029 and the beginning of 2030.

The first major repayment is the convertible Strategy bonds for $ 3 billion in December 2029 with a possible early payment in December 2026.

Coinex analysts agree with this opinion and add that the corporate accumulation trend will continue in the second half of 2025.

Rat poison

Bitcoin appeared against the backdrop of the 2008 global financial crisis caused by the risky and opaque activities of large Wall Street players. Gradually, many of them moved from comparison with his “rat poison” to integration into the traditional financial system. Michael Saylor himself in 2013 criticized Bitcoin, but now he has become one of his most noticeable supporters. Like US President Donald Trump and CEO BlackRock Larry Fink.

However, irony is not only in this. The mechanisms designed to allegedly speed up the “institutional acceptance” of bitcoin can become a source of its instability. The situation when one structure after another accepts the Strategy model can provoke the domino effect with the unfavorable development of events.

In the short term, the threat of forced sales is minimal – most debts will not occur until 2029–2030. However, the psychological effect may turn out to be more significant: even small sales of one of the large organizations can provoke panic.

Coinex analysts believe that in the new reality of corporate reserves, the causes of the next crisis can be hidden not inside the industry, but in old financial mechanisms. And in this reality, Bitcoin really risks becoming a rat poison for corporations.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.