Aspen Digital last conducted the survey in 2022. Then 58% of respondents answered positively to the question about investing in cryptocurrencies. This suggests that interest in digital assets in Asia continues to grow.

The new study involved 80 family investment firms and wealthy residents across Asia. Most of them have assets ranging from $10 million to $500 million.

Currently, the volume of investments in digital assets among private capital is not very large – 70% of respondents invested less than 5% of their portfolio. However, some reported an increase in the share of cryptocurrencies over 10% in their assets.

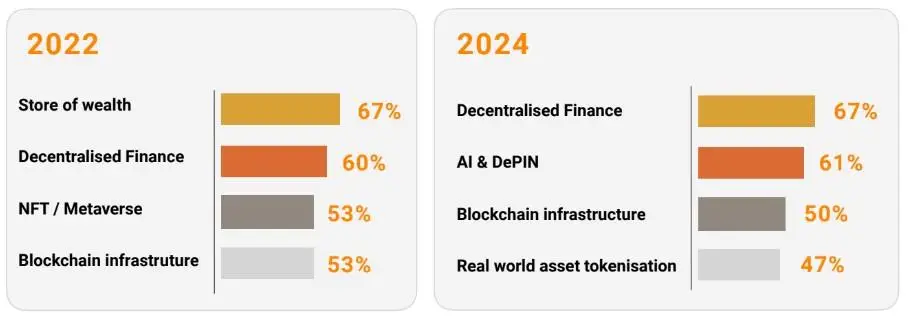

About 53% of respondents use cryptocurrency ETFs and private funds for investments. The most interesting area in the cryptocurrency industry for family offices has become decentralized finance (DeFi). Interest in AI and infrastructure blockchain projects has also grown significantly.

It was previously reported that almost half of traditional hedge funds invest in cryptocurrencies.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.