- AUD/JPY rises at the end of the session, supported by a risk-on sentiment fueled by the advance of Wall Street.

- Buyers are in control as the pair breaks above 97.00, aiming for a daily close above 98.00 for further gains.

- Despite the rise, downside risks persist; Sellers could target levels below 97.00 on bearish momentum.

He AUD/JPY rises at the end of the North American session on Friday, supported by a boost in risk appetite, since the advance of Wall Street could appreciate it. Therefore, safe-haven pairs come under pressure while US Treasury yields retreat, a tailwind for riskier assets. At the time of writing, the AUD/JPY pair is trading at 97.79, marking a new six-day high.

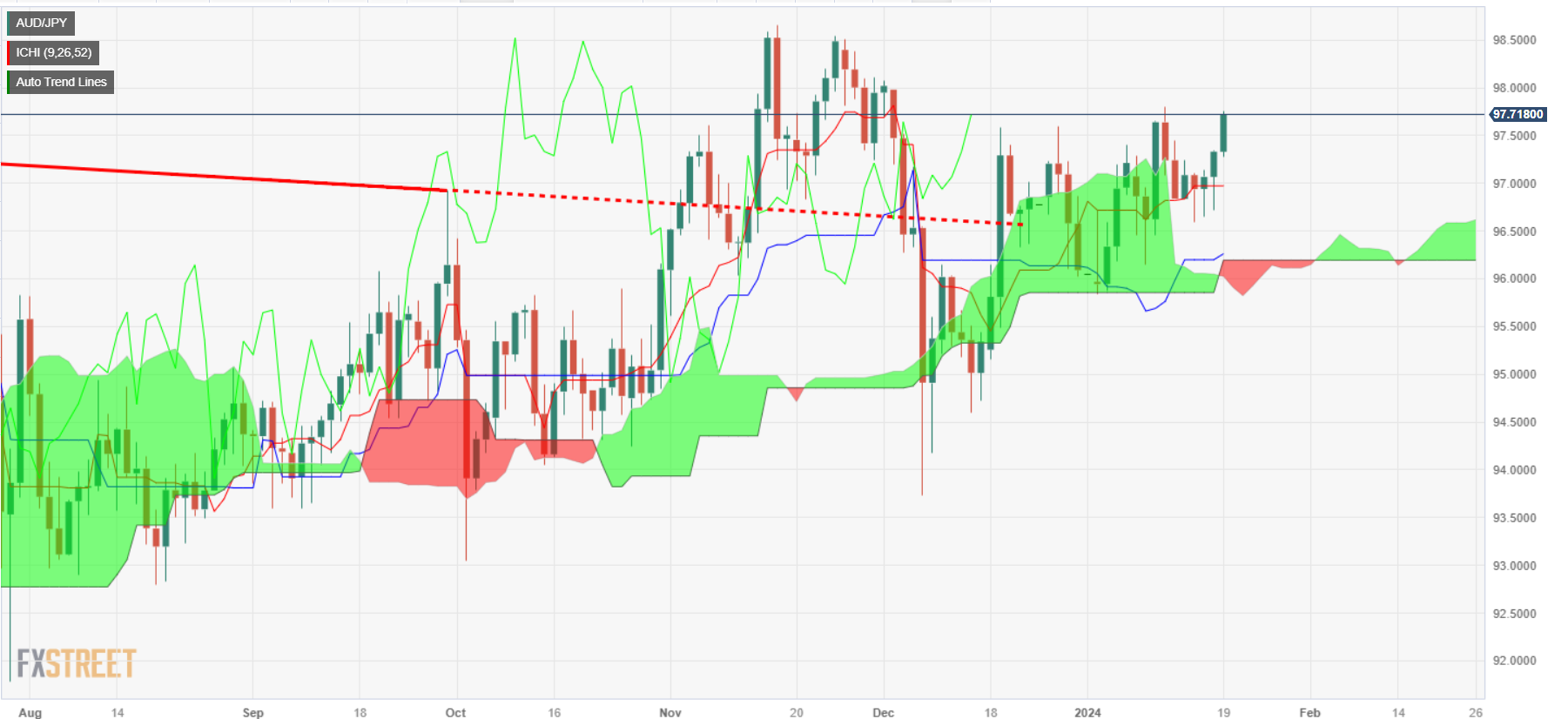

The pair started the week around the week's lows, below the Tenkan-Sen, but the AUD/JPY exchange rate was already above the Ichimoku (Kumo) Cloud, suggesting buyers were on the command. Consequently, they recovered 97.00 and, on Friday, extended their gains. Still, downside risks remain as buyers need a daily close above 98.00 to hold out hope of testing last year's high of 98.58. Once these levels are surpassed, the next stop would be 99.00.

For the bears, sellers need to take prices below 97.00, through the Tenkan Sen at 96.97, towards the January 16 low at 96.58. A break of this last level would expose sellers to a decline. A break of the latter will expose the Kijun-Sen at 96.18, before the Senkou Span B and A, each at 96.14 and 96.01.

AUD/JPY Price Action – Daily Chart

AUD/JPY Key Technical Levels

AUD/JPY

| Overview | |

|---|---|

| Latest price today | 97.72 |

| Today Daily Change | 0.39 |

| Today's daily variation | 0.40 |

| Today's daily opening | 97.33 |

| Trends | |

|---|---|

| daily SMA20 | 96.84 |

| daily SMA50 | 96.88 |

| SMA100 daily | 96.05 |

| SMA200 daily | 94.66 |

| Levels | |

|---|---|

| Previous daily high | 97.34 |

| Previous daily low | 96.71 |

| Previous weekly high | 97.8 |

| Previous weekly low | 96.15 |

| Previous Monthly High | 98.07 |

| Previous monthly low | 93.73 |

| Daily Fibonacci 38.2 | 97.1 |

| Fibonacci 61.8% daily | 96.96 |

| Daily Pivot Point S1 | 96.92 |

| Daily Pivot Point S2 | 96.5 |

| Daily Pivot Point S3 | 96.28 |

| Daily Pivot Point R1 | 97.55 |

| Daily Pivot Point R2 | 97.76 |

| Daily Pivot Point R3 | 98.18 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.