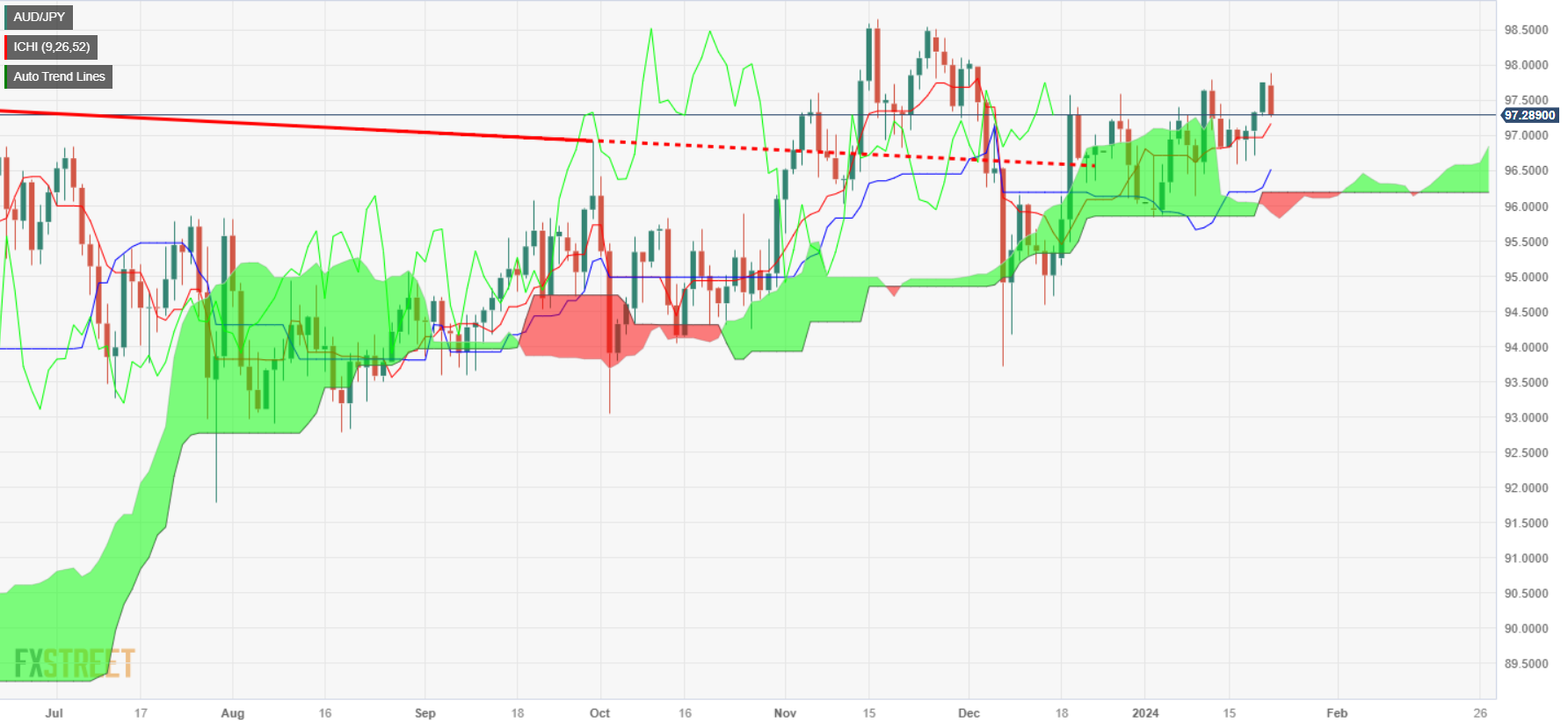

- AUD/JPY daily chart hints at bearish trend; Tenkan-Sen at 97.16 is key for the bulls.

- If it breaks below 97.00, AUD/JPY could test the supports at 96.73, 96.31, 96.14 and then 96.00.

- Holding above 97.00, AUD/JPY targets 97.88 and 98.00, with additional resistances at 98.58 and 99.00.

He AUD/JPY reverses its course at the end of the North American session amid an optimistic mood in the markets, which usually supports risk currencies such as the Australian dollar (AUD). However, the Bank of Japan's looming monetary policy decision keeps the Japanese Yen (JPY) in the driver's seat as AUD/JPY trades at 97.28, losing 0.42% on the day.

On the daily chart, a bearish cancellation pattern is seen, suggesting that AUD/JPY could see a pullback in the near term, but will find buyers at the Tenkan-Sen at 97.16, the first line of defense for the bulls. If sellers take that level and push prices below 97.00, losses will be compounded. The next support would be the Senkou Span A at 96.73, the Kijun-Sen at 96.31, and the Senkou Span B at 96.14. Afterwards, sellers will hit 96.00.

Conversely, if AUD/JPY buyers prevent the exchange rate from falling below 97.00, further rises will be seen at 97.88, the January 22 high, ahead of the 98.00 signal. A breakout of this last signal would expose sellers to a possible decline. A break of the latter would expose the November 15 high at 98.58, followed by 99.00.

AUD/JPY Price Action – Daily Chart

AUD/JPY technical levels

AUD/JPY

| Overview | |

|---|---|

| Latest price today | 97.29 |

| Today Daily Change | -0.47 |

| Today's daily variation | -0.48 |

| Today's daily opening | 97.76 |

| Trends | |

|---|---|

| daily SMA20 | 96.88 |

| daily SMA50 | 96.91 |

| SMA100 daily | 96.08 |

| SMA200 daily | 94.7 |

| Levels | |

|---|---|

| Previous daily high | 97.76 |

| Previous daily low | 97.28 |

| Previous weekly high | 97.76 |

| Previous weekly low | 96.59 |

| Previous Monthly High | 98.07 |

| Previous monthly low | 93.73 |

| Daily Fibonacci 38.2 | 97.58 |

| Fibonacci 61.8% daily | 97.46 |

| Daily Pivot Point S1 | 97.43 |

| Daily Pivot Point S2 | 97.11 |

| Daily Pivot Point S3 | 96.95 |

| Daily Pivot Point R1 | 97.92 |

| Daily Pivot Point R2 | 98.09 |

| Daily Pivot Point R3 | 98.41 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.