- AUD/JPY resumes the uptrend, trading near Thursday’s highs, with a 2.29% recovery since Monday.

- Buyers aim to challenge the yearly high of 97.67, with first resistance levels at 97.00 and the June 20 high at 97.41.

- If sellers push prices towards Tenkan-Sen at 95.58, AUD/JPY could turn neutral, exposing the bottom of the Ichimoku Cloud at 94.33.

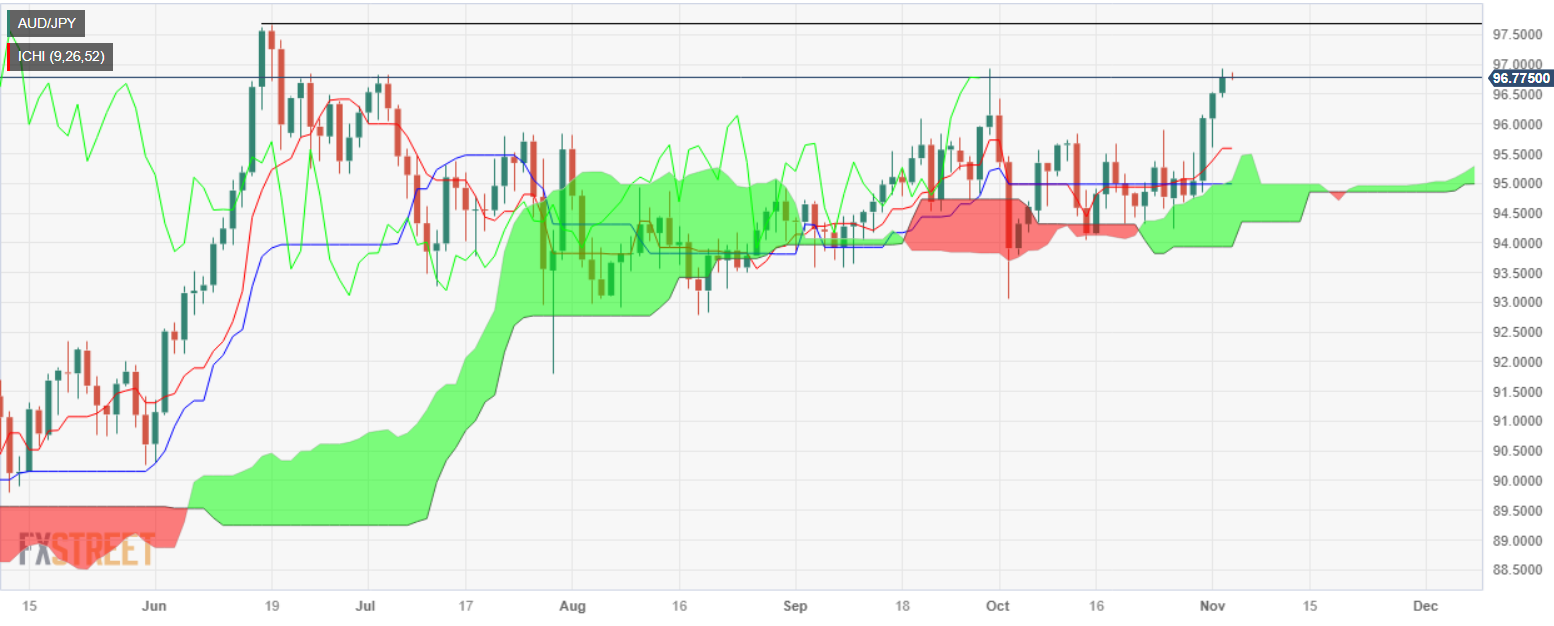

he AUD/JPY appears to have resumed its uptrend, although it remains below the year-to-date high at 97.67. Still trading around Thursday’s highs as buyers entered the market. However, at the start of the Asian session, the pair is trading at 96.74, almost flat.

Since Monday, AUD/JPY has rallied 2.29%, breaking crucial resistance levels at the 96.00 figure and the 96.50 psychological zone on its way north. However, the recovery stopped at the September 29 high of 96.92. It must be said that if buyers wanted to challenge the recent years high, they would first have to conquer 97.00, followed by the June 20 high at 97.41, which, once surpassed, would expose the aforementioned recent years high.

On the other hand, AUD/JPY could turn neutral if sellers push prices towards the Tenkan-Sen at 95.58, followed by the Kijun-Sen at 94.97. This would drag prices within the Ichan-Sen at 94.97. Prices within the Ichimoku (Kumo) cloud, exposing the bottom of the latter at 94.33.

AUD/JPY Price Chart – Daily

AUD/JPY Key Technical Level

AUD/JPY

| Overview | |

|---|---|

| Latest price today | 96.77 |

| Today Daily Change | 0.25 |

| Today’s daily variation | 0.26 |

| Today’s daily opening | 96.52 |

| Trends | |

|---|---|

| daily SMA20 | 95.11 |

| daily SMA50 | 94.9 |

| SMA100 daily | 94.91 |

| SMA200 daily | 92.82 |

| Levels | |

|---|---|

| Previous daily high | 96.52 |

| Previous daily low | 95.61 |

| Previous weekly high | 95.9 |

| Previous weekly low | 94.25 |

| Previous Monthly High | 96.42 |

| Previous monthly low | 93.05 |

| Daily Fibonacci 38.2 | 96.18 |

| Fibonacci 61.8% daily | 95.96 |

| Daily Pivot Point S1 | 95.91 |

| Daily Pivot Point S2 | 95.3 |

| Daily Pivot Point S3 | 94.99 |

| Daily Pivot Point R1 | 96.82 |

| Daily Pivot Point R2 | 97.13 |

| Daily Pivot Point R3 | 97.74 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.