- AUD/JPY is recovering markedly from a two-week low touched earlier on Friday.

- The emergence of fresh selling around the JPY is seen as a key supportive factor.

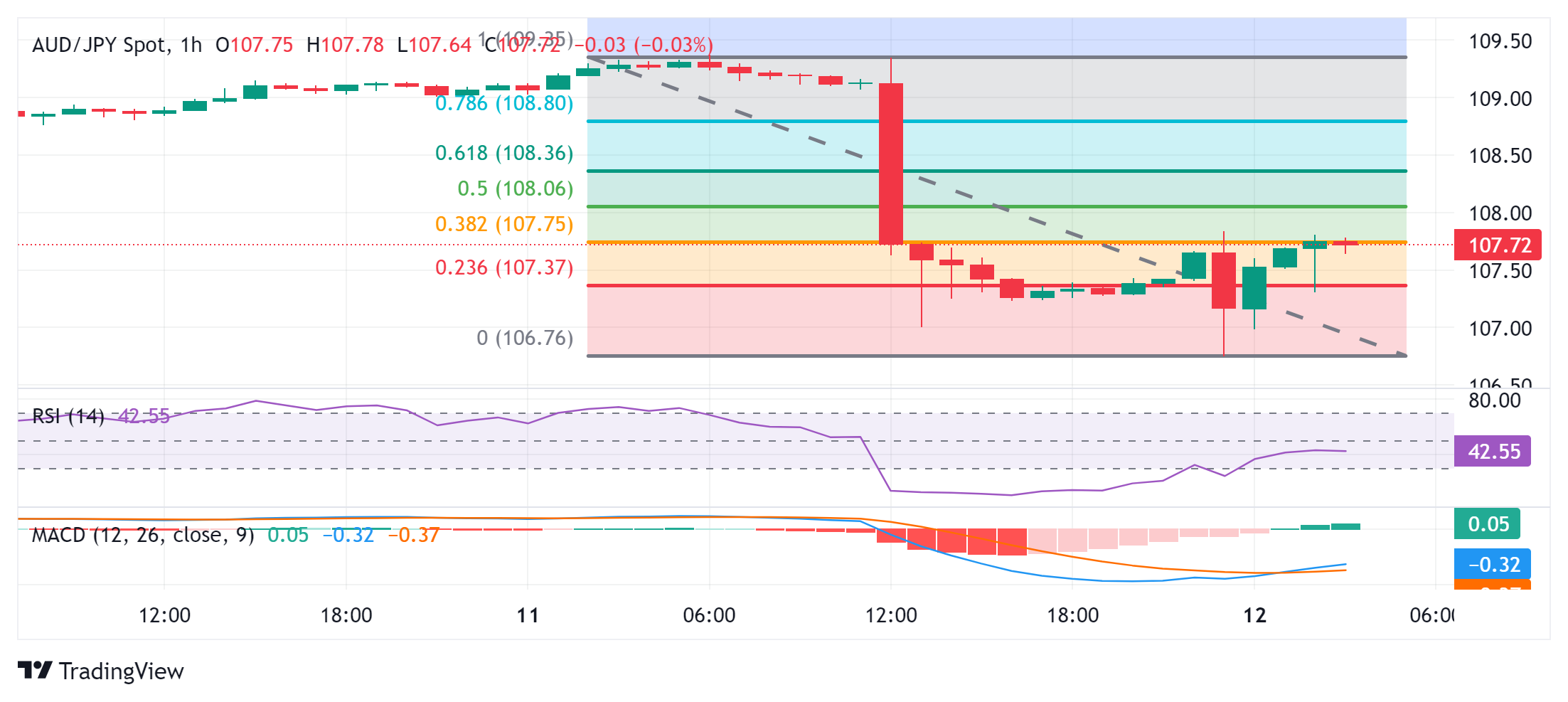

- The technical setup warrants caution before positioning for further intraday gains.

The AUD/JPY pair is attracting some buyers in the 106.75 region, or a two-week low touched during the Asian session on Friday and halting the previous day’s retracement slide from its highest level since May 1991. The intraday up-move is sponsored by a combination of factors and is lifting spot prices to the 107.70 region, or a fresh daily peak in the past hour.

The Japanese Yen (JPY) is facing fresh bid in the absence of any concrete evidence that Japanese authorities intervened in the foreign exchange market to support the domestic currency. Adding to this, the strong underlying bullish sentiment in global equity markets undermines the safe-haven JPY and benefits the risk-sensitive AUD, which is further supported by bets that the Reserve Bank of Australia (RBA) could hike rates again.

Meanwhile, Chinese data released on Friday showed that the trade surplus, in Chinese Yuan terms, widened to CNY 703.73 billion from the previous figure of CNY 586.40 billion. Additional details in the report revealed that exports rose 10.7% year-on-year in June versus 11.2% seen in May, while the country’s imports fell 0.6% year-on-year during the reported month versus 5.2% previously. This, however, does little to provide any impetus to the AUD/JPY cross.

From a technical perspective, spot prices have, so far, been struggling to build on strength beyond the 38.2% Fibonacci retracement level of the decline from the overnight swing high. Moreover, oscillators on hourly charts are still holding in negative territory and warrant some caution for bullish traders. A sustained strength beyond the said barrier, however, should pave the way for a fresh intraday up-move.

The AUD/JPY pair could then aim to reclaim the 108.00 mark, which now coincides with the 50% Fibonacci level. Some follow-up buying will suggest that the corrective pullback is over and set the stage for the resumption of the uptrend seen over the past month or so.

On the other hand, the 107.35 zone, or the 23.6% Fibonacci level now seems to protect the immediate downside ahead of the 107.00 mark and the Asian session low, around the 106.75 region. A convincing break below it will be seen as a fresh trigger for bearish traders, making the AUD/JPY cross vulnerable to accelerate the decline further towards the intermediate support of 106.50-106.40 en route the 106.00 mark and the 105.65 region.

AUD/JPY 1 hour chart

Economic indicator

CNY Trade Balance

The trade balance published by the General Administration of Customs of the People’s Republic of China The Chinese currency pair is a balance between exports and imports of total goods and services. A positive value indicates a trade surplus, while a negative value shows a trade deficit. This is an event that creates some volatility for the CNY. As the Chinese economy has an influence on the global economy, this economic indicator would have a notable impact on the foreign exchange market. Generally, a high reading is considered positive (or bullish) for the CNY, while a lower reading is negative (or bearish) for the CNY.

Latest Post:

Fri Jul 12, 2024 03:00

Frequency:

Monthly

Current:

703.73B

Dear:

–

Previous:

586.4B

Fountain:

National Bureau of Statistics of China

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.