- AUD/JPY remains neutral but holds above 100.00, supported by risk-on sentiment and weakness in the Yen against the US Dollar.

- If the pair breaks above 101.40, it could point to further upside towards 102.00 and 102.50, with possible resistance at 103.00.

- A drop below 100.00 would bring support at the top of the Ichimoku Cloud around 99.70/80, with additional support at 98.77.

AUD/JPY consolidates around 100.30, although posting small gains of over 0.06% at the time of writing. A boost in risk appetite prevents the Australian Dollar from posting losses against the Japanese Yen, which is losing some ground against the US Dollar.

AUD/JPY Price Forecast: Technical Outlook

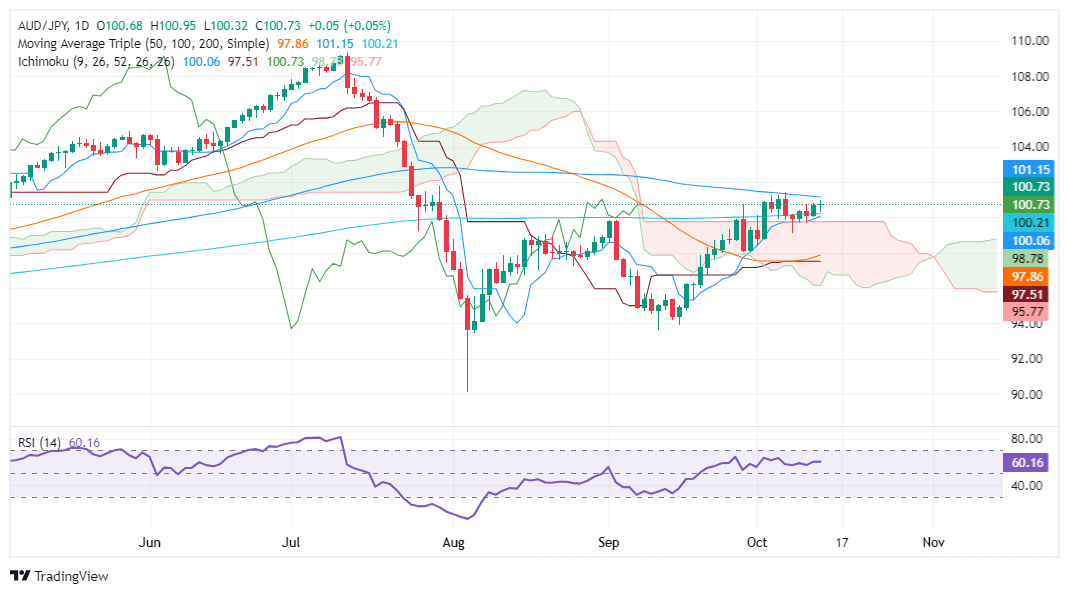

AUD/JPY has a neutral bias, although it has broken the 100.00 barrier. This opened the door for the cross to trade within the 100.00-101.40 range, with further upside in sight.

Now that buyers have lifted the exchange rate above the Ichimoku Cloud (Kumo), the pair could test the year-to-date (YTD) peak at 109.37.

Momentum remains bullish and slightly consolidated, as shown by the Relative Strength Index (RSI).

If AUD/JPY breaks the October 7 high at 101.40, the door would open to challenge 102.00. With further strength, AUD/JPY’s next resistance would be 102.50, before challenging the 103.00 mark.

On the contrary, if the cross falls below 100.00, the first support would be the top of the Kumo at 99.70/80. Once cleared, the next support would be Senkou Span A at 98.77.

AUD/JPY Price Action – Daily Chart

The Australian Dollar FAQs

One of the most important factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). As Australia is a resource-rich country, another key factor is the price of its largest export, iron ore. The health of the Chinese economy, its largest trading partner, is a factor, as is inflation in Australia, its growth rate and the Balance of Trade. Market sentiment, that is, whether investors bet on riskier assets (risk-on) or seek safe havens (risk-off), is also a factor, with the risk-on being positive for the AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The RBA’s main objective is to maintain a stable inflation rate of 2%-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low ones. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former being negative for the AUD and the latter being positive for the AUD.

China is Australia’s largest trading partner, so the health of the Chinese economy greatly influences the value of the Australian Dollar (AUD). When the Chinese economy is doing well, it buys more raw materials, goods and services from Australia, which increases demand for the AUD and drives up its value. The opposite occurs when the Chinese economy does not grow as fast as expected. Therefore, positive or negative surprises in Chinese growth data usually have a direct impact on the Australian Dollar.

Iron ore is Australia’s largest export, with $118 billion a year according to 2021 data, with China being its main destination. The iron ore price, therefore, may be a driver of the Australian dollar. Typically, if the price of iron ore rises, the AUD also rises as aggregate demand for the currency increases. The opposite occurs when the price of iron ore falls. Higher iron ore prices also tend to result in a higher likelihood of a positive trade balance for Australia, which is also positive for the AUD.

The trade balance, which is the difference between what a country earns from its exports and what it pays for its imports, is another factor that can influence the value of the Australian dollar. If Australia produces highly sought-after exports, its currency will gain value solely from the excess demand created by foreign buyers wanting to purchase its exports versus what it spends on purchasing imports. Therefore, a positive net trade balance strengthens the AUD, with the opposite effect if the trade balance is negative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.