- AUD/NZD wavers ahead of Australian jobs data.

- The pair’s lack of momentum is notable as the high continues to strengthen from 1.0880.

- The Kiwi, without data, is mainly driven by market flows.

The pair AUD/NZD retreated on Wednesday and consolidated again, as the Australian dollar (AUD) struggles to find significant momentum against its counterpart, the Kiwi (NZD).

The Australian Dollar managed to break above the 1.0880 area yesterday, but could not maintain control and has retreated to the 1.0860 area. The low of the day is marked near 1.0845.

Australian employment figures approaching

The Australian dollar could be wavering ahead of jobs data just around the corner, with employment change and unemployment rate numbers expected early Thursday.

The Australian economy is expected to have created 23,000 jobs in August, up from a decline of 14,600 the previous month. Meanwhile, the unemployment rate for the same period is expected to remain stable at 3.7% month-on-month. Australian bulls are certainly hoping for better-than-expected jobs data to push the Australian dollar higher. Both indicators will be published on Thursday at 01:30 GMT.

The Kiwi, for its part, remains very underrepresented in this week’s economic calendar, with little relevant data to boost the New Zealand dollar. The Business NZ Purchasing Managers’ Index (PMI), a diffusion index of purchasing managers within New Zealand’s manufacturing sector, will be released late on Thursday. Little reaction is expected from the markets and generally no forecasts are made on the indicator. The industrial PMI has been publishing below 50.0 since March, and no major surprises are expected.

AUD/NZD Technical Outlook

The Australian Dollar has been trading in familiar territory against the Kiwi for much of the year, in a cycle of deep consolidation and a far cry from last year’s highs at 1.1490, an area that could well be on another planet.

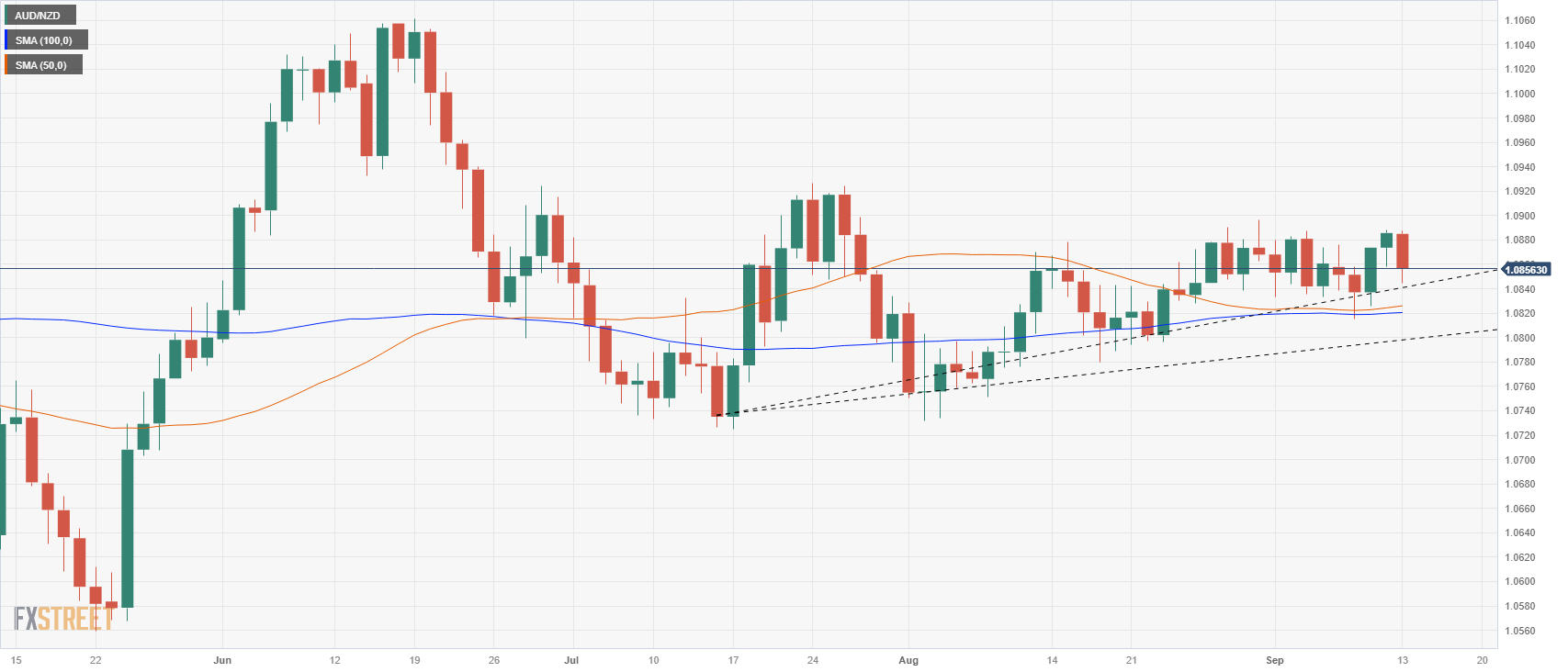

The daily candles show a slightly bullish bias, with the lows slowly rising, but 1.0880 seems to represent the ceiling for the moment, and the ascending trend line from 1.0725 is compressing the price action at the level.

The 100-day and 50-day simple moving averages remain flat and consolidated, currently parked near 1.0820, and significant moves in either direction will be needed to reintroduce momentum to the moving averages.

AUD/NZD Daily Chart

AUD/NZD technical levels

AUD/NZD

| Overview | |

|---|---|

| Last price today | 1.0856 |

| Daily change today | -0.0030 |

| today’s daily variation | -0.28 |

| today’s daily opening | 1.0886 |

| Trends | |

|---|---|

| daily SMA20 | 1.0847 |

| daily SMA50 | 1.0824 |

| daily SMA100 | 1,082 |

| daily SMA200 | 1,081 |

| Levels | |

|---|---|

| previous daily high | 1.0888 |

| Previous daily low | 1.0858 |

| Previous Weekly High | 1.0888 |

| previous weekly low | 1.0815 |

| Previous Monthly High | 1.0897 |

| Previous monthly minimum | 1.0732 |

| Fibonacci daily 38.2 | 1.0877 |

| Fibonacci 61.8% daily | 1,087 |

| Daily Pivot Point S1 | 1.0866 |

| Daily Pivot Point S2 | 1.0847 |

| Daily Pivot Point S3 | 1.0836 |

| Daily Pivot Point R1 | 1.0897 |

| Daily Pivot Point R2 | 1.0908 |

| Daily Pivot Point R3 | 1.0927 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.

.jpg)