- The AUD/USD is recovered from a minimum of one month about 0.6372 while the mixed data of the US PMIs cool the safe refuge flows towards the dollar.

- The PMI composed of the US Global S&P falls slightly; Manufacturing remains stable, while services weaken but exceed expectations.

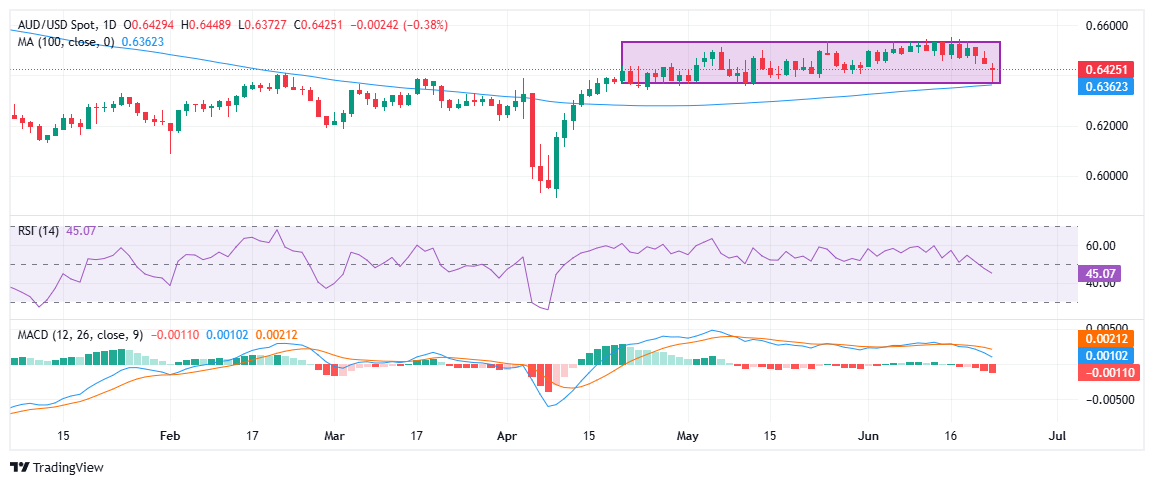

- The aud/USD bounces from a key support about 0.6400; A daily closure above 0.6450 could open the way to 0.6500–0.6550.

The Australian dollar (AUD) reverses the above losses and advances against the US dollar (USD) on Monday, since operators reassess the safe refuge flows after the United States (USA) launched attacks against Iran during the weekend. The initial hurry towards the dollar pushed Aussie at a minimum of one month before a mixed data batch of the US Purchase Management Index (PMI) helped to moderate the demand of the US dollar.

The AUD/USD is currently quoting around 0.6426 at the time of writing these lines, during the American session, having erased most of its intradic losses and now lowering approximately 0.38% in the day. The pair bounced strongly from a session minimum of 0.6372, finding a tail wind since the last American PMIs failed to provide a decisive impulse to the US dollar.

The US data painted a slightly softer tone, the PMI composed of Global S&P fell to 52.8 in June from 53 in May, hinting at a slight loss of impulse while still marks more than two years of expansion. The manufacturing PMI remained stable in 52, in line with the maximum of May 15 and exceeding the forecasts, while the services PMI dropped to 53.1 from 53.7 but remained above the market expectations. In general, mixed readings cooled the new buying interest in the US dollar, giving the aud/USD margin to recover.

Meanwhile, earlier in the day, the Global S&P figures showed that the private sector of Australia grew at its second fastest pace in ten months, with the service activity reaching a maximum of three months and the manufacturing manufacturer remaining stable. The PMI encouraging impression offered a relief for Aussie, providing some tranquility after recent launches Weak economic ones that had revived the conversation about possible rates cuts.

Technically, the strong recovery of the torque from the lower limit of its narrow range suggests that buyers are defending the key support about 0.6400, reinforced by the 100 -day mobile average around 0.6362. The RSI has turned up to the midline, and the MACD shows early stabilization signs. A daily closure above 0.6450 could open the door for a thrust to the area of 0.6500–0.6550, keeping alive the negotiation strategies in range. However, a ruling to stay above 0.6400 would expose the negative side towards 0.6300.

Economic indicator

PMI compound global s & p

The index composed of purchasing managers (PMI), published monthly by S&P globalit is an advanced indicator that measures private business activity in Australia for both manufacturing and services sectors. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to the total production of manufacturing or services counted by the sub-director to which that company belongs. The responses of the survey reflect the change, if there is, in the current month compared to the previous month and can anticipate changing trends in official data series such as the Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with 50.0 levels pointing out that there is no change compared to the previous month. A reading above 50 indicates that the Australian private economy is expanding in general, which is an upward sign for the Australian dollar (Aud). Meanwhile, a reading below 50 points out that the activity is decreasing in general, which is considered bassist for the AUD.

Read more.

Last publication:

Dom Jun 22, 2025 23:00 (Prel)

Frequency:

Monthly

Current:

51.2

Dear:

–

Previous:

50.5

Fountain:

S&P global

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.