- The Australian dollar is affected by negative Chinese house price data on Friday.

- The fall in new Chinese loans and the M2 money supply add to the tightening narrative.

- AUD/USD fell on Thursday after US data showed inflationary trends in the US economy.

AUD/USD is trading almost two tenths lower on Friday, extending Thursday's decline into the weekend. The pair is pressured by negative housing and lending data in China, which indicates that the real estate sector of the world's second largest economy remains in the eye of the storm.

Weak Chinese data is a negative factor for the Australian dollar, which is heavily dependent on the Chinese market for its exports, particularly iron ore, which is Australia's main export commodity.

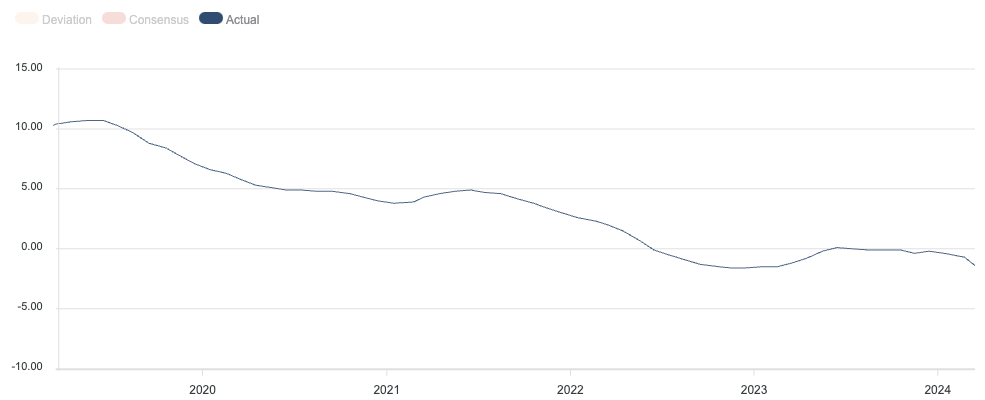

The Chinese housing price index showed a decrease of – 1.4% in February, compared to – 0.7% in the previous month, January, according to data from the National Bureau of Statistics of China, published early on Friday. The downward trend in housing prices in China since 2019 thus continues.

The problems in the Chinese real estate market have had a direct impact on iron ore prices, as the country uses much of the ore to make the steel beams it uses in its buildings. Since the beginning of 2024 alone, iron ore prices have seen a drop of approximately 25%.

-638461042762640597.png)

Other data released on Friday showed an unexpected drop in new loans in China in February. According to data from the People's Bank of China (PBoC), new loans fell to €1.45 billion. This figure represents a decrease compared to January's 4,920 billion and is below estimates of 1,500 billion. The data indicates lower lending, which could limit growth, especially for the loan-intensive real estate sector.

Data showing lower-than-expected M2 money supply, which increased 8.7% year-on-year in February versus 8.8% expected, suggests a slowdown in liquidity.

Inflation rises in US factories

The AUD/USD pair fell more than half a percentage point on Thursday following the release of US macroeconomic data indicating that the US economy was hotter than expected.

The US Producer Price Index, which measures inflation at factory prices, rose to 1.6%, easily surpassing the 1.1% forecast and the previous 1.0%, suggesting a continued inflationary trend.

The core PPI also rose more than estimated. The data suggests that inflation will be passed on to consumers and show up later to annoy shoppers in the Consumer Price Index.

Higher inflation makes it less likely that the Federal Reserve (Fed) will rush to cut interest rates. While market expectations continue to see the odds favoring a rate cut in June, the chance of a rate cut in May has been reduced to virtually zero.

Higher interest rates for longer are positive for the USD because they attract more foreign capital inflows. They are negative for the AUD/USD, which measures the number of Australian dollars that can be purchased with one US dollar. Therefore, the data was negative for the pair, which fell substantially after its publication on Thursday.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.