- AUD/USD has been hit by the strong NFP headline.

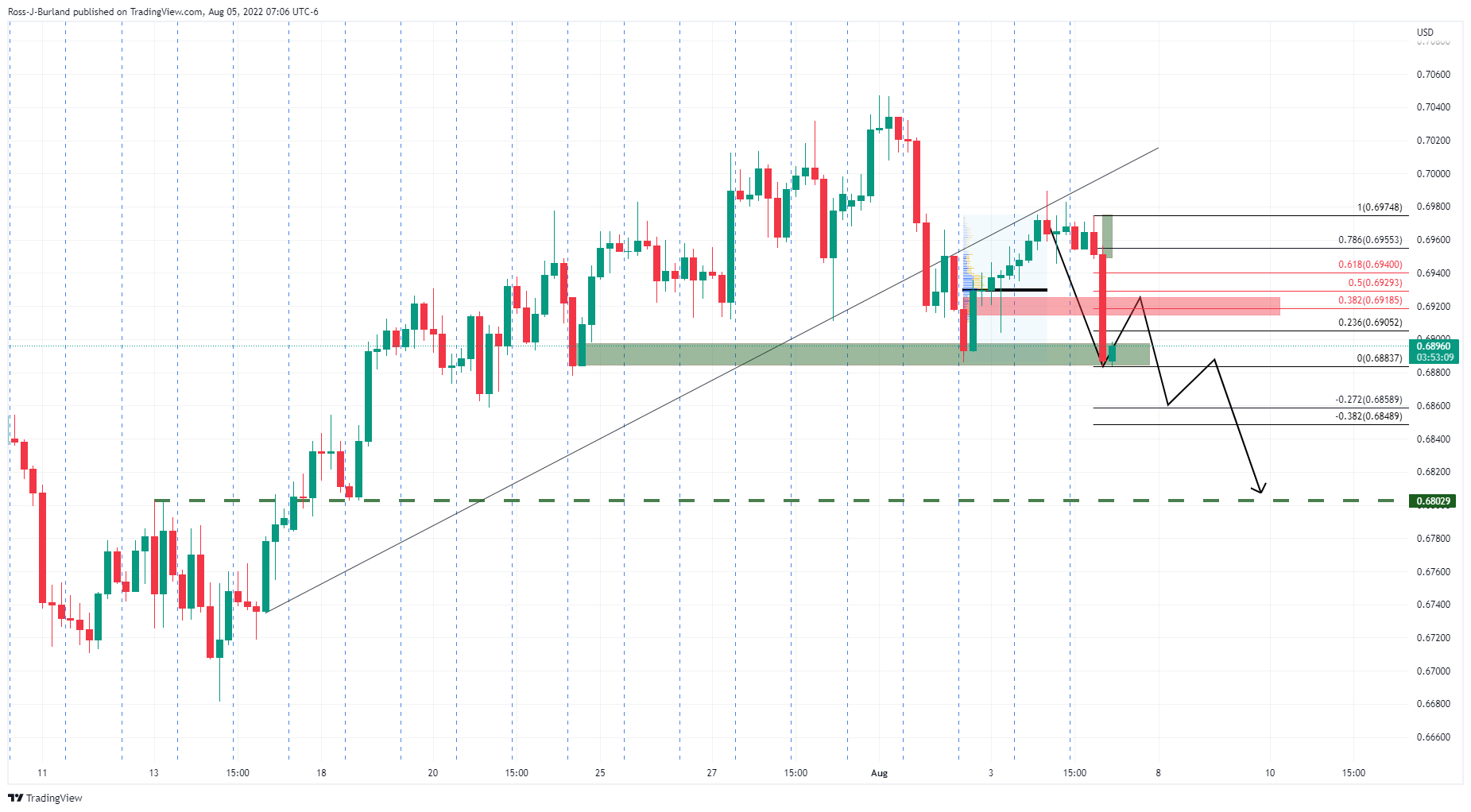

- Price is taking the 4hr support, a break of that opens up the risk of a deeper run below the counter-trend line to test the 0.68 figure.

The AUD, sensitive to risk tones in the financial markets, has been affected by the doubling of market expectations in the result of non-farm payrolls. The AUD/USD has fallen to 0.6882, falling three pips below the August 2 lows. This move could be forging a bearish technical break towards 0.6900, as illustrated below.

NFPs double market expectations

Nonfarm payrolls in the US rose by 528,000 in July, according to data released by the US Bureau of Labor Statistics on Friday. This figure follows the increase of 398,000 in June (revised from 372,000) and exceeds market expectations of 250,000. The unemployment rate dropped to 3.5%.

Other details in the release revealed that annual wage inflation, measured by median hourly wages, was unchanged at 5.2%, versus analysts’ estimate of 4.9%. Finally, the labor force participation rate decreased to 62.1% from 62.2%.

Investors awaited the report in search of new clues about the performance of the US economy, considering that the Federal Reserve depends on the data. The data now raises the prospects for a 75 basis point hike by the Federal Reserve, which will not be good for risk sentiment or the Aussie, which tends to track global stock markets. The odds of a 75 basis point hike have jumped to 61% from 40% at press time.

The dollar rises after the NFP

Meanwhile, ahead of the jobs data, the US dollar rose on Friday in a correction of the biggest daily decline in more than two weeks, as it fell 0.68% on Thursday, the biggest drop since July 19. The US Dollar Index (DXY), which measures the USD against a basket of currencies, rose 0.15% to 105.90 just before the data release, just below the day’s high of 106.00. As the data digests, the index is rising to a high of 106,808, up more than 1% so far today.

AUD/USD technical analysis

The price is taking a 4-hour support. There is a possibility of a correction following this sell-off as markets continue to position themselves around the data. There is a chance that the price could correct towards a higher volume zone to the upside near 0.6920/0.6940, but given the strength of sentiment surrounding the Fed, a break below the lows printed today opens up the risk of a further run. deep below countertrend line to test 0.68 and previous resistance structure.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.