- Continuation of AUD/USD decline driven by strong US ADP employment and falling jobless claims, overshadowing China PMI data.

- The swaps market adjusts its expectations for Federal Reserve policy, anticipating less aggressive rate cuts by the end of 2024.

- Attention is focused on the upcoming US nonfarm payrolls, with predictions of a decline in job creation and a slight increase in the unemployment rate.

AUD/USD extends its losses in early trading on Thursday during the North American session, down 0.33% and about to dip below 0.6700. Strong economic data from the United States is the main reason for the pair's decline, while the Dollar recovered losses and rose, as shown by the Dollar Index (DXY). The AUD/USD pair is trading at 0.6711 after hitting a daily high of 0.6759.

AUD/USD extends losses to five consecutive days following improved US employment data

US employment data released ahead of the Wall Street open was strong, suggesting inflationary pressures remain skewed upward. Reporting from Automatic Data Processing (ADP) and Stanford University revealed that companies hired more than expected, creating 164,000 new jobs, shattering economists' forecasts of 115. In additional data, the US Department of Labor US (DoL) announced that jobless claims for the week ending December 30 increased by 202K, less than estimates of 216,000, and below the previous reading of 220,000.

Following the data, the swap market priced in a less dovish Federal Reserve, with traders expecting 140 basis points of rate cuts by the end of 2024, 30 basis points less than the 27,170 basis points of cuts projected by investors in December. according to data from the Chicago Board of Trade (CBOT).

Today's data and yesterday's release of the Minutes from the latest Federal Reserve meeting changed traders' views that the US central bank could begin to ease policy sooner rather than later. The tone of the minutes was one of uncertainty among policy makers regarding the rate path to follow because inflation risks remain tilted upward.

Apart from this, the economic agenda in Australia was absent, although data from China influences the AUD (AUD). In the Asian session, the Caixin Services PMI improved to 52.9, up from 51.5 in November, and above the consensus of 51.5.

Looking ahead to the week, the Australian economic agenda will be absent. In the United States, December nonfarm payrolls are expected to fall to 170,000, down from 199,000 in November, and the unemployment rate is estimated to rise to 3.8% from 3.7%.

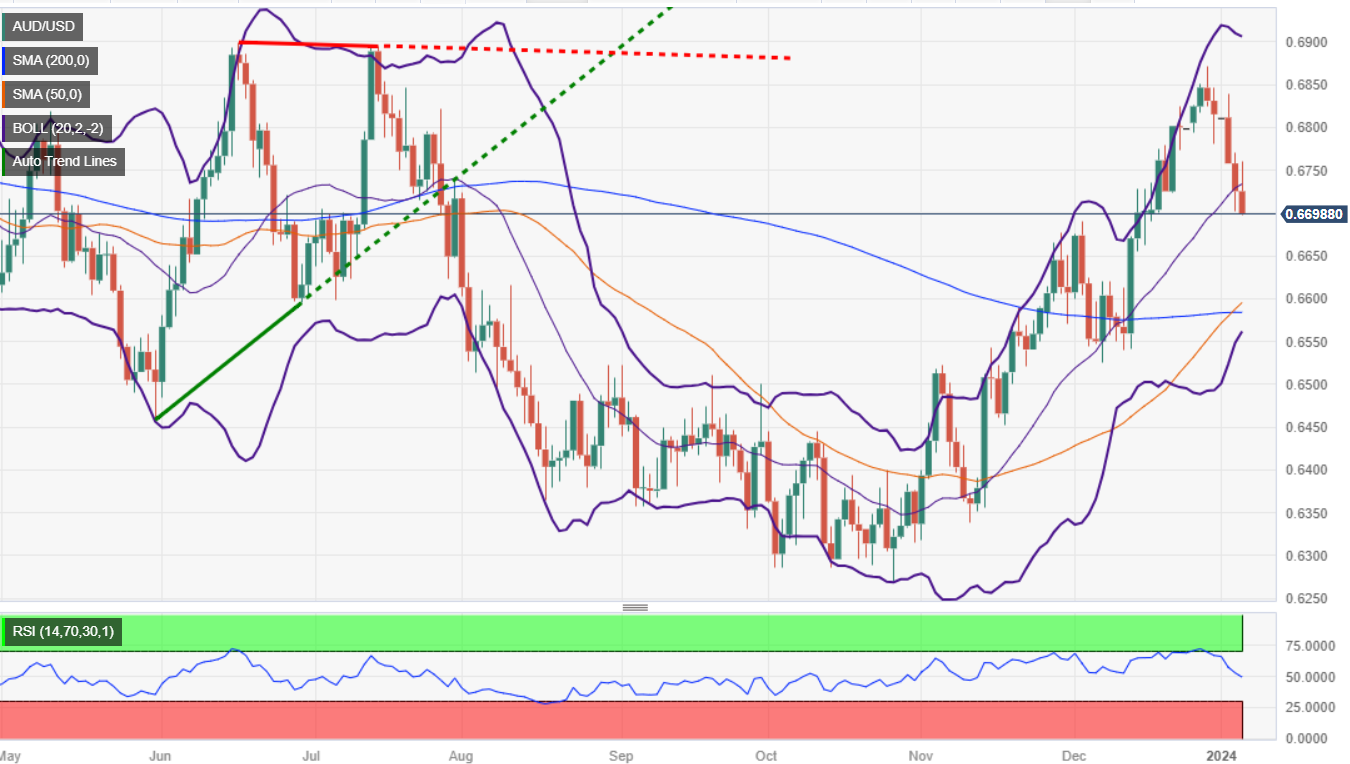

AUD/USD Price Analysis: Technical Outlook

The daily chart shows the pair under strong bearish pressure, but remains above the current weekly low of 0.6701. A decisive breakout would sharpen AUD/USD's decline towards the confluence of the 50-day and 200-day moving averages (DMA) around 0.6582/84. Once broken, the next demand zone would be a previous resistance-turned-support level at 0.6522, the November 6 high. On the other hand, if buyers hold the exchange rate above 0.6700 and reclaim the day's high at 0.6759, this could pave the way to test the December 28 high at 0.6871.

AUD/USD

| Overview | |

|---|---|

| Latest price today | 0.6702 |

| Daily change today | -0.0024 |

| Today's daily variation | -0.36 |

| Today's daily opening | 0.6726 |

| Trends | |

|---|---|

| daily SMA20 | 0.6729 |

| daily SMA50 | 0.6588 |

| SMA100 daily | 0.6493 |

| SMA200 daily | 0.6584 |

| Levels | |

|---|---|

| Previous daily high | 0.6771 |

| Previous daily low | 0.6702 |

| Previous weekly high | 0.6871 |

| Previous weekly low | 0.6781 |

| Previous Monthly High | 0.6871 |

| Previous monthly low | 0.6526 |

| Daily Fibonacci 38.2 | 0.6728 |

| Fibonacci 61.8% daily | 0.6745 |

| Daily Pivot Point S1 | 0.6695 |

| Daily Pivot Point S2 | 0.6664 |

| Daily Pivot Point S3 | 0.6626 |

| Daily Pivot Point R1 | 0.6764 |

| Daily Pivot Point R2 | 0.6801 |

| Daily Pivot Point R3 | 0.6832 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.