- AUD/USD attracts some buying at lower levels on Monday, although the rally lacks bullish conviction.

- The technical situation advises caution before positioning for any further bullish movement.

- Bears should wait for a break below 50% Fibonacci before opening new positions.

The AUD/USD pair begins the new week on a positive note, snapping a two-day losing streak and halting its recent pullback from the highest level since February 2023 touched last Monday. Spot prices are currently trading just above the 0.6800 level, up 0.20% on the day, although lacking follow-through buying amid a bullish US Dollar (USD).

Upbeat US monthly jobs data released on Friday eased concerns about an economic slowdown, which, coupled with optimism over Chinese stimulus, remains supportive of risk appetite. Furthermore, the Reserve Bank of Australia’s (RBA) hawkish stance benefits the risk-sensitive AUD. Meanwhile, declining odds of more aggressive policy easing by the Federal Reserve (Fed) and rising geopolitical tensions in the Middle East help the safe-haven dollar hold firm near a seven-week high . This, in turn, acts as a headwind for the AUD/USD pair.

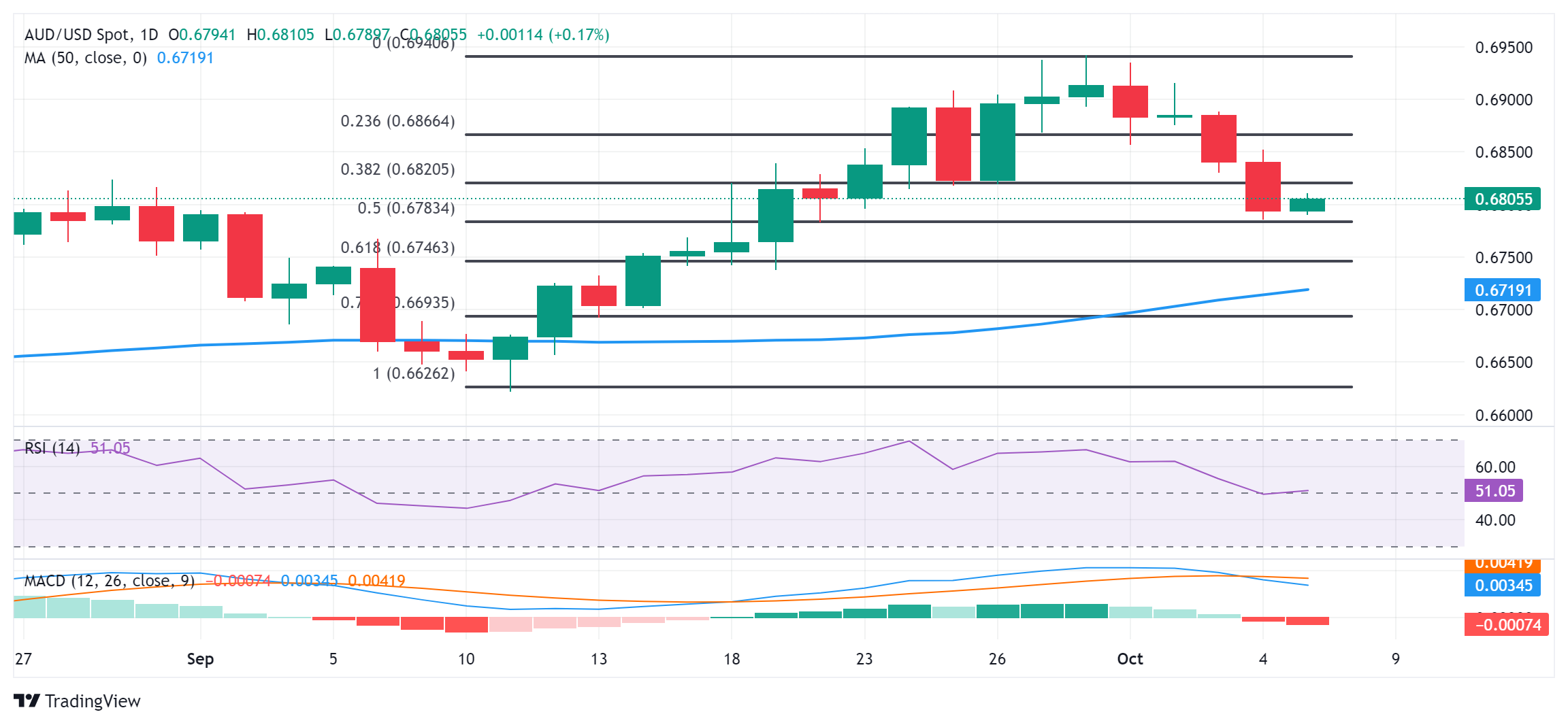

From a technical perspective, spot prices on Friday found support near the 0.6785 region, or the 50% Fibonacci retracement level of the September upmove. The subsequent move favors the bulls, although the fact that the oscillators on the daily chart have begun to gain negative traction advises some caution before positioning for any further bullish movement. Meanwhile, the 0.6820 region, or the 38.2% Fibonacci level, is likely to act as an immediate hurdle, above which the AUD/USD pair could accelerate the positive move towards the 0.6865-0.6870 region.

The latter near the breakout point of the 23.6% Fibonacci level, which if exceeded, will suggest that the correction is over and trigger new buying. Spot prices could then aim to reclaim the round 0.6900 level and extend the momentum towards the 0.6940-0.6945 region, or the yearly high touched last week.

On the other hand, bears should wait for a sustained breakout and acceptance below the 50% Fibonacci level, around the 0.6785 region, before opening new positions. The AUD/USD pair could then slide to the 61.8% Fibonacci level, around the 0.6745 region, before eventually falling towards levels below 0.6700, or the 100-day SMA.

AUD/USD Daily Chart

The Australian Dollar FAQs

One of the most important factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). As Australia is a resource-rich country, another key factor is the price of its largest export, iron ore. The health of the Chinese economy, its largest trading partner, is a factor, as is inflation in Australia, its growth rate and the Balance of Trade. Market sentiment, that is, whether investors bet on riskier assets (risk-on) or seek safe havens (risk-off), is also a factor, with the risk-on being positive for the AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The RBA’s main objective is to maintain a stable inflation rate of 2%-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low ones. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former being negative for the AUD and the latter being positive for the AUD.

China is Australia’s largest trading partner, so the health of the Chinese economy greatly influences the value of the Australian Dollar (AUD). When the Chinese economy is doing well, it buys more raw materials, goods and services from Australia, which increases demand for the AUD and drives up its value. The opposite occurs when the Chinese economy does not grow as fast as expected. Therefore, positive or negative surprises in Chinese growth data usually have a direct impact on the Australian Dollar.

Iron ore is Australia’s largest export, with $118 billion a year according to 2021 data, with China being its main destination. The iron ore price, therefore, may be a driver of the Australian dollar. Typically, if the price of iron ore rises, the AUD also rises as aggregate demand for the currency increases. The opposite occurs when the price of iron ore falls. Higher iron ore prices also tend to result in a higher likelihood of a positive trade balance for Australia, which is also positive for the AUD.

The trade balance, which is the difference between what a country earns from its exports and what it pays for its imports, is another factor that can influence the value of the Australian dollar. If Australia produces highly sought-after exports, its currency will gain value solely from the excess demand created by foreign buyers wanting to purchase its exports versus what it spends on purchasing imports. Therefore, a positive net trade balance strengthens the AUD, with the opposite effect if the trade balance is negative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.